Government shutdown could jeopardize U.S credit rating, Moody's warns

The U.S.' credit worthiness is one of its most prized fiscal assets, with global investors relying on the guarantee that the nation can make good on its debts. But now, a leading credit agencies is warning that a possible federal government shutdown this week could tarnish the country's gold-plated rating.

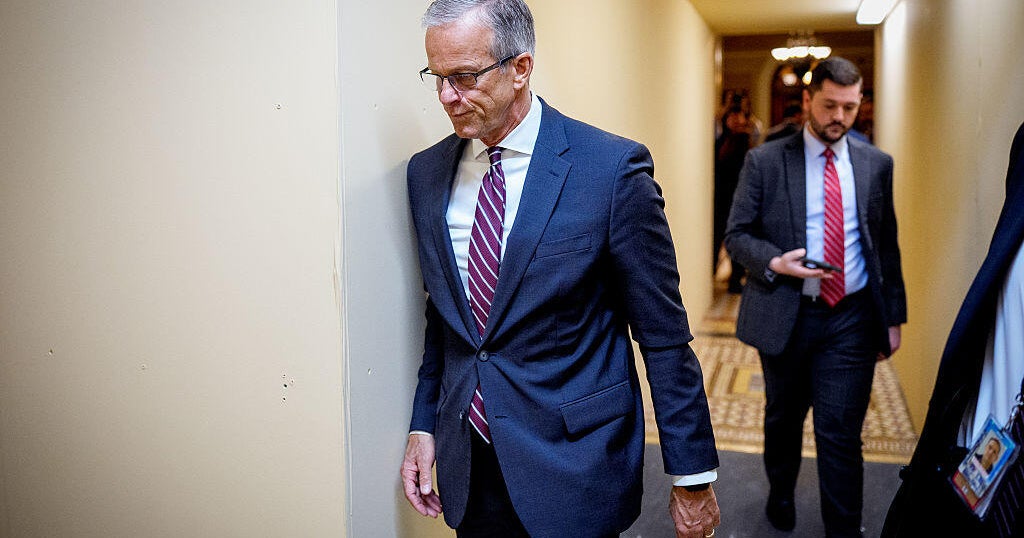

Time is running out for for House Speaker Kevin McCarthy to find a compromise to keep government agencies running and to avoid a shutdown on October 1, the first day of the new fiscal year. If McCarthy and other Republicans are unable to find a solution, funding would expire on September 30 and many agencies would be forced to halt some of their operations. Hundreds of thousands of federal workers also wouldn't draw a paycheck until the crisis is resolved.

With Congress divided between a Democratic-controlled Senate and Republican-led House — and with some far-right conservatives looking to use the shutdown as leverage to force government spending cuts — many are bracing for a stoppage that could last weeks. While the actual economic impact of a shutdown is likely to be reversed once the government reopens, the damage could be longer-lasting for other reasons, Moody's Investors Service said Monday in a report.

"A shutdown would be credit negative" for the U.S. debt, while "A shutdown "would underscore the weakness of U.S. institutional and governance strength relative to other Aaa-rated sovereigns that we have highlighted in recent years," Moody's analysts wrote.

The credit rating firm added, "In particular, it would demonstrate the significant constraints that intensifying political polarization put on fiscal policymaking at a time of declining fiscal strength, driven by widening fiscal deficits and deteriorating debt affordability."

Moody's didn't change its Aaa rating on U.S. debt, but cautioned that the nation's "lack of an institutional focus on medium-term fiscal planning ... is fundamentally different from what is seen in most other Aaa-rated peers, for instance historically in Germany (Aaa stable) and Canada (Aaa stable)."

No longer AAA

The warning comes roughly two months after Fitch Ratings, another major credit ratings agency, downgraded U.S. credit from the highest rating, citing the nation's rising debt and eroding political stability. In that case, the firm lowered the nation's rating to AA+, from its previous AAA level.

Fitch cited the country's "repeated debt-limit political standoffs and last-minute resolutions" as weakening investors' faith in U.S. fiscal management.

Like Fitch, Moody's also cited the nation's ballooning debt as a pressing issue, partly because it requires higher costs to service the debt, resulting in less fiscal flexibility. Meanwhile, political infighting could create "extremely difficult" conditions for creating a plan to reverse widening fiscal deficits by either increasing federal revenue or cutting entitlement spending, it warned.

"In the absence of significant fiscal policy measures, we expect debt affordability to deteriorate at a much faster pace, with federal interest payments relative to revenue and GDP rising to around 27% and 4.6%, respectively, by 2033, from 9.7% and 1.9% in 2022, driven by materially higher interest rates and relatively weak revenue," Moody's said.

Costs of a government shutdown

Despite such concerns, the economic effects of a government shutdown itself is likely to be short, with the impact most heavily felt in industries and geographical areas with a high concentration of federal workers, such as Washington, D.C., Moody's noted.

"Some defense contractors and municipal issuers, including mass transit systems, and certain municipal housing sector bonds that rely on annual federal appropriations could be affected," Moody's, led by analyst William Foster, said in the report. "Mass transit authorities, already grappling with lower post-ridership and the looming expiration of pandemic relief funds, may face further challenges due to potential delays in federal grants."

Even so, a shutdown would occur just as millions of American workers are set to face another economic challenge with the resumption of student debt repayments in October.

Furloughed government workers "will not receive pay until the shutdown ends," noted High Frequency Economics in a research report. "They are likely to step back from spending, at least temporarily."