Many Millennials Have A New Approach To Their Finances

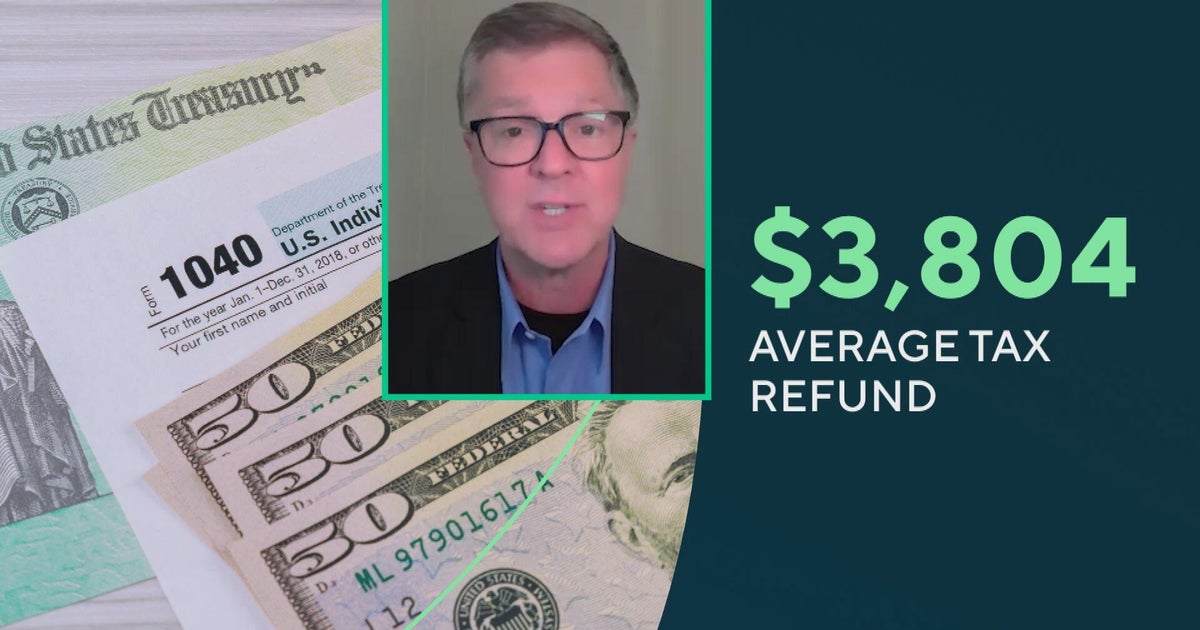

PHILADELPHIA (CBS) -- When it comes to millennials and their money, it seems traditional banks may be missing out. More than 83 million Americans make up the millennial generation, born in the early 1980's to 2000, and as 3 On Your Side consumer reporter Jim Donovan finds, they have a new approach to their finances.

Thirty-two-year-old surgical resident Travis Shiba hasn't walked into a bank in years.

"Everything is online, pay my bills online, money transfers, like everything," said Shiba.

By some estimates, 30 percent of millennials don't have a checking or savings account.

"Between their student loans and the great recession and the crash of the price of their parents' house and value, they have become extraordinary distrustful of America's banks," said millennial expert, Morley Winograd.

Hidden fees from the big banks are pushing technology dependent millennials to do their banking with online startups like chime and affirm which gives out debit cards and small loans.

Mobile payment services like Vemno, that allow peer to peer transactions, process hundreds of million of dollars a year.

"They just don't see any purpose to all the cost associated with banks when so much can be done online," said Winograd.

Bankrate estimates 63 percent of millennials ages 18 to 29 don't even have a credit card.

"You have to think about how to maximize your limited financial power so that you're not putting yourself in a hole in the future," said Shiba.

Analysts say the big banks need to pay attention, in fact one recent survey found that millennials would rather go to the dentist than listen to a banker.