Stock Market Soars As U.S. Posts Stronger Than Expected Jobs Report

NEW YORK (CBSNewYork) – Friday was a good day for your investments on Wall Street.

A strong jobs report – even better than expected – unleashed the bulls, with all indexes seeing green.

The Dow Jones Industrial Average ended the day up more than 400 points to close over 25,000. The S&P 500 went up about 50 points to 2,786, and the Nasdaq hit a record high before finishing the day over 7,500.

President Donald Trump tweeted, "jobs, jobs, jobs" Friday morning, on the heels of the latest numbers. Employment rose in several sectors, including construction, retail trade and manufacturing, CBS2's Andrea Grymes reported.

Consumers in Times Square reacted to another indicator the economy is heading in the right direction.

"I think it's good. I think it's the best it's been in years," one man told Grymes.

"You just don't have to travel too far outside of Times Square to recognize that not everybody is feeling the love of the economy, regardless of what the numbers say," said another.

On Friday morning, the Bureau of Labor Statistics reported the U.S. economy added 313,000 jobs in February. That far exceeded the 200,000 many analysts predicted. It's also the biggest gain since July 2016. The unemployment rate stayed at 4.1 percent, the lowest in 17 years.

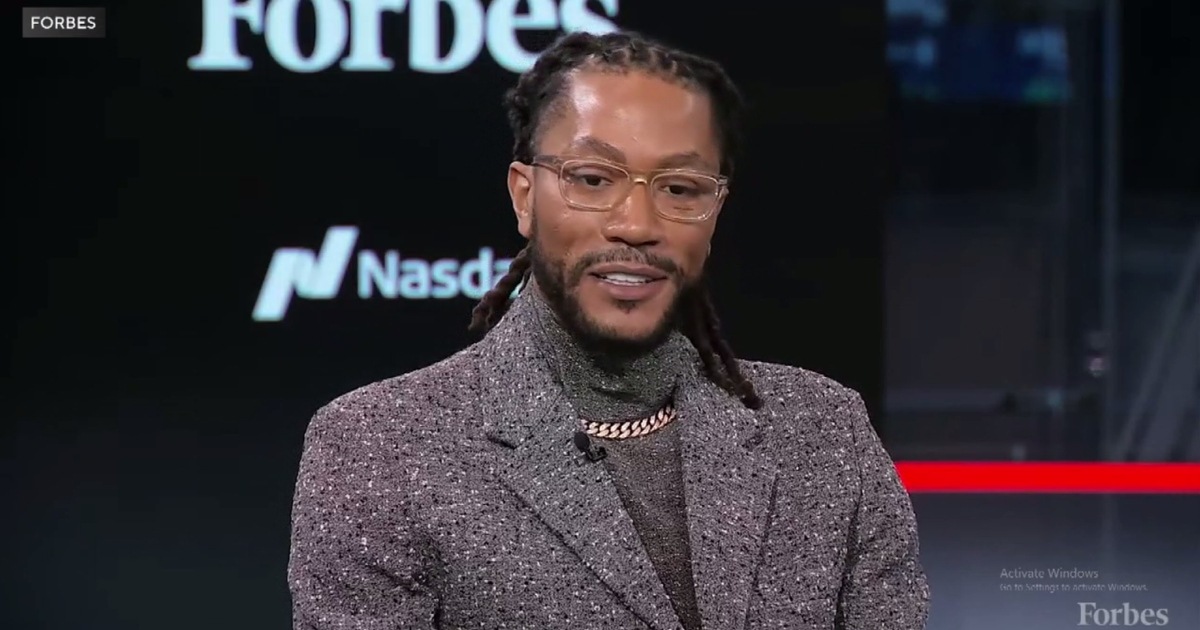

"Very strong growth in jobs. Of course, that's great for the economy, it's great for consumers and individuals and the unemployed," Tim Ghriskey, chief investment strategist at Inverness Counsel, told Grymes.

One reason for the good numbers, according to some experts, is the recent tax cuts. They say some businesses and consumers likely boosted investments and spending.

Ghriskey said inflation is a big factor to watch moving forward, because that's going to drive the Federal Reserve in terms of raising interest rates.

"We want the Fed to raise rates but very gently and very slowly," he said. "We don't want them to raise rates significantly, or it's going to shock the economy."

The stock market has had several recent corrections – that's when an index, like the S&P 500, falls 10 percent or more from a recent high – most recently in February.

Ghriskey said, historically, there are always corrections, and he thinks we're going to head higher when it comes to stock valuations.

A story that's still to be played out is exactly how Trump's new tariffs on steel and aluminum will impact the markets and the economy in the long term.

Another interesting note Friday – the stock market is celebrating the ninth anniversary of the ongoing bull market.