Dealing With Job Insecurity & Preparing For The 'What Ifs'

DALLAS (CBSDFW.COM) - American workers are worried and with good reason.

"People are getting laid off. They don't know how they're gonna pay their mortgages, let alone raise the kids and get a working salary," said Fort Worth resident Joe McCarthy.

McCarthy's concerns are being mirrored by workers across the nation. According to a recent Gallup Poll, some 30-percent of workers are worried about losing their job. And they had those concerns before Bank of America announced plans to split into two companies and possibly shedding some 40,000 jobs in the process.

"I've been in industries that evaporated, overnight," said Dallas career coach Mike McCormack.

His advice for workers – don't panic and get prepared. "Have a game plan, understand what your gifts and abilities are, and network like crazy!"

Preparations could mean brushing up on social media avenues, like Facebook and Linkedin, or simply letting everyone you know you're looking for a job.

Reconnecting with former colleagues and industry peers is also recommended. "Continue to network," said McCormack. "Know what others are doing in your industry. Make sure you're keeping your skills up to date."

Use a potential job transition as an opportunity to reassess what it is you truly want to do. Some say a lost job can be a blessing in disguise.

"Find out what your strengths are. Find out how you can help companies, and go into this looking at it as an opportunity to do something different," said McCormack, who believes the next job could be something better fit for an individual.

Experts acknowledge that a job loss is extremely stressful, but say unemployed workers will weather the storm better they get their finances in order early.

"You need to know what's going to happen if that was you, whether that's going to be you, or not," advises Todd Mark, Vice President of Education at the Consumer Credit Counseling Service of Greater Dallas.

Financial preparations should include:

• Having at least three to six months of living expenses set aside in an emergency fund—more if possible. The average job search now lasts 10 months.

• Do not take on any additional debt

• Look into other avenues for additional income: is there a hobby or skill that could be cultivated after hours or on weekends that could bring in extra cash?

• List your assets so you will know exactly what resources could be tapped, in a worst case scenario

"If you went two months, or four months, or six months without a job, you'd be able to say, 'I've got this much savings. I've got this much open credit [and] this much help from my family'," Mark said, of those prepared. He also advises answering the questions, "If I had to, in a worst case scenario, could I borrow from my 401k? Is my house worth anything? Or am I upside down, there?"

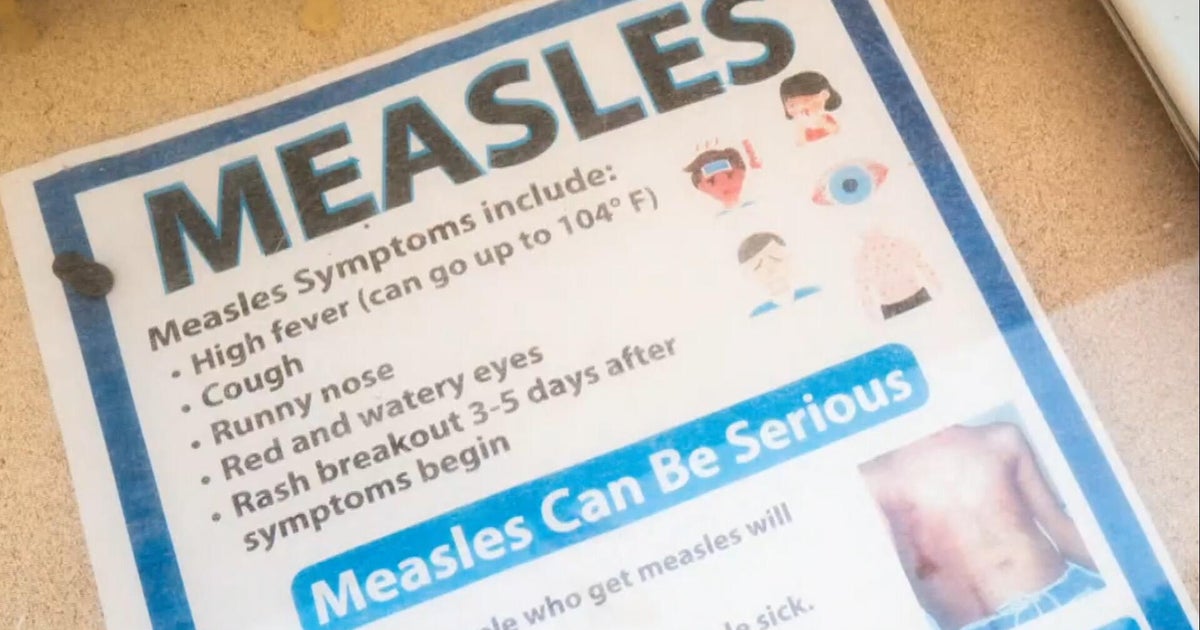

Most experts agree workers should be as proactive with their finances as they are with preventative health measures.

Consumer Credit Counseling Service of Greater Dallas offers free online courses that deal with a variety of financial education topics.

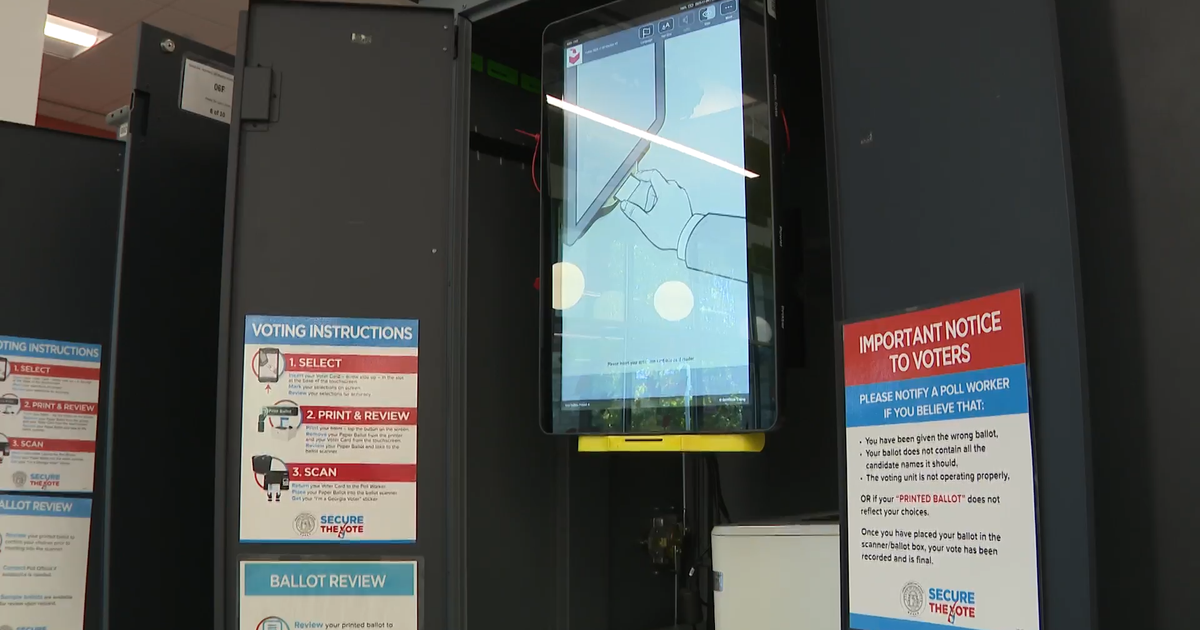

Bottom line, Mark said everyone should know their "SWAN" factor or what steps need to be taken to help them "Sleep Well At Night."