Judge Approves Massive Madoff Settlement

NEW YORK (AP) -- A historic $7.2 billion deal was approved Thursday to settle a lawsuit brought against the estate of one of the oldest and wealthiest clients of disgraced financier Bernard Madoff.

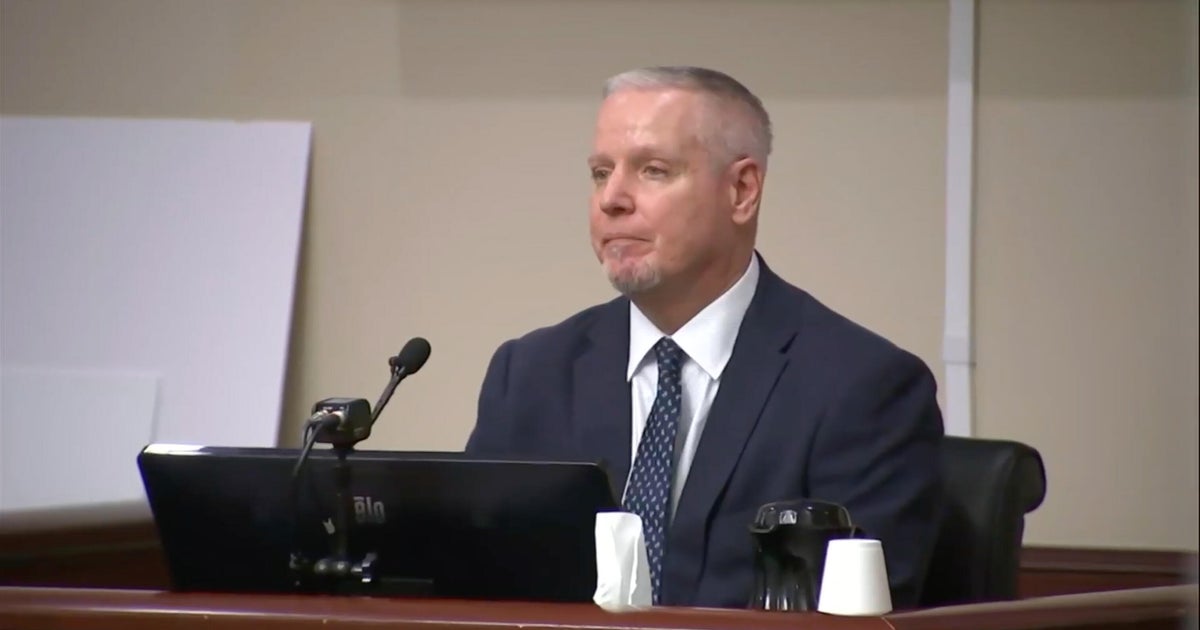

U.S. Bankruptcy Judge Burton Lifland signed off on the deal at the urging of a court-appointed trustee seeking to recover funds for thousands of investors burned by Madoff's epic Ponzi scheme.

"This is a unique and great day for customers of (Madoff's firm),'' trustee attorney David Sheehan said Friday at a hearing federal bankruptcy court.

Lawyers representing a handful of former Madoff customers opposing the settlement signaled they will appeal _ a move the judge warned could further harm wiped-out victims waiting to recover at least a portion of their life savings.

"You must take into account the effect of these delays,'' he said.

Trustee Irving Picard and federal authorities reached the settlement last month with the estate of Jeffry Picower, a businessman and philanthropist who drowned in 2009 after suffering a heart attack in the swimming pool of his Palm Beach, Fla., mansion. Federal prosecutors have called the forfeiture the largest in Justice Department history.

Picard had sued Picower in a so-called clawback litigation, alleging his earnings from Madoff consisted of money stolen from other investors. However, Picower's widow, Barbara, has insisted he was in the dark about the fraud and he was never charged with a crime.

The $7.2 billion represents "every cent Picower ever received'' from the fraud, Sheehan told the judge.

Sheehan said settlement negotiations were contentious and complicated by Picower's death. But in the end, he said, Barbara Picower did the right thing for the victims.

"She stepped up and stepped up big time,'' he said.

Madoff, 72, is serving a 150-year prison term after admitting that for decades he used fraudulent account statements to trick investors into believing they had more than $60 billion invested in stocks. Investigators found, though, that no investments were made, and that an estimated $20 billion in principal was simply being paid out bit by bit to other investors.

Authorities have said the Picower deal, combined with smaller seizures and settlements, means that half of the $20 billion has now been recovered and could be returned to victims. But it's unclear who will end up benefiting and when: Picard has authorized payments to fewer than 2,400 of the nearly 16,500 Madoff customers who filed a claim for a share of recovered money.

Some investors who can't qualify for the trustee payments _ either because they invested indirectly with Madoff or withdrew more than they originally invested _ had objected to the Picower settlement, arguing that it dries up funds they had a right to recover.

Lawyers for the opponents also complained about a provision barring Madoff clients from pursuing their own lawsuits against the Picower estate.

Attorney Helen Chaitman alleged that Picower, like Madoff, is guilty of "heinous crimes'' and should be held liable.

Sheehan argued that additional suits were unnecessary since the trustee is working on behalf of all former customers.

Picard "is the uber-customer,'' Sheehan said. "He represents every one of them.''

(Copyright 2011 by The Associated Press. All Rights Reserved.)