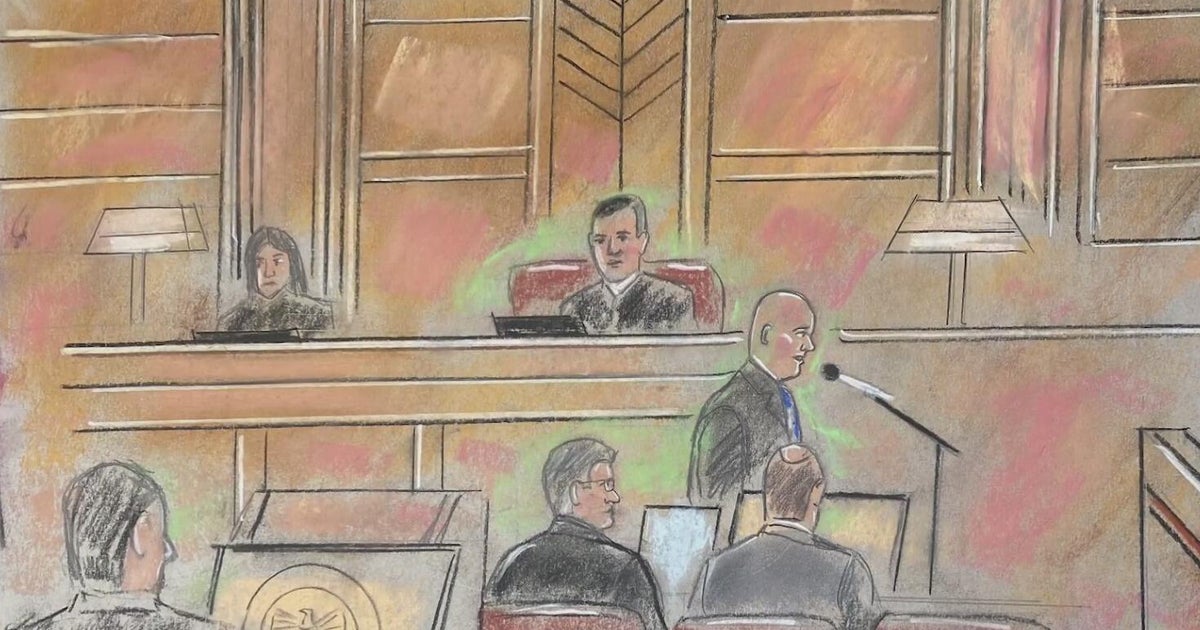

Goldman Sachs CEO Testifies At NYC Hedge Trial

NEW YORK (AP) -- The chief executive of Goldman Sachs told a jury at an insider trading trial Wednesday that a former board member violated the company's confidentiality policies when he discussed board secrets with a then-billionaire hedge fund boss.

CEO Lloyd Blankfein listened as federal prosecutors played snippets of a 2008 telephone conversation record by the FBI between Galleon founder Raj Rajaratnam and ex-board Goldman member Rajat Gupta.

When asked if Gupta had broken board rules in the chat, Blankfein responded, "Uh ... yes.''

Blankfein testified that board members are expected to observe a strict code of confidentiality on possible deals that could move markets once they're announced.

"We don't want the information about our company getting outside before it's appropriate,'' he said.

The Wall Street titan was subpoenaed to testify at the Manhattan trial of Rajaratnam, who is accused of making more than $50 million through illegal trades by extracting secrets from other financial professionals and employees at public companies. Rajaratnam has said through his lawyer that he only traded based on information that was already known.

Prosecutors allege Gupta called Rajaratnam, founder of the Galleon funds, twice to give him tips. They said Rajaratnam then traded hundreds of thousands of shares of Goldman Sachs stock.

RELATED: Govt: Galleon Founder Wanted Edge In Stock Trading | Accused Hedge Fund Boss's Trial Could Start Today | Jury Selection To Begin In NY Insider Trading Trial | Defendant Pleads Guilty In New York Hedge Fund Case

Gupta has not been charged criminally in what prosecutors say is the largest hedge fund insider trading case in history.

A spokesman for Gupta's attorney said Wednesday there was no comment on the court proceedings. The lawyer, Gary Naftalis, has said the allegations about Gupta were "totally baseless.''

The Securities and Exchange Commission has filed civil charges against Gupta, saying he tipped Rajaratnam seven minutes before the stock markets closed on Sept. 23, 2008, allowing Rajaratnam to buy 175,000 shares of Goldman stock within a minute of receiving the tip.

A prosecutor asked Blankfein about a board meeting earlier that day, when the board approved an offer from Warren Buffett's Berkshire Hathaway to invest $5 billion in the investment giant. The board hoped the move would send a positive message to investors, the witness said.

"However shape we were in before, they would think we were in better shape as a result of this,'' he said. Blankfein called Buffett a 'very, very shrewd and successful investor'' and said his investment would be a positive sign to the markets at a time of financial crisis.

Blankfein also testified about a board meeting on Oct. 23, 2008, amid the financial markets meltdown, when board members were told that Goldman was facing a quarterly loss for the first time since it had gone public in 1999. He said the company was "concerned that this number would be a surprise'' to investors, because the consensus in published reports was that the company was making money.

The SEC has said Gupta called Rajaratnam 23 seconds after the meeting ended to reveal the expected quarterly loss, causing Rajaratnam to sell his entire position the next morning.

On cross-examination, Blankfein testified that before the government brought the case, Gupta had a solid reputation as a trusted board member. He also said that Galleon "was a prominent client of Goldman Sachs.''

Rajaratnam, who was arrested in October 2009, is the biggest name to be charged in a probe that has resulted in more than two dozen arrests. Already, 19 of those arrested have pleaded guilty, and many of them are cooperating with prosecutors.

The trial is in its third week.

(TM and Copyright 2011 CBS Radio Inc. and its relevant subsidiaries. CBS RADIO and EYE Logo TM and Copyright 2011 CBS Broadcasting Inc. Used under license. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. The Associated Press contributed to this report.)