Sen. Casey, Gov. Wolf Say GOP Tax Plan Will Take Deductions From Pennsylvanians

Follow KDKA-TV: Facebook | Twitter

PITTSBURGH (KDKA) -- Thousands of Pennsylvanians will lose an important tax deduction, say U.S. Sen. Bob Casey and Gov. Tom Wolf, both Democrats, if a Republican tax plan moves forward in Congress.

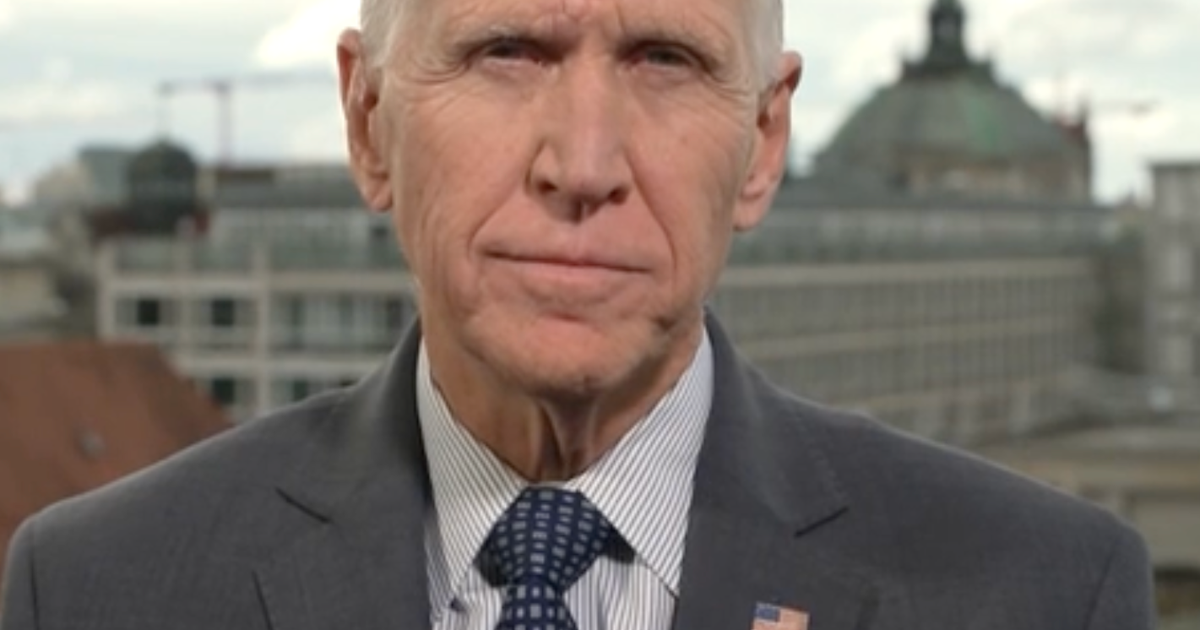

"I don't think we've seen a proposal like this in a long, long time, if not ever," Casey told KDKA political editor Jon Delano on Tuesday.

Republican lawmakers are talking of eliminating or reducing the tax deduction that many local taxpayers take for property, sales, and-or income taxes.

"The elimination of this deduction has both an adverse impact on taxpayers, middle income taxpayers especially, but it also has an adverse impact on communities because of the services that are supported by this deduction," added Casey.

According to the National Association of Counties, over 175,000 families in Allegheny County use this deduction, along with nearly 42,000 in Westmoreland, 28,000 in Butler, 27,000 in Washington, and 18,000 in Beaver.

Wolf said 1.8 million Pennsylvanians use this tax break, 86 percent of whom have incomes under $200,000.

Wolf says Republicans should not take this away to pay for a tax cut for the super wealthy.

"Prioritizing tax cuts for the one percent over millions of middle class families simply does not make sense for Pennsylvania," declared the governor. "It doesn't make Pennsylvania stronger or help our economy."

The tax savings to local families are not insignificant, ranging from $7,000 to $12,000 per family in the region.

In Allegheny County, the value of those deductions add up to $2.1 billion, $388 million in Westmoreland, $288 million in Washington, $284 million in Butler, and $149 million in Beaver.

And Casey says he's hearing from Republicans, too.

"Local Republican officials who say don't do this to our community, in addition to don't hurt the middle class," he said.

Republican lawmakers -- like U.S. Sen. Pat Toomey and Congressmen Bill Shuster, Mike Kelly, and Keith Rothfus -- say you have to look at these deductions as part of a total tax plan.

If Republicans eliminate these deductions, some say, they could be made up for it in other tax breaks -- like doubling the standard deduction.

Of course, the devil is in the detail.

And we won't know that until House Republicans release their plan on Wednesday.