California says insurers must cover certain zip codes to reap new state-mandated rewards

FORESTHILL — Wildfire impacts on soaring homeowner insurance costs are leading to a brand new coverage plan for California, which will include identifying zip codes that insurance companies will have to cover to reap new state-mandated rewards.

The Placer County community of Foresthill is in one of the 350 zip codes where the state insurance commissioner said he wants insurance companies to increase the policies they offer.

John Michelini lives in Foresthill.

"Everybody in the foothills community essentially has been canceled by their insurance provider," Michelini said. "Our primary coverage was canceled three years ago."

Michelini has basic and minimal state FAIR Plan coverage in place of traditional coverage.

"That map was both long overdue, perhaps larger and more expansive than many of us would have expected," said Carmen Balber, Consumer Watchdog executive director.

Barber said the best way to get insurance companies back into these neighborhoods is to guarantee coverage for homeowners, like Michelini, who harden their homes in wildfire-prone areas.

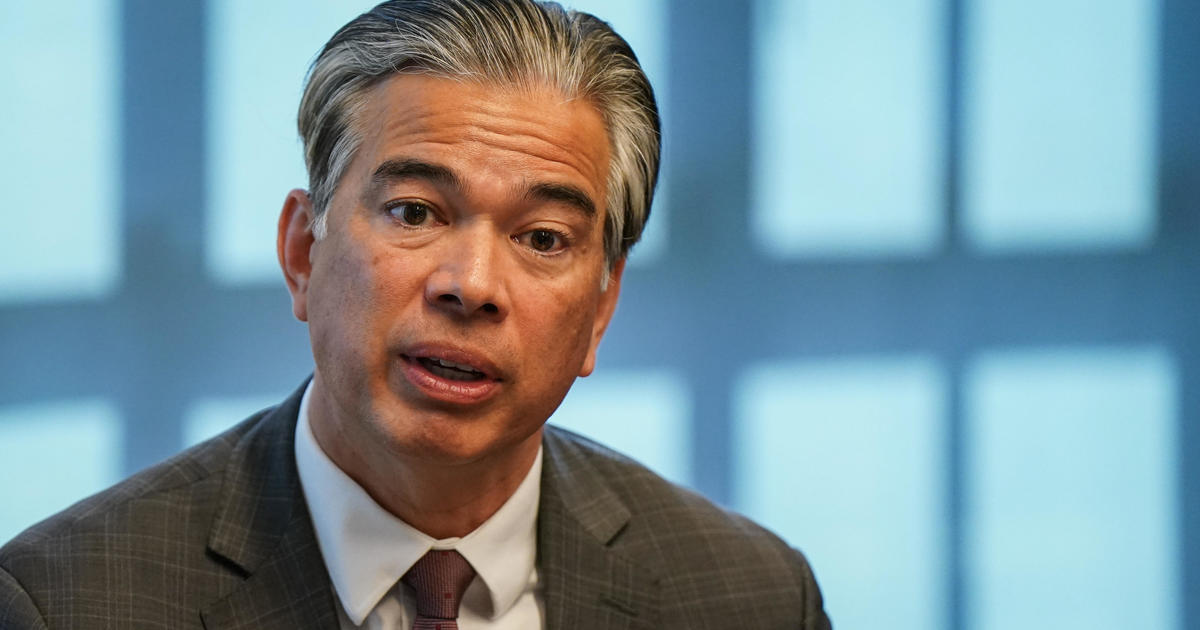

California Insurance Commissioner Ricardo Lara's new insurance sustainability plan does not go that far. Instead, it forces insurers to cover homeowners in high-risk areas at 85% of their state-wide coverage and to take over policies from the state's high-cost FAIR Plan for people who couldn't get coverage anywhere else.

In exchange, the insurers can use forward-looking models to base rate increases on future risk.

"On day one, insurance companies will be allowed to raise rates," Balber said. "And that's not just for people in fire areas but for every homeowner in the state of California."

"The drive for profit will remain, regardless of the environment that we're working in," Michelini said. "The least we got to do is get it under control."

Michelini is not expecting the state insurance plan to save him any money. He's hopeful his massive bill hikes won't be as wild.

The new sustainable insurance strategy is only a proposal right now. The insurance commissioner hopes to have it in place by the end of the year.