Folsom voters set to decide on one-cent sales tax increase

FOLSOM — From fixing parks and potholes to funding fire and police, a proposed one-percent sales tax increase in Folsom would provide more money for city services.

"That would bring up to about $29 million in extra revenue," Folsom City Manager Elaine Andersen said.

Andersen is not taking a position on Measure G, but she said it comes at a time when Folsom is facing tough budget decisions.

"I think people would be very surprised to hear a city like Folsom is facing a structural deficit," she said.

Opponents are concerned the extra tax money won't be spent wisely.

"What are they going to spend it on? Why do they need that? There haven't been reasons shown why they need these additional funds,"

Some say not everyone can afford to pay higher taxes.

"Sales tax are regressive taxes," said. "They affect the lowest income seniors, youth."

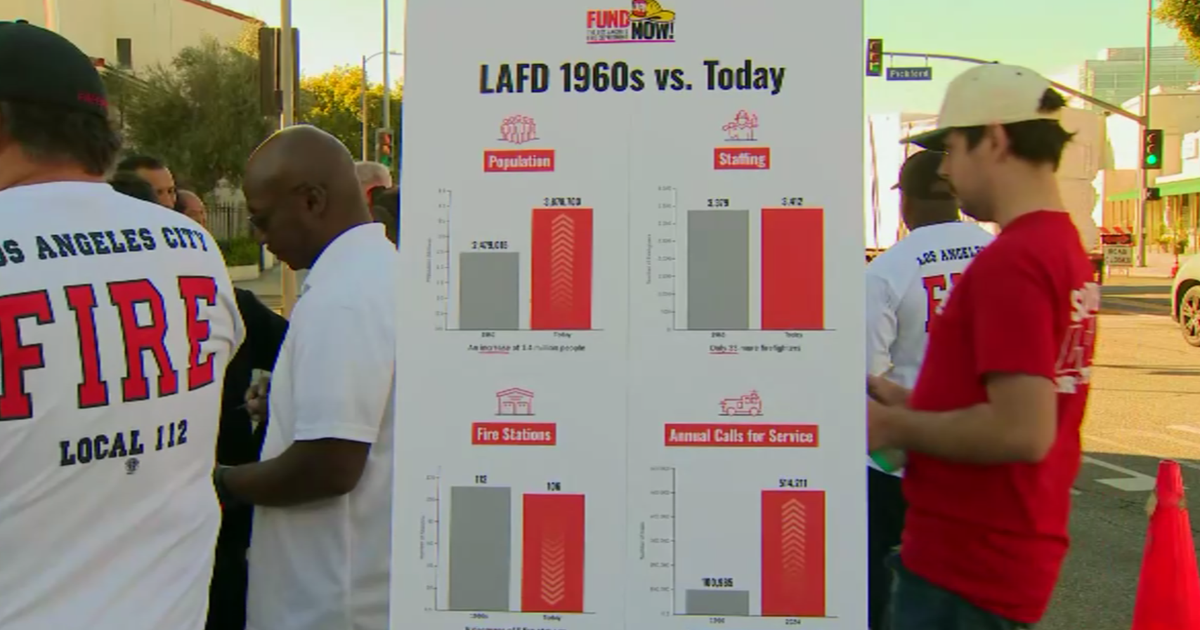

Supporters say the city is already doing more with less.

"We have fewer police officers budgeted now than we did in 2008, despite about 18,000 more population," said.

They want to ensure parks and public safety are not compromised.

"Are we just going to survive as a community or do we want to thrive?" said.

If passed, the new tax rate would be 8.75% — the same as Elk Grove, Rancho Cordova, and Sacramento.

Measure G requires a simple majority to pass and the new rate would take effect April 1 of next year.