'We're Not Asking For A Lot': Local Small Business Owners Feel The Paycheck Protection Program Failed Them

PITTSBURGH (KDKA) -- The Paycheck Protection Program, a federal loan program designed to help small businesses keep paying employees during the pandemic, ran out of money this week.

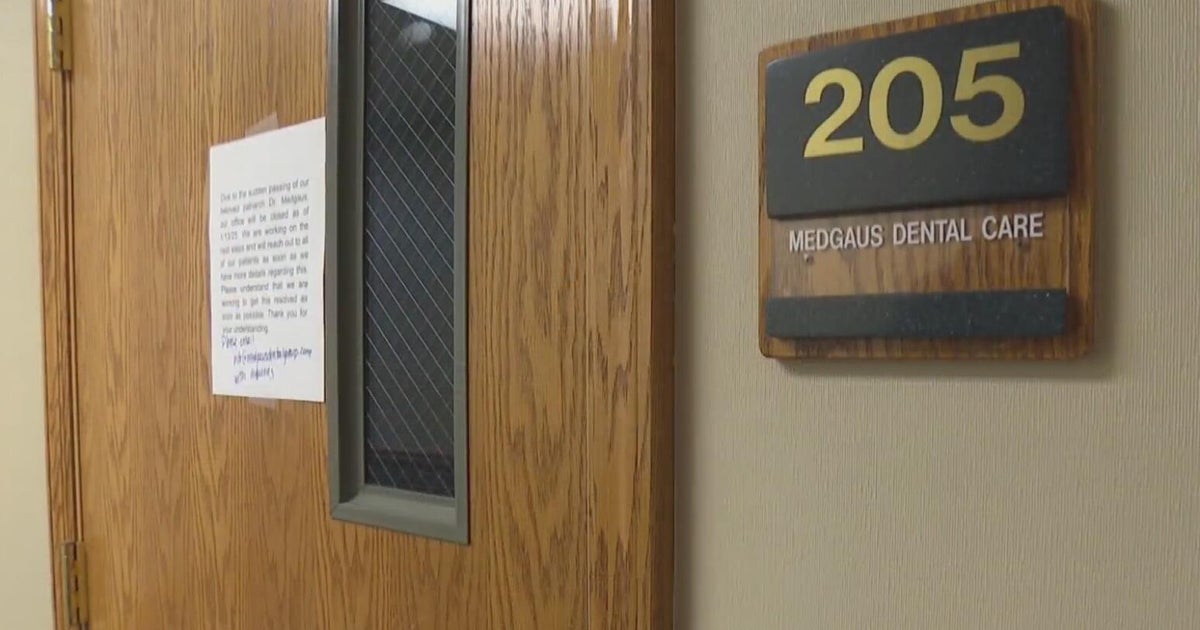

Many small businesses in our area tried but never got any help.

Many small business owners are upset that they didn't get to complete or turn in their applications before the money ran out.

For some, it was because their financial institutions or advisors they were working with didn't know how to do that.

On top of that, they're finding out that corporations got millions of dollars instead of small mom-and-pop shops.

Laura Fonzi is home helping her four young children while also trying to teach online classes for the gym she owns, Local Motion.

She applied for a federal loan from the Paycheck Protection Program.

"We're not asking for a lot," Fonzi said. "I think all we asked for was $30,000. It wasn't millions. It wasn't hundreds of thousands of dollars. It was small amounts to keep people with money in their pockets."

Fonzi wanted to use the money to pay the 25 employees she had to lay off. She worked with her accountant and bank to fill out the application.

"Nobody had the same story," Fonzi said. "Everyone told us something a little different. Everyone was hesitant about giving information, and no one seemed to have the right answer."

She has not heard whether she got the loan, but she and many owners of businesses that don't have big corporations to back them up are frustrated when they see that restaurants like Ruth's Chris got $20 million.

The most recent PPP report shows that while the average loan is $236,152, almost half of the $247 billion is for loans over $1 million.

"It's very sad because all the small business owners I know who really do need it, middle class, small businesses, either didn't get anything or have no idea if they got anything," Fonzi said.

Local congressmen Guy Reschenthaler and Mike Doyle both told KDKA's Jon Delano that they support adding another $250 billion to the PPP.

But PNC Bank is already telling its business customers that it is not accepting new applications. The bank is only working on existing applications, should more money be allocated.

The bank released a statement, which in part, says:

"To assist customers, we will continue to work on PPP applications that have already been received so that they can be prepared, to the extent possible, should the SBA begin accepting applications again. In order to focus our resources on these existing applications, PNC is currently not accepting new PPP applications."