3 On Your Side: Standard Insurance Doesn't Cover Everything

Jim Donovan reports...

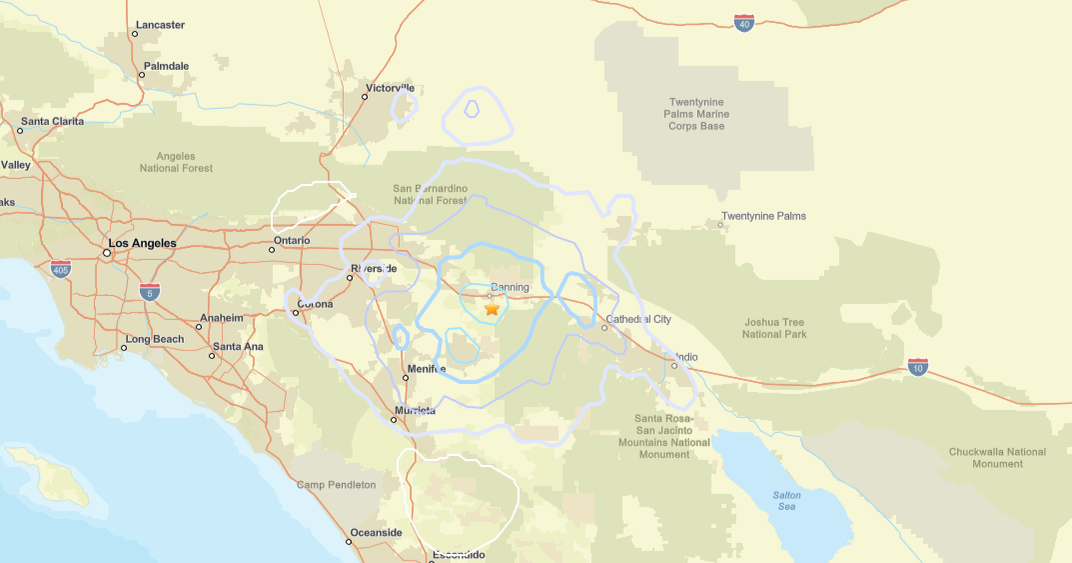

PHILADELPHIA (CBS) -- Yesterday we were dealing with an earthquake. This weekend we may have to prepare for a hurricane. When a disaster strikes many of us come to rely on our insurance when we need to put the pieces back together. But would your home owner or renter insurance policy cover you in situations like this? 3 On Your Side Consumer Reporter Jim Donovan finds, most likely not.

When was the last time you really looked at your home owner insurance or renters policy? Chances are you probably never have, and that is the problem. Most policies cover fire, a burst pipe, even high winds, but standard insurance doesn't cover everything.

Earthquakes aren't covered by standard homeowners or business insurance policies. Most companies offer it as add-on coverage to an existing policy for an additional cost. Rates are based on the type of structure being insured. On the east coast that averages from $100 to $300 a year. Car damage cause by a quake would be covered by your automobile comprehensive policy.

When it comes to hurricanes, most homeowner policies will cover wind damage, but not rising flood waters. You need a separate flood insurance policy to protect your property and personal belongings. Flood coverage can be obtained through your insurance agent and is provided by the Federal Flood Insurance Plan.

For more information about flood insurance visit: http://www.floodsmart.gov/floodsmart/ & CBSPhilly's Hurricane Preparedness Guide

Reported by Jim Donovan, CBS 3