Gov. Murphy Signs Law Exempting Military Combat Pay From New Jersey Income Tax

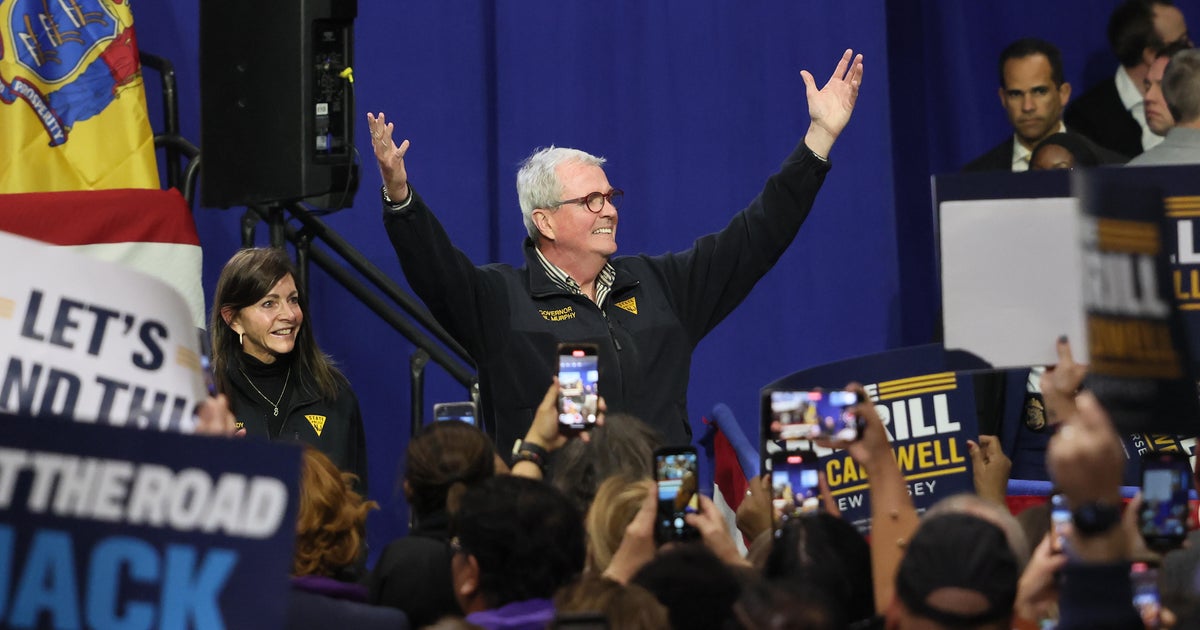

TRENTON, N.J. (CBSNewYork/AP) — Gov. Phil Murphy on Monday signed bipartisan legislation exempting combat pay earned by members of the military from the state income tax.

Federal law already exempts combat pay from income tax, but the New Jersey law means pay that residents earn while in combat zones won't be subject to the state's income tax as well.

Murphy signed the bill Monday during a Facebook Live session with Republican Sen. Michael Testa and Democratic Assemblywoman Annette Quijano. Both lawmakers sponsored the legislation, which passed unanimously in both chambers earlier this month.

The measure defines a combat zone as any area the president designates as such in an executive order. Combat zone pay is an additional payment beyond a military member's regular salary.

Lawmakers say there are currently four active combat zones: the Sinai Peninsula; the Afghanistan area, which includes 10 countries; the Kosovo area, which includes parts of the Balkans; and the Arabian Peninsula area.

You can get the latest news, sports and weather on our brand new CBS New York app. Download here.

(© Copyright 2020 CBS Broadcasting Inc. All Rights Reserved. The Associated Press contributed to this report.)