Shareholder Sues Wells Fargo Over Phony Accounts Scandal, Systemic Failures

SAN FRANCISCO (CBS SF) -- A longtime shareholder sued Wells Fargo Bank executives on Thursday for allegedly incentivizing misconduct and breaching their fiduciary duties when they allowed millions of accounts to be opened without customers' permission.

The shareholder, Peninsula resident William Sarsfield, teaches finance at Golden Gate University where he's a senior adjunct professor. One of the courses Sarsfield teaches focuses on management operations at banks and the legal and regulatory environment in which banks operate.

Sarsfield believes that what Wells Fargo is accused of doing - creating phantom accounts in an effort to bring in more fees and create artificially high sales figures - is illegal, and he's seeking reparations as a shareholder.

Sarsfield's complaint, filed in San Francisco Superior Court by the law firm Cotchett, Pitre & McCarthy, alleges the bank engaged in the misconduct in order to "boast to the public markets that the Bank was achieving continuous growth, and pay themselves lucrative compensation packages."

In addition to the bank, Sarsfield names Wells Fargo CEO John Stumpf and executive Carrie Tolstedt, as well as over a dozen other defendants in the suit.

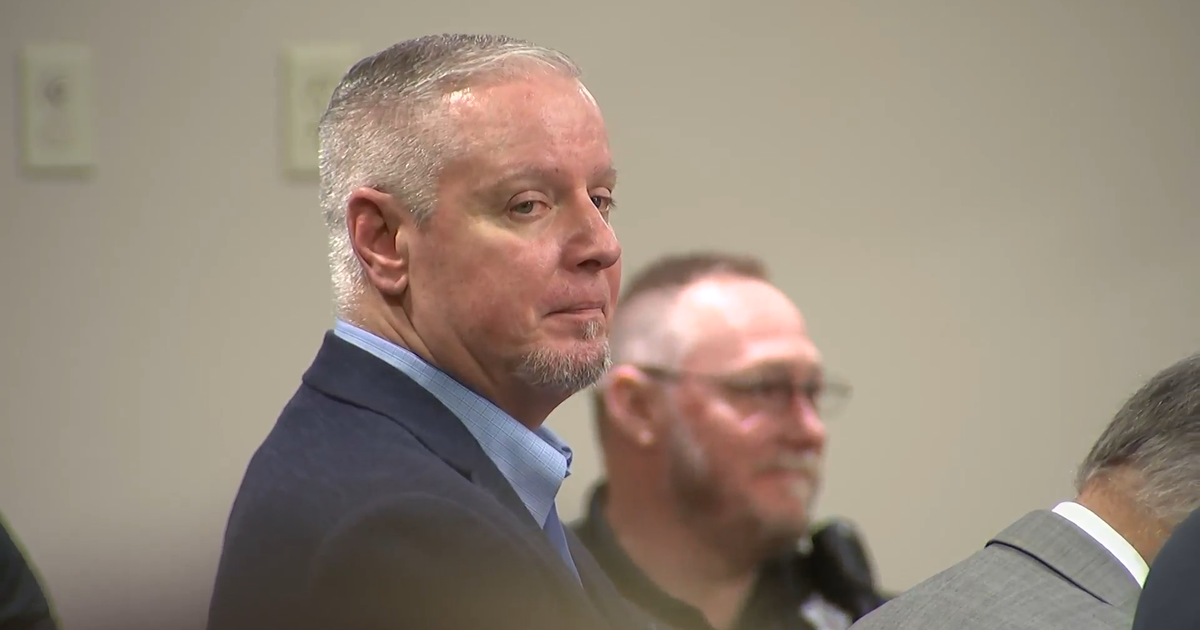

Stumpf, who was called to testify before a Senate panel over the alleged fraud earlier this week, announced on Thursday that he is resigning from the Federal Reserve's advisory council, amid the growing scandal.

During his testimony, Stumpf apologized for the scandal involving some 1.5 million fake bank accounts created on behalf of unwitting customers, calling the behavior "unethical" but refusing to say whether it constituted fraud.

Stumpf earned $15.3 million in compensation last year, while Toldstedt - who headed up the division where the false accounts were created - is expected to take $124.6 million in stock and options with her when she retires later this year.

While 5,300 low-level Wells Fargo employees were fired for the misconduct, members of the Senate panel, including U.S. Senator Elizabeth Warren (D-MA), maintain that the bank hasn't fired any of the high-level employees responsible.

Read Also: Senators Slam Wells Fargo CEO Over Unauthorized Accounts

Wells Fargo was fined $185 million by federal and California regulators earlier this month and Stumpf has said that the bank has reimbursed millions to customers who were impacted during the five-year period in which the misconduct allegedly occurred.

Wells Fargo is also the defendant in a class-action lawsuit and is the subject of a federal investigation into the misconduct allegations. Bank employees at other banks have also reported abusive practices.

Read Also: Bank Employees Say Wells Fargo Not The Only Bank With Abusive Policies

The complaint maintains that the regulatory settlements "exposed a far-reaching, systemic breakdown in corporate governance at Wells Fargo, including the Board of Directors' utter failure to implement, monitor and enforce basic systems of internal controls over its sales and risk management, and compensation programs approved by the Company's senior management that incentivized illegal behavior..."

The bank's misconduct, the complaint states, was concealed from investors and regulators and has negatively impacted the value of the Wells Fargo stock and investor confidence.

Sarsfield is seeking redress against Wells Fargo's top executives and a jury trial.

By Hannah Albarazi - Follow her on Twitter: @hannahalbarazi.