Mayor Ed Gainey vowed to make major non-profit organizations pay their fair share. Here's what happened after

PITTSBURGH (KDKA) — A year ago, Pittsburgh Mayor Ed Gainey vowed to make the city's major non-profit organizations pay their fair share to city government, and his administration began challenging the tax-exempt status of their properties.

But as KDKA-TV Lead Investigator Andy Sheehan found out, the city is spending hundreds of thousands of dollars to challenge the properties and has yet to cover its costs. Meanwhile, most of those tax exemptions remain in place.

A year ago, Mayor Gainey signed an executive order to challenge the tax-exempt status of properties owned by the city's major nonprofits, saying UPMC, Allegheny Health Network, the University of Pittsburgh and Carnegie Mellon University needed to pay up.

"In order for the region to grow, we all have to come together and do what's necessary in order to ensure that everyone is paying their fair share," Gainey said in March of last year.

But a year later, the city concedes the results so far have been less than overwhelming.

"I do think it's taken a long time," Pittsburgh Solicitor Krysia Kubiak said. "We're still in the early stages."

Of the thousands of tax-exempt properties within its borders, so far the city has challenged 26 individual properties and has been successful in returning 10 of them to the tax rolls. The largest being a parking lot owned by Pitt, assessed at $2.4 million, and a parking garage owned by CMU, assessed at $5.5 million.

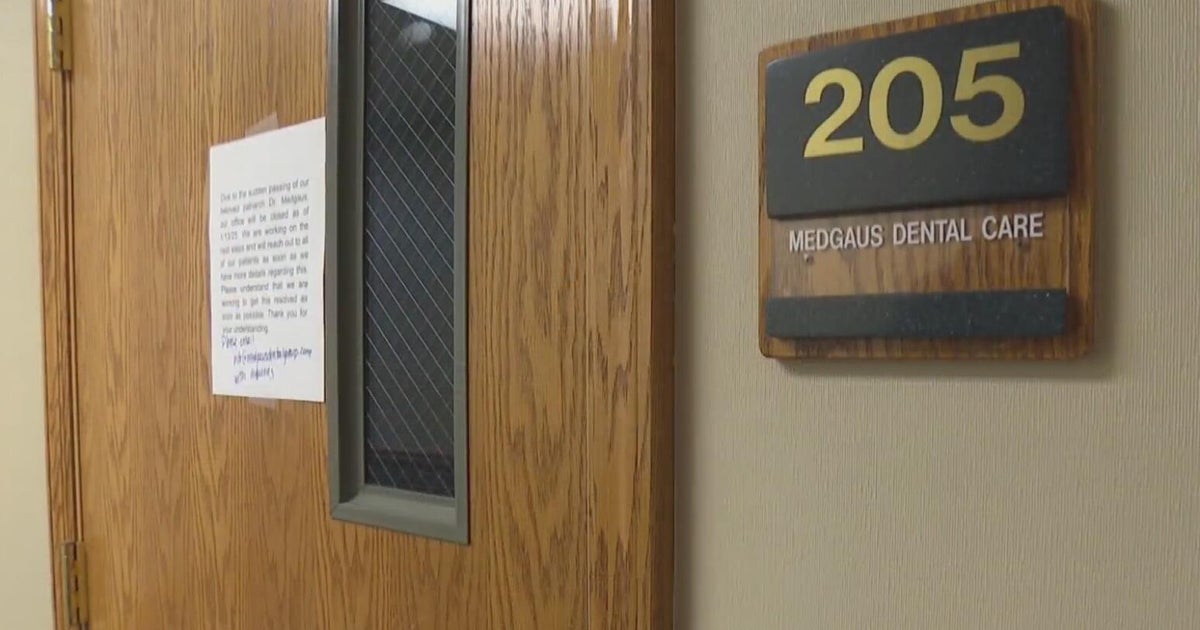

The county assessment board maintained the tax-exempt status of six UPMC properties, including a medical office building in Oakland.

"It was a small start, but we're fully confident it will grow over this year," Kubiak said.

So far, the cost of starting this program has exceeded the new revenue. To assist in the process, the city hired a Washington, D.C. law firm, Loeb and Loeb, at an initial cost of $150,000, which has now been increased to $400,000.

The successful challenges will result in additional annual revenue of only $88,000, but Kubiak said the city will cover those costs over time.

"There is always with government work some initial investment that then we hope pays for itself in the Gainey administration, but then long into the future continues to bring revenue for the city," Kubiak said.

But while City Controller Rachel Heisler agrees that the city should continually review the tax-exempt status of properties, she says the city law and the finance departments should be doing that without outside help.

"It's my opinion that the talent and capacity would exist in-house if we had pursued a different route before consulting outside counsel," Heisler said.

Heisler questions why the city isn't more aggressively negotiating payments in lieu of taxes from the major non-profit organizations.

UPMC had promised the prior administration $40 million in payments to the city over five years, but as KDKA-TV has reported, talks between UPMC and the Gainey administration broke down over the mayor's push for a health care workers union.

Communications Director Maria Montaño disputes that $40 million offer, calling it a promise of in-kind donations to the city and not money to fund core services. But she says the mayor is open to talks with all the nonprofits.

Montaño: "We are ready and willing and open to meet with anyone who wants to work with the city to make it better."

Sheehan: "But you've seen to cut off negotiations."

Montaño: "Our door is open. We're ready, willing to meet with anyone who wants to work with us to establish a PILOT in the city of Pittsburgh."

For its part, UPMC said it is still open to talks, but a spokesperson says it already funds a number of community programs, including behavioral health services at the Second Avenue Commons.

"The City of Pittsburgh and Mayor Gainey are aware of UPMC's ongoing support of various initiatives and can count on our full participation in programs that are fair and equitable and include the region's other major nonprofits," UPMC said.