Summer Camp May Be Tax Deductible

By Amy E. Feldman

PHILADELPHIA (CBS) - In case you thought your summer camp experience was rustic, think of the poor kids whose parents sent them to the Hunger Games-themed summer camp. The camp culminates in a tournament where the kids fight to the proverbial—not actual—death using flag football-like flag belts. Um parents? Your thinking what exactly? Maybe you're thinking: this sure would be a good tax write off. And, if that's what you were thinking, you're smarter than you look.

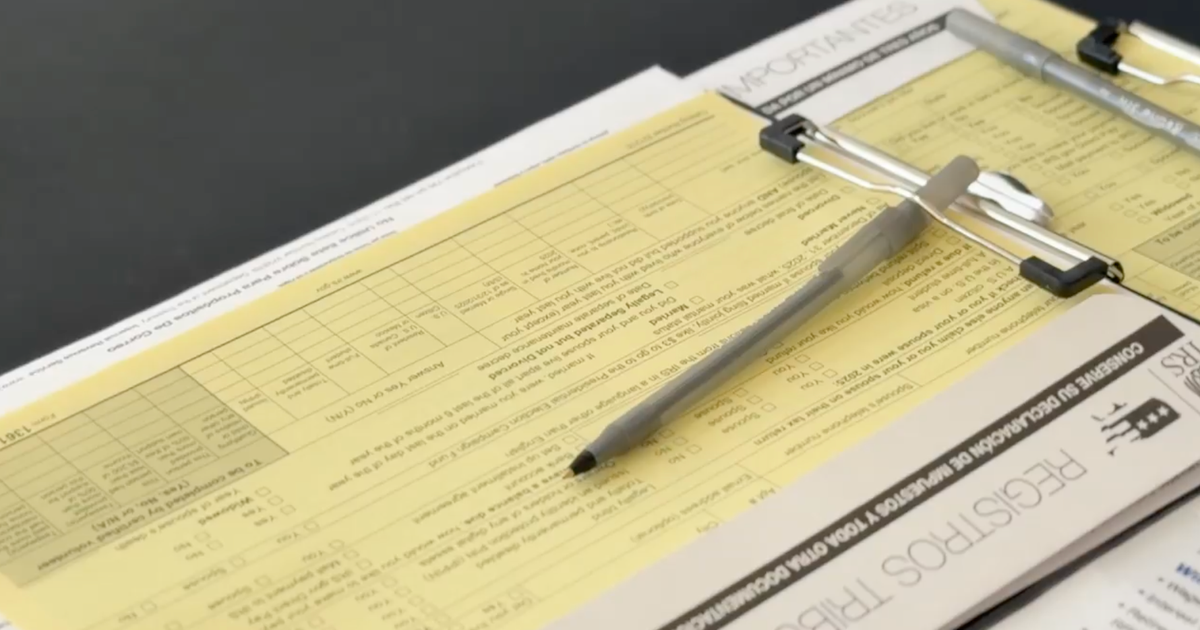

Many working parents must arrange for the care of young children during the summer when school is out - and often turn to day camps. The cost of day camp counts as an expense toward the child and dependent care credit. You can use up to $3,000 of the unreimbursed expenses you pay in a year for one camper or $6,000 for two or more campers. Expenses for overnight camps or summer school tutoring do not qualify.

Now that the summer is over, be sure to keep your receipts and records to use when you file your 2013 tax return next year. Note the name, address and Social Security number or employer identification number of the care provider. You must report this information when you claim the credit on your return.

The cost of future therapy they'll need to get over the Hunger Games Camp experience, is sadly not covered.