Sharp Jump In Foreclosure Notices In August

SACRAMENTO (CBS13) -- Banks have stepped up their actions against homeowners who have fallen behind on their mortgage payments, and the Sacramento area is one of the hardest-hit regions in the country.

The number of homes that received an initial default notice -- the first step in the foreclosure process -- jumped 33 percent nationwide in August from July, foreclosure listing firm RealtyTrac Inc. said Thursday.

It increased a whopping 76 percent in the Sacramento region -- Sacramento, Yolo, Placer and El Dorado counties -- and 55 percent statewide.

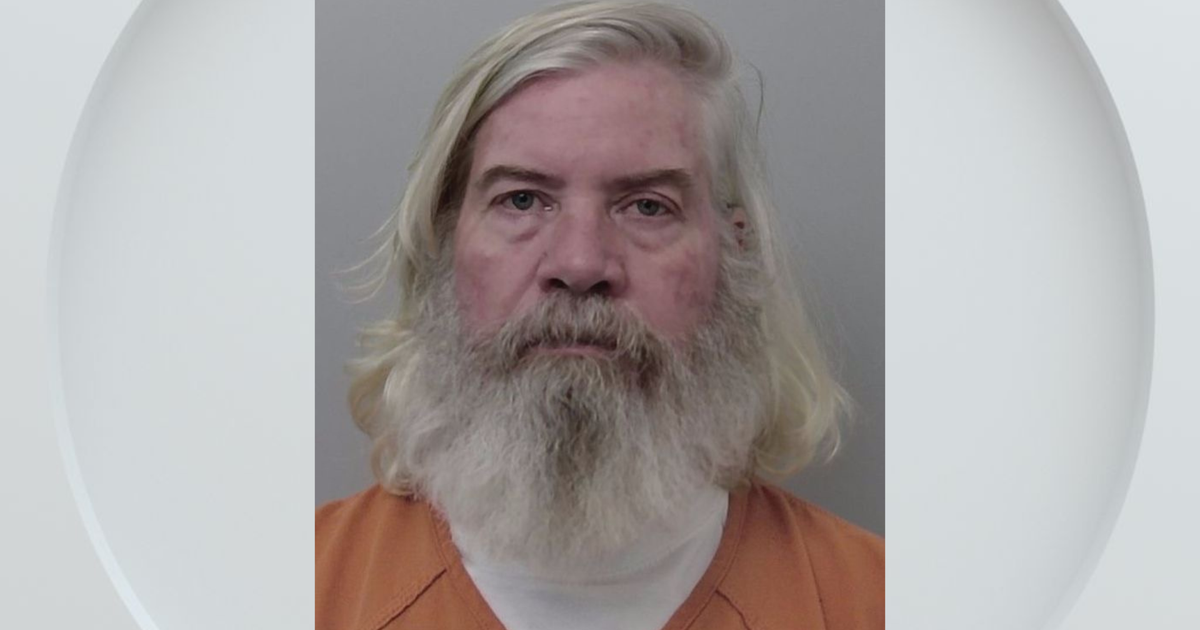

Susan Torres told CBS13's Ben Sosenko she's days away from losing her North Highlands home despite trying to work something out with Wells Fargo for more than a year.

"When do they get to stop lying to people? When do these companies stop people from ripping their hearts and their lives like they're nothing?" she asked. "To lose your home is devastating to me."

The Sacramento region had 2,432 notices of default in August, up from 1,374 in July. Notices from Bank of America accounted for a big part of the jump, according to RealtyTrac, as the Charlotte-based bank steps up efforts to cut down on its number of distressed loans.

"Strong gains like that from July to August demonstrate our progress –- primarily in non-judicial states like California and Nevada -- clearing more volume to advance to foreclosure once we pass the numerous, improved quality controls we have in place and only after all other options with homeowners have been exhausted," Bank of America's Jumana Bauwens said in an email.

Realtor Bill Sturgin of Tower Realty says banks are acting on people who have failed to make their mortgage payments like Torres.

"It looks like the banks are aggressively foreclosing now where in the past they let them slide with the hope they could sell them on the short side," he said.

Modesto is No. 2 in the nation behind Las Vegas in the number of homes to receive foreclosure-related notices, with one out of every 129 homes in the foreclosure process, according to the firm. Vallejo-Fairfield had the third-highest percentage of homes in default nationwide.

The national increase represents a nine-month high and the biggest monthly gain in four years. The spike signals banks are starting to take swifter action against homeowners, nearly a year after processing issues led to a sharp slowdown in foreclosures.

"This is really the first time we've seen a significant increase in the number of new foreclosure actions," said Rick Sharga, a senior vice president at RealtyTrac. "It's still possible this is a blip, but I think it's much more likely we're seeing the beginning of a trend here."

In all, 78,880 properties received a default notice in August. Despite the sharp increase from July, last month's total was still down 18 percent versus August last year and 44 percent below the peak set in April 2009, RealtyTrac said.

In all, 228,098 U.S. homes received a foreclosure-related notice last month, a 7 percent increase from July, but a nearly 33 percent decline from August last year. That translates to one in every 570 U.S. households, said RealtyTrac.

Nevada still leads the nation, with one in every 118 households receiving a foreclosure-related notice last month. Rounding out the top 10 states with the highest foreclosure rate in August are California, Arizona, Georgia, Idaho, Michigan, Florida, Illinois, Colorado and Utah.

(The Associated Press contributed to this story.)