Credit card balances just rose by $44 billion. Here's how to have your debt forgiven now.

With credit card balances surging now, a forgiveness program could be worth exploring. Here's how to qualify.

Watch CBS News

Matt Richardson is the senior managing editor for the Managing Your Money section for CBSNews.com. He writes and edits content about personal finance ranging from savings to investing to insurance. Previously, he worked as a senior editor for FoxNews.com and FoxBusiness.com. A former sports reporter, Matt covered professional boxing in New York City for 18 years. He is the former Vice President and Secretary for the Boxing Writers Association of America (BWAA) and is an elector for the International Boxing Hall of Fame. He has a master's degree in journalism from Columbia University.

With credit card balances surging now, a forgiveness program could be worth exploring. Here's how to qualify.

Need to find a home for your $50,000? Here's how much interest you can earn by leaving it in a money market account.

The price of silver has been volatile in recent weeks. Here's where it stands as of February 10, 2026.

Hoping to buy a home or refinance your existing one? These are the mortgage interest rates to know right now.

Money market accounts remain viable for savers. Here's what's considered a good money market account interest rate now.

The price of silver has changed considerably in recent weeks. Here's where it stands as of February 9, 2026.

Want to buy a home or refinance the one you live in now? Here are the mortgage interest rates to know right now.

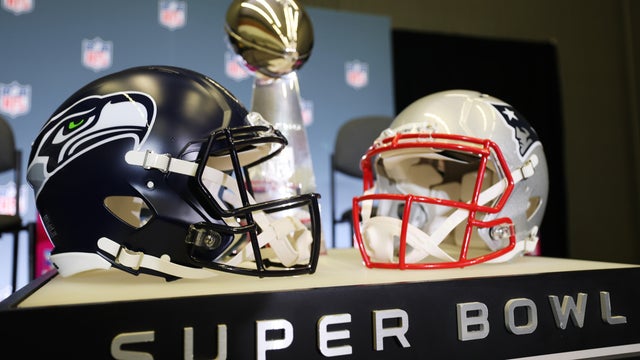

Not sure where to watch the 2026 Super Bowl live? There are multiple ways to watch the game for free today. Here's how.

The price of silver dropped in early February, opening new, more affordable opportunities for investors.

Looking to buy a home or want to refinance your current one? These are the mortgage rates to know right now.

Interest rates on money market accounts remain competitive. Here's how much a $40,000 account can earn in 2026.

HELOC interest rates fell yet again this week. Here's how much a $100,000 HELOC will cost per month now.

Considering a silver investment in today's economic climate? Here's where the price stands as of February 5, 2026.

Want to purchase a home or refinance your existing one? These are the mortgage interest rates to know right now.

Mortgage interest rates are much lower than they were one year ago. Here's how much a $500,000 costs monthly now.