Colorado rents could fall, say some experts: "There's a lot more to be reckoned with"

The release of the 59th annual Colorado Business Economic Outlook shows Colorado will be better positioned than many states to meet economic challenges that are coming; continuing job growth and expanding employment in several areas, benefited by a diverse economy.

But at the same time, real estate doldrums are ahead, depending on how you look at it.

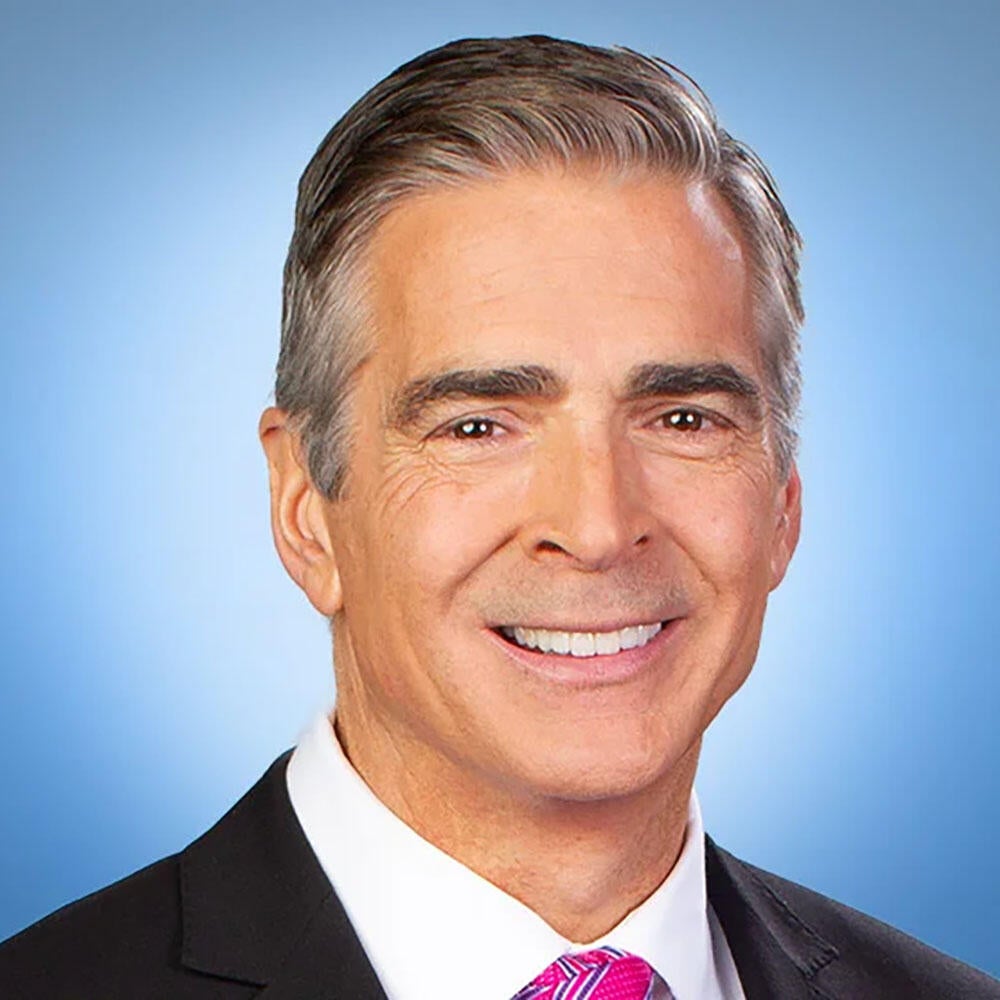

"Very interesting times. High-interest rates, real estate issues," said Richard Wobbekind, senior economist with the University of Colorado's Leeds School of Business and an associate dean of finance.

Colorado has benefitted from having the second-highest education levels among states.

"The correlation between education and income level and education and employment are very, very high," said Wobbekind. That will help add tens of thousands of jobs in 2024, says the 160-page report.

"Nationally there is about a job and a half available for each unemployed person. In Colorado that number is closer to two," said Wobbekind."

But there are concerns about real estate.

"That piece of the economy nationally and in Colorado is probably only about fourth or fifth inning in a nine-inning game at this point. There's a lot more to be reckoned with in the months ahead," said Wobbekind of commercial real estate. Office vacancy rates in the Denver-Boulder metro area are now running at 16 to 17% and could go higher.

"So we project that the vacancy goes up to 25 or 30% for the next couple of years. And office is already in the tank," said Marcel Arsenault, CEO of real estate investment firm Real Capital Solutions, who attended the conference that accompanied the release of the Leeds School of Business report.

Arsenault, who says he's more on the pessimistic side about the economy points to problems ahead for investors in an oversupply of apartments.

The metro area, he says, "probably needs on average 8 to 10,000 units a year. And we've been producing about 15,000 for the last several years."

His company sold apartments in recent years.

"I wouldn't build an apartment unless you put a gun to my head," he said.

Bad for investors, but for renters maybe some positives. "If you're a renter, I've got great news. In about a year from now, you're going to be able to get two months free rent, maybe even three months free rent on your apartment."

High-interest rates are hitting home ownership and reluctant to negotiate new mortgages fewer people are willing to sell homes and condos.

"Nobody wants to sell their house and get rid of a 3% mortgage. Or a 3%. And so there isn't much of a supply of houses on the market. We think that will change as interest rates come down," which he believes will be in 2024 or 2025.

Wobbekind believes there will be a slight reckoning of real estate prices, but nothing like the 2008 recession. "I don't see a crash in residential real estate prices and the reason for that in particular is that we have so many people who re-financed at very low-interest rates and are not losing a job like they did in 2008 and 2009."