Apple shares lost about $200 billion in value this week. Here's why.

Apple's gold-plated stock suffered a rare setback this week, with the technology giant's market value sinking roughly $200 billion amid reports that China is banning government employees from using iPhones.

Apple shares fell 3% Thursday and are down more than 5% for the week, although they nosed up in early trading Friday. Despite that mild slump, the stock has risen nearly 38% this year, largely on the strength of Apple's growing business for services such as Apple Pay and iCloud storage.

The iPhone ban was first reported by the Wall Street Journal, which cited unnamed sources saying China is ordering officials at central government agencies not to use the devices or other foreign branded phones. The Financial Times cited six unnamed sources at government institutions and state-owned companies, including a nuclear technology company and a hospital, saying they've been told to stop using Apple phones. The ban widens earlier restrictions on using iPhones for work, the outlets said.

"Beijing is looking to reduce its dependence on U.S. technology, but this [ban] acts as a significant headwind to Apple as China is its largest international market and accounts for about 20% of its revenues," said Victoria Scholar, head of investment at interactive investor, a U.K. investment platform.

Apple didn't respond to a request for comment.

When asked about the ban at a daily briefing in Beijing, Chinese Foreign Ministry spokesperson Mao Ning didn't comment directly, saying only that "products and services from any country are welcome to enter the Chinese market as long as they comply with Chinese laws and regulations."

Growing tensions

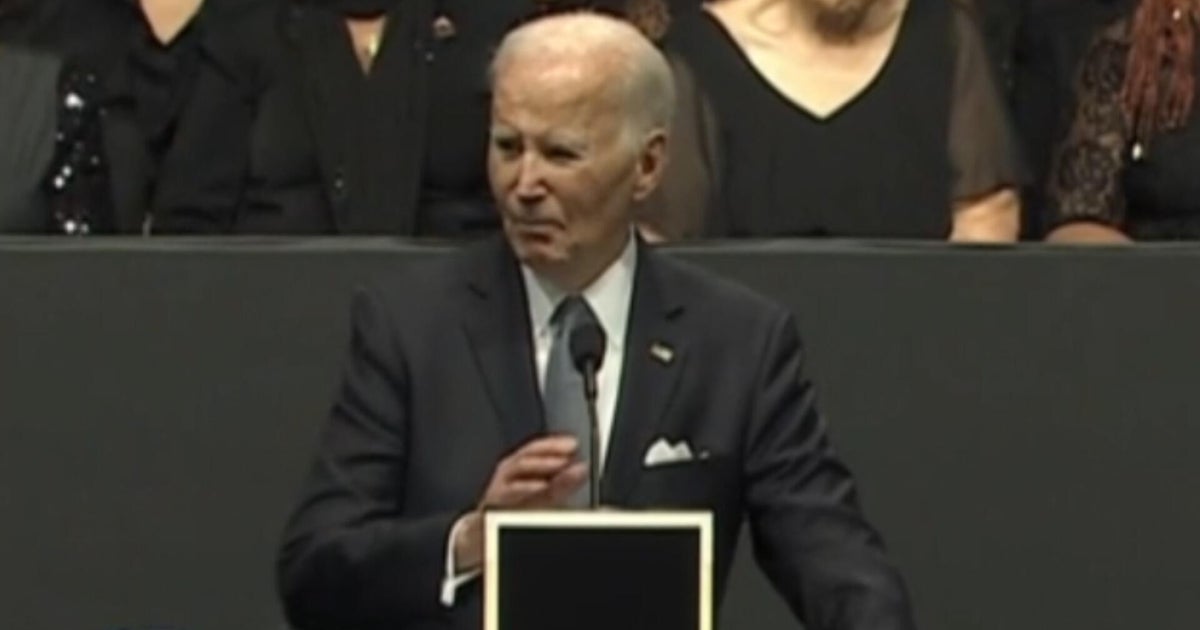

Tensions between the U.S. and China have been rising and early last month, President Joe Biden signed an executive order to impose blocks and regulations on U.S. high-tech investment in China, reflecting the intensifying competition between the world's two largest economies.

White House officials said Mr. Biden, who departed Thursday evening for New Delhi, will use the annual G20 summit as an opportunity for the U.S. to highlight a proposition for developing and middle-income countries that would increase the lending power of the World Bank and International Monetary Fund by some $200 billion.

Mr. Biden seeks to drive home that the U.S. and its like-minded allies are better economic and security partners than China.

The reported ban on the iPhone comes at a bad time for Apple, which is gearing up for its latest product launch next Tuesday Sept. 12, when it's expected to unveil its latest smartphone, the iPhone 15.

A teaser of the livestream for the event, dubbed "Wonderlust," has been posted on YouTube, revealing no details. Reports are swirling that big changes are in store for the iPhone, including a switch from Apple's Lightning connector to the USB-C plug that rivals are starting to adopt, partly in response to a European Union mandate.

Yet some Apple watchers think the risks posed by China's iPhone restrictions are overblown. Wedbush analyst Dan Ives noted in a report that Apple's share of the smartphone market in China has surged over the last 18 months and that next week's iPhone 15 release will stoke even greater demand.

Banning the device for usage by government employees would reduce iPhone sales in China by only about 500,000 units, he estimated, a fraction of the 45 million phones Wedbush expects Apple to sell in China over the next 12 months.

Faster Huawei phone

Apple also faces a threat from Chinese tech giant Huawei, which recently launched its latest flagship smartphone, the Mate 60 Pro.

The phone reportedly has enough power and speed to rival the iPhone and has been selling briskly in China. Huawei has been low key about the device, but its capabilities have raised concerns that China has been able to circumvent U.S. curbs on Huawei that stop it from acquiring high tech components like advanced processor chips that had effectively crippled its smartphone business.

"The breakthrough suggests that China has made progress in overcoming some of the constraints imposed by U.S. export controls," analysts with Capital Economics said in a report.