Analyst optimistic about a downtown San Francisco rebound

SAN FRANCISCO - With tech layoffs and some people still working from home, office vacancy rates in San Francisco went from a historic low of about 5% before the pandemic to a record high of almost 30% in just a matter of three years.

Downtown San Francisco hasn't just struggled coming out of the pandemic. It's been one of the slowest cities in the country to bounce back. But while the market is down, it's not completely dormant. One expert sees a silver lining in the available space and expects those empty buildings to be filling up soon.

"San Francisco skews heavily toward tech," Robert Sammons, Senior Research Director at Cushman & Wakefield, "But you have a lot of business services as well."

If you want to see some silver linings in the doom and gloom, look at San Francisco's Financial District through the eyes of Sammons. For starters, there's the timing of the downturn.

"That was the best timing," he said of the pandemic and downtown crash. "Honestly, if there has to be good timing, in that there were a lot of projects in South of Market that could've been under construction but they had not started yet. And so we could've had a much higher vacancy rate quite frankly."

He also points to the explosion of city-based AI ventures.

"The different companies have about 1,000,000 ft.² of need from that sector alone," he said of new demand.

But the downturn, he says, isn't over yet. The vacancy numbers, about 30% citywide, will likely grow for at least another year.

"They will rebound eventually," Sammons said of the vacancy numbers. "But we're saying probably mid 2024 before the recovery starts to take hold."

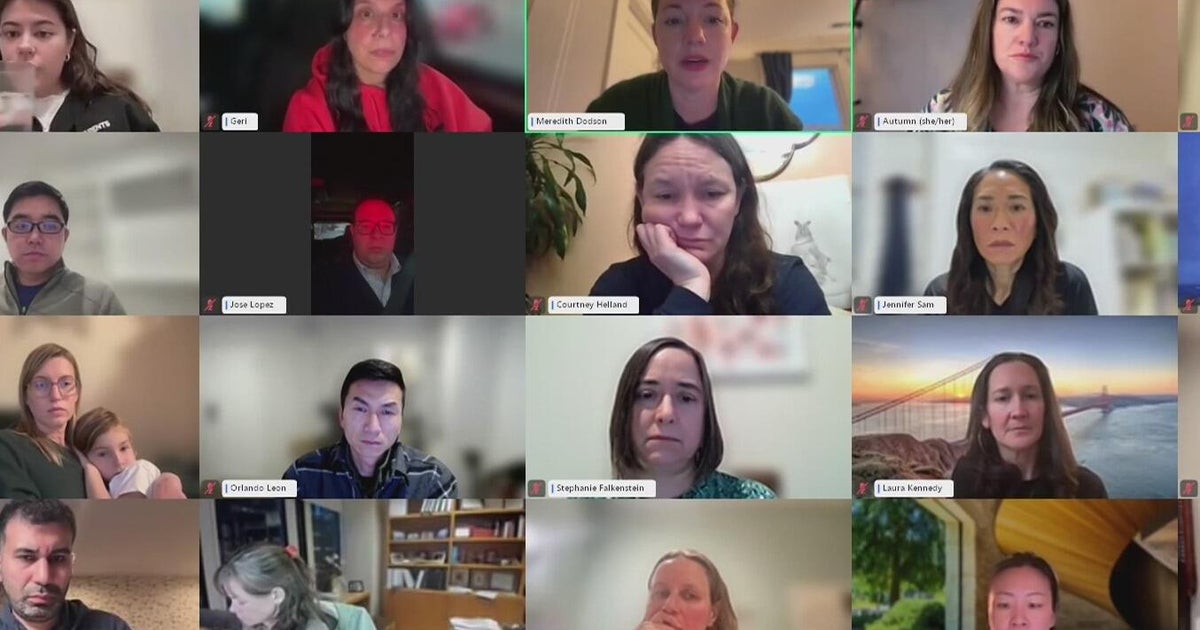

So what's happening now? More employers are asking workers to come in, at least part of the time and that's shifting things around.

"Employers are trying to lure employees back to work," Sammons explained. "So they are relocating when their lease expires to the best of the best buildings in San Francisco right now. We've seen it tick up, especially Tuesday, Wednesday, Thursday where it's really above about 50% occupancy to the pre-pandemic levels."

"Yeah, things are going OK," said Financial District restaurant owner Lauren Ketellapper. "In the middle of the week, Tuesday, Wednesdays, and Thursdays, I've picked up a bit. We're not quite pre-Covid levels yet, but those days are pretty good."

Local Roots is one of the downstream businesses surviving in this very different environment. Ketellapper says she's seeing new changes. like more catering requests.

"I think a lot of companies are trying to entice their employees to come back to the office," she said. "Give them a little perk to come in and have some face-to-face time."

That's why top tier office space, often newer buildings, is still in demand.

"The vacancy rate in those buildings is less than 10%," Sammons said.

It's many of the city's older office buildings for which the future is less certain, and that too will eventually change the market.

"You do have buildings that probably will be pulled out of inventory because they are obsolete for office use," Sammons said. "So that lowers the inventory of the office stock in San Francisco, which adjusts the vacancy rate."

Thus creating more space for housing, which could bring people into a transformed neighborhood. In short, the business district, as it used to be, is going away.

"The change needs to happen," Sammons said of downtown metamorphosis. "It needs to be more mixed. It really needed to be more mixed-use pre-pandemic. This is our chance to remake that, but it takes a lot of money. It takes a lot of resources. It's not gonna just be the city, it's probably going to be the state and federal government to kick in something, to give incentives to woo developers to either convert or to build new in the CBD."

And nobody's quite sure how to do that yet.

"No," Sammons acknowledged. "No one's quite sure how that works, and a lot of people are trying to figure that out right now."

Swapping obsolete office buildings for housing is now a kind of holy grail in the city, but conversions are not easy. Then there is what might be called the San Francisco confidence question. Can a city with a bartered reputation inspire people to be bullish on downtown? Can AI growth really fill office buildings? All things that will take years to answer, in what is a monumental shift for this end of the city.