Wrongly Convicted Won't Pay Taxes On Compensation

DALLAS (AP) -- Some former inmates who were wrongly convicted say they feel twice cheated -- first for being imprisoned and then again when the government that locked them up taxed them on the money they were paid to make amends.

A recent Internal Revenue Service decision, however, means the federal government will no longer collect income tax on that money, allowing exonerated ex-inmates nationwide to keep payments meant to compensate them for their time in prison.

Texas attorney Kevin Glasheen, who represents a group of inmates exonerated by DNA evidence, said the government had been "giving with one hand and taking away with the other."

"It doesn't make sense when the government is the one that perpetrated this injustice and the government steps forward to correct it and then the government turns around and says, 'We want to take a third of it back,"' Glasheen said.

The IRS had been treating compensation as income, taxing it at a rate that varied depending on a former inmate's tax bracket. But in an internal memo released Friday, IRS officials agreed to reinterpret existing law so that compensation is treated the same as money received in a personal injury settlement. Such settlements are not subject to income taxes.

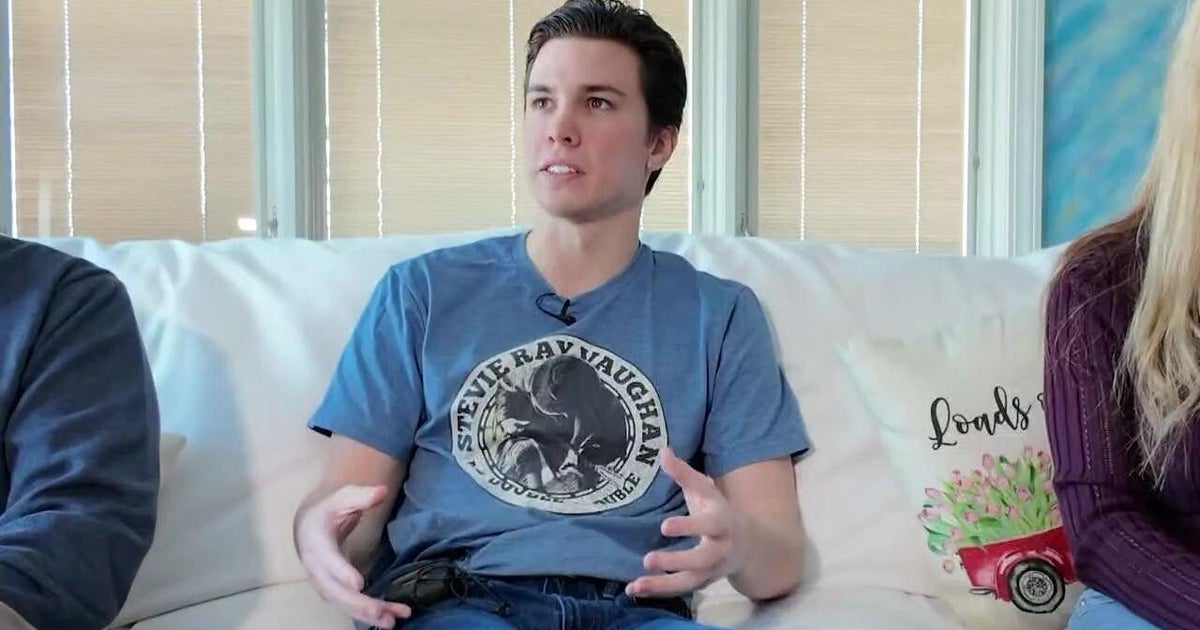

Glasheen, who brought his exonerated clients to Washington to lobby lawmakers and the IRS for the rule change, said former inmates proven innocent must show some form of personal injury suffered as a result of long-term incarceration.

That was easy for James Woodard, a Texas man who spent 27 years in prison for rape and murder until a 2008 DNA test proved his innocence. While in a meeting with IRS officials, Woodard suffered a seizure and was carried out by paramedics. He suffered head injuries in prison that have caused permanent damage.

"I think that had a dramatic impact on the IRS' perception of what these men have suffered," Glasheen said.

The change amounts to a massive savings for the wrongly convicted in Texas, which leads the nation with 40 DNA exonerations.

In 2009, the state legislature passed a law making Texas the nation's most generous in compensating the wrongly convicted. Under the new law, Texas pays $80,000 for each year of incarceration, plus a lifetime annual payment that varies based on life expectancy and other factors but is worth about $80,000.

Cory Session, whose wrongly convicted brother Tim Cole died in prison before he could be cleared by DNA testing, said the exonerees were thrilled with the rule change. One of the exonerees made Session repeat the news to his wife over the telephone.

"It's an early stimulus package," said Session, the policy director for the Innocence Project of Texas.

Inmates who already paid federal income taxes on their compensation have a three-year window to file for refunds. Those who received compensation and paid taxes more than three years ago likely have no recourse, Glasheen said.

James Giles, who served 10 years on a wrongful rape conviction because one of the perpetrators identified a different James Giles as an accomplice, said he is skeptical. The self-employed tax practitioner and bail bondsman in Lufkin said he's not holding his breath until he's certain the tax change has taken effect.

"My reaction right now is I am not going to do anything until I hear the last bell ring," Giles said.

(Copyright 2010 by The Associated Press. All Rights Reserved.)