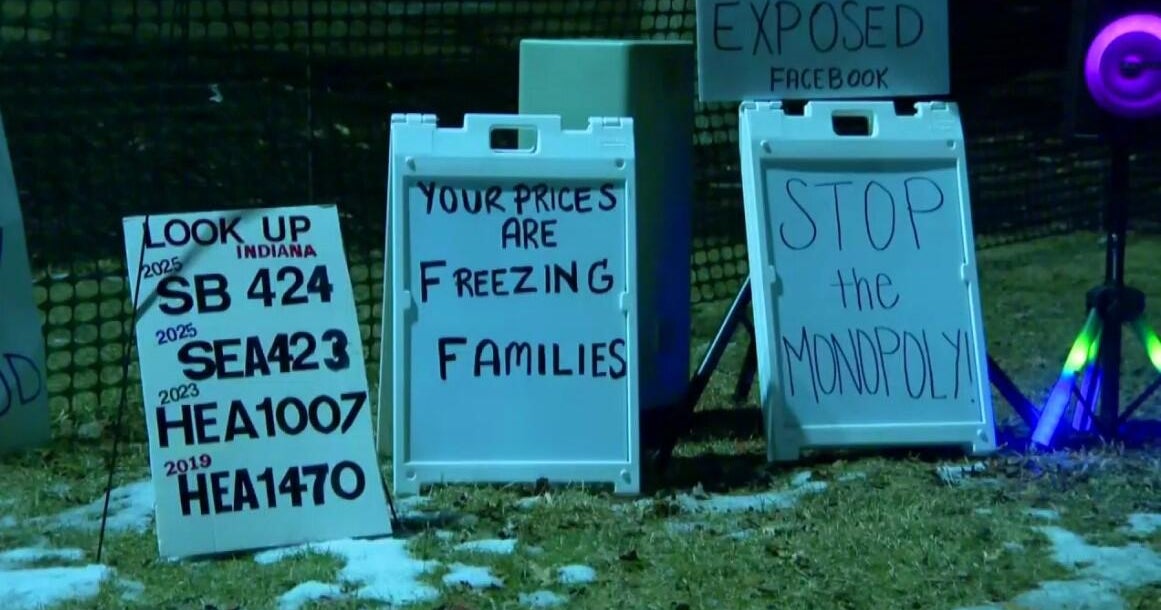

Consumer Prices Rise After 3 Straight Declines

WASHINGTON (AP) _ Consumer prices rose in July by the most since last August as energy costs increased for the first time in five months.

The Labor Department said Friday that the Consumer Price Index, the government's most closely watched inflation measure, increased by 0.3 percent in July, after three months of declines. Wall Street economists expected a smaller increase.

Over the past year, consumer prices rose by 1.2 percent, the department said. That's up slightly from last month's 1.1 percent pace but still a mild increase.

One small benefit of the weak economy is that it is keeping prices in check. Consumers are spending cautiously and saving more, which makes it harder for companies to raise prices.

Excluding volatile food and energy prices, the so-called "core" index increased by 0.1 percent in July, as the cost of housing, clothes, and used cars and trucks all rose.

Core prices moved up by 0.9 percent in the past year for the fourth month in a row, the department said. That's below the Federal Reserve's inflation target and is the slowest pace in 44 years.

July's increase in consumer prices may assuage concerns, raised in recent weeks by some Federal Reserve officials, that the economy is moving toward deflation. Deflation is a widespread and prolonged drop in the price of goods, real estate and stocks. It also reduces wages and can make it harder to pay off debts.

The U.S.'s last serious case of deflation was during the Great Depression.

Most economists don't believe deflation will happen. But they are watching consumer prices closely for any signs of it.

Meanwhile, tame inflation allows the Federal Reserve to keep the key interest rate it controls at a record low of nearly zero percent in an effort to bolster economic growth. The Fed usually fights rising inflation by raising rates.