Pa. Banking & Securities Secretary Says Bitcoin Investor Beware

Follow KDKA-TV: Facebook | Twitter

PITTSBURGH (KDKA) -- The stories of Bitcoin successes are intoxicating.

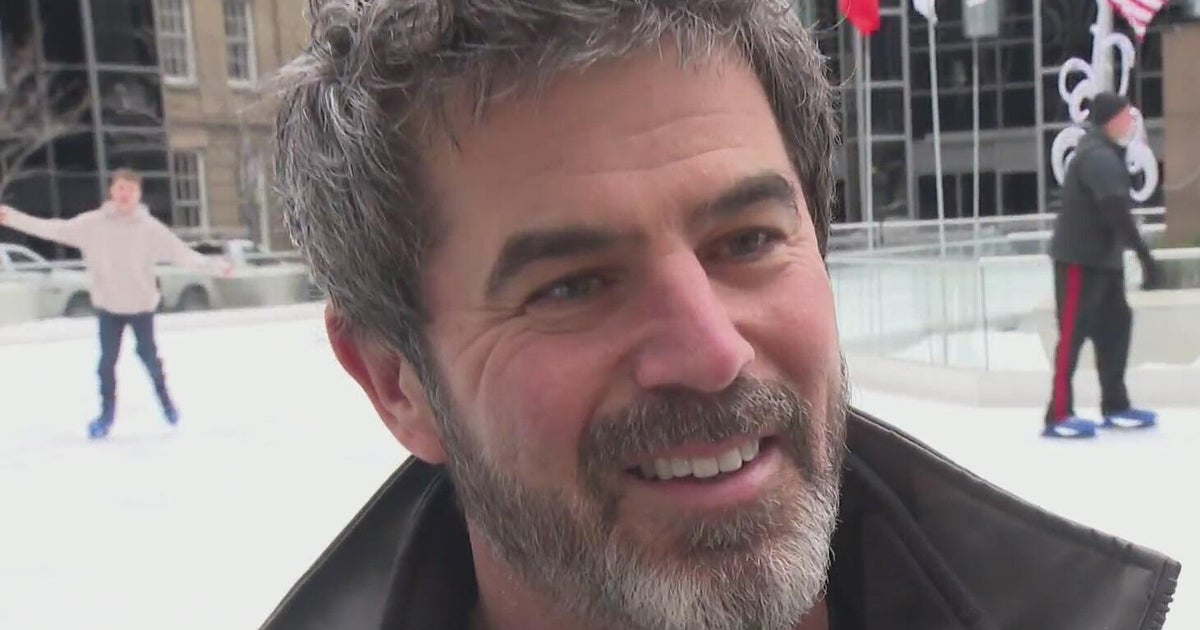

"I've put over a thousand dollars into the machine a couple of times," says Sheldon Mooney, of Canonsburg, adding with a huge grin, "Its working out well."

Mooney was making one of his many visits to the Bitcoin ATM at the Quick Stop in Lawrenceville.

"I'm going to buy at the price I observed, and when it goes up, I'll sell back to my bank and I will make a profit," he said.

The first thing you have to understand about Bitcoin and all cryptocurrencies is they exist only in the ether of the internet. While for promotional purposes you can find images of Bitcoin and other cryptocurrencies, they are digital, there is nothing tangible that you can hold in your hand.

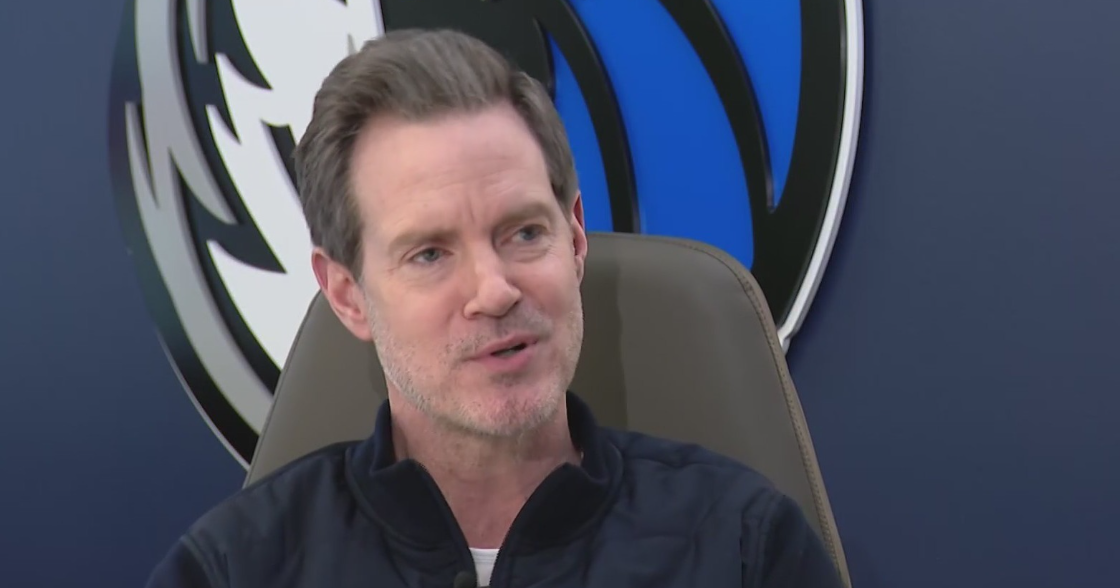

Certified Financial Advisor Rick Applegate says, "Bitcoins and cryptocurrency exist only to the extent that I believe in them, and you believe in them, and now we have two. Then three, then four, and if we can get the believers together into this model, then we have value and that's the extent of it."

Cryptocurrency can be used to purchase things between you and a seller on the net, but your balance remains there until you choose to cash it out.

Mooney explains it this way, "I will transfer from my Bitcoin account to my regular account at my bank and they will convert it to U.S. dollars.

Applegate says since they first went on sale, Bitcoin have been extremely volatile.

"Initially, Bitcoins had no value, then they went to $20,000 a coin, and now they've dropped to 10,000-12,000 a coin," he said.

It's that wild ride that has made people fortunes and has investors like Mooney in the game 24/7.

"This is everyday, constantly. Sometimes, I'll wake up in the middle of the night, and if it's low enough, I'll get into the car and go buy," he says.

KDKA's John Shumway Reports:

But Pennsylvania Banking and Securities Secretary Robin Weissman says investor beware.

"Retrieval and actually having your currency is one risk. Not only do you not know which bank to go to, there is absolutely no guarantee behind it," Weissman said.

Secretary Weissmann issued these warnings today:

- Cryptocurrency accounts are not insured like traditional banking accounts, which are insured by the U.S. government up to $250,000.

- Cryptocurrency is subject to minimal regulatory oversight, susceptible to cybersecurity breaches or hacks, and there may be no recourse should the cryptocurrency disappear.

- The high volatility of cryptocurrency investments adds additional risk for most investors, especially those investing for long-term goals or retirement.

- Investors in cryptocurrency are relying upon companies that may not be accountable to a government regulator charged with investor protection, such as the Pennsylvania Department of Banking or Securities or the federal Securities and Exchange Commission.

Applegate says like any risky speculation, it's up to the investor to control the risk.

"If you are going to invest in these things, it should be a small amount that you can afford to lose," he said.

Secretary Weissmann says do your homework because it's very easy to go online, or to an ATM and make an investment but remember, "Something that is so smooth and easy to take care of is smooth and easy to lose, too."

Of particular concern to Applegate and Secretary Weissmann are the reports people are mortgaging their homes to put the money in cryptocurrencies.

Applegate is blunt, "I think that's extremely foolish and dangerous."

Cryptocurrencies might be the future, but Applegate says, "It's not there today, and it's not something I would not be betting the house on tomorrow."