Van Zandt County residents claim chief appraiser isn't adhering to same rules as everyone else

VAN ZANDT COUNTY (CBSNewsTexas.com) – The outrage over sky high property tax appraisals is getting personal in one North Texas county.

Property owners in Van Zandt County, just east of Dallas, are criticizing the assessed value of the chief appraiser's own home and land.

Chief appraiser Emily Reeves tells CBS News Texas that she's adhering to the same rules as everyone else.

Angry property owners in Van Zandt County are posting about their 2023 property tax appraisal increases on social media. Tiffany Koffel is one resident who couldn't believe her appraisal.

"I wasn't sure whether to laugh or cry," she said. "Last year it was valued to $322,000 and this year it's valued as $757,000."

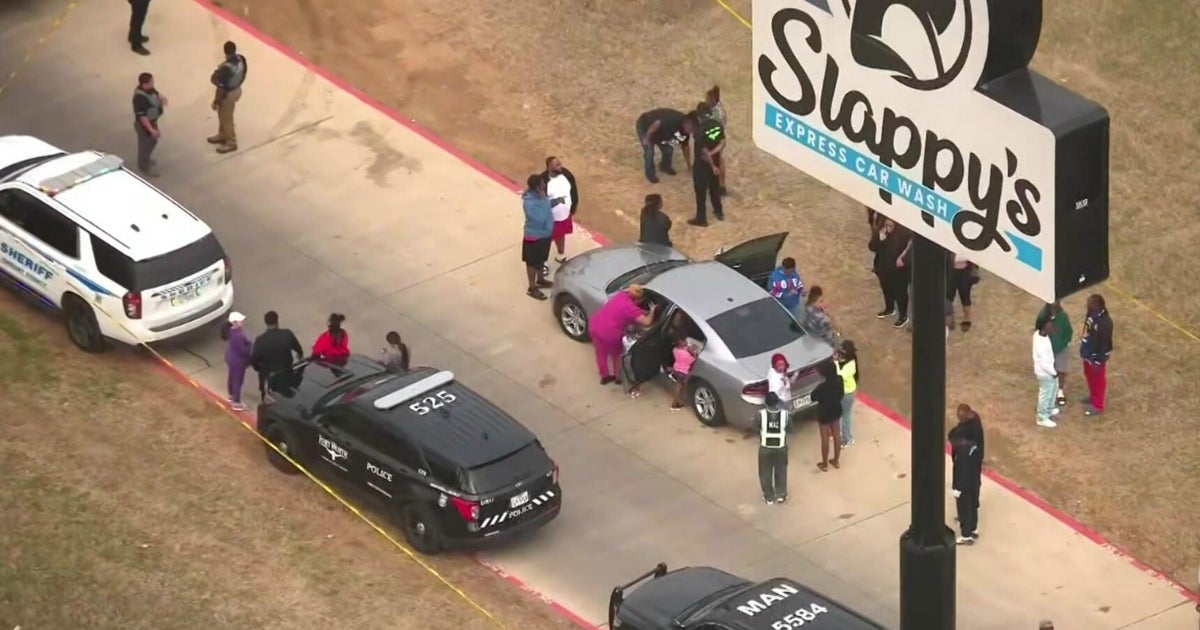

Koffel was among property owners who attended a contentious meeting with the appraisal board on Tuesday, when they were told higher home sale prices in Van Zandt County have resulted in a 22% increase in market values.

"So when you get a house payment, it's about $300, $400 or $500 more a month," said Wills Point resident Dennis Wood. "That hits you in the pocketbook, you can't afford to make your house payment."

"We've got so many ways to address this," said Edom resident Dwayne Collins. "No. 1, the state needs to...they talk about property tax relief. I want to know where it is."

On social media, angry property owners are taking their frustration out on Reeves, because two of the three assessments on her own personal property for this year appear to show a reduction in land value.

Reeves tells CBS News Texas those criticizing her are misreading her appraisal and insists she has been fully transparent about her own assets.

But the intense scrutiny on her shows just how fed up Texans are getting.

Read the full statement from Reeves below:

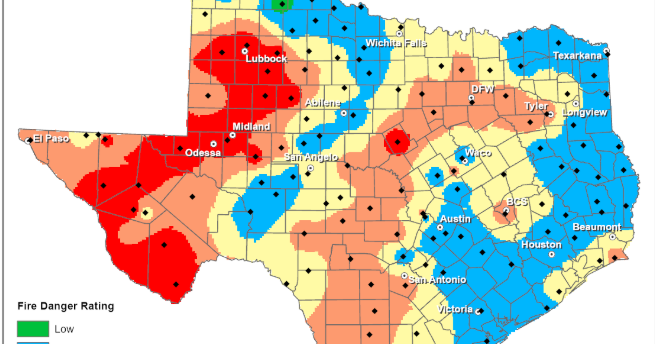

With the ability of more people to work from home, our county has seen in influx of new developments and increased sales prices for our real property that was sold/purchased over the last year. This data accounted for roughly a 22% increase in market values from January 1, 2022 to January 1, 2023. The biggest drive of this was in land values of smaller tracts.

We do operate in Mass Appraisal, meaning that we use the systematic appraisal of groups of properties using standardized procedures and statistical analysis. Unlike a Fee Appraisal that most property owners are more commonly familiar with that looks at that individual property and makes specific adjustments. The Protest Time is an essential step in Mass Appraisal as to give us an opportunity to review individual properties and rectify any issues that may be specific to that property. I encourage all property owners that feel that their value is high, to file a protest and provide any information that would affect their property's value. Our goal is to be accurate, not high or low as the State Comptroller's office does come in every other year to perform a Property Value Study ensuing that the CAD is within a 5% margin of error from 100% of market value.

I understand that there has been some concern voiced regarding my personal property. So, lets take a look at it. Late last year, I was given the opportunity to purchase 5 acres of a 52 acre tract that adjoins my home property of 10 acres. Wanting to secure the land surrounding my home, we jumped on the opportunity. The 52 acres was comprised of two parcels. The smaller of the two parcels was resurveyed and split leaving my 5 acre parcel as the account that retained the historical data from the original 12.03 acres prior to the split. This erroneously made the account look like it went down in value; however, if you see the below illustration, you will see that the price per acre on R10865 actually increased 82.7% due to economies of scale and market increase year over year.

So, lets talk about economies of scale a minute. Typically smaller acreage sells for a greater price per acre than a larger tract. Think of when you go to the grocery store and purchase a 4 pack of toilet paper. You will pay more per roll when buying a smaller package than if you went to Sam's Club or Costco and purchased a huge package of many rolls. This same principle applies to land sales as well. When we purchased the 5 acres, this increased the size bracket of our original tract of 10 acres to 15 acres. This less per acreage value is reflective of the slight decrease in my land value on R104064.

I should also point out that my home is a metal residence and is valued as such, this construction type has shown a less increase in market value than a typical brick or wood frame home. This is driven by sales and cost to construct.

Transparency is extremely important to me and I encourage anyone that has any questions to reach out to me and I will gladly answer any questions that they have.