Seen At 11: College Is Expensive, But It's Possible To Significantly Cut Costs

NEW YORK (CBSNewYork)-- It's no secret that college tuition costs continue to skyrocket. The average tuition for an out-of-state school will run you about $34,000 a year.

But there are things you can do to cut costs and even go to school for free, CBS2's Dick Brennan reported.

Can you imagine paying $80,000 for a standard, basic model Sedan? That's how much it would be today if car prices were rising as fast as college costs.

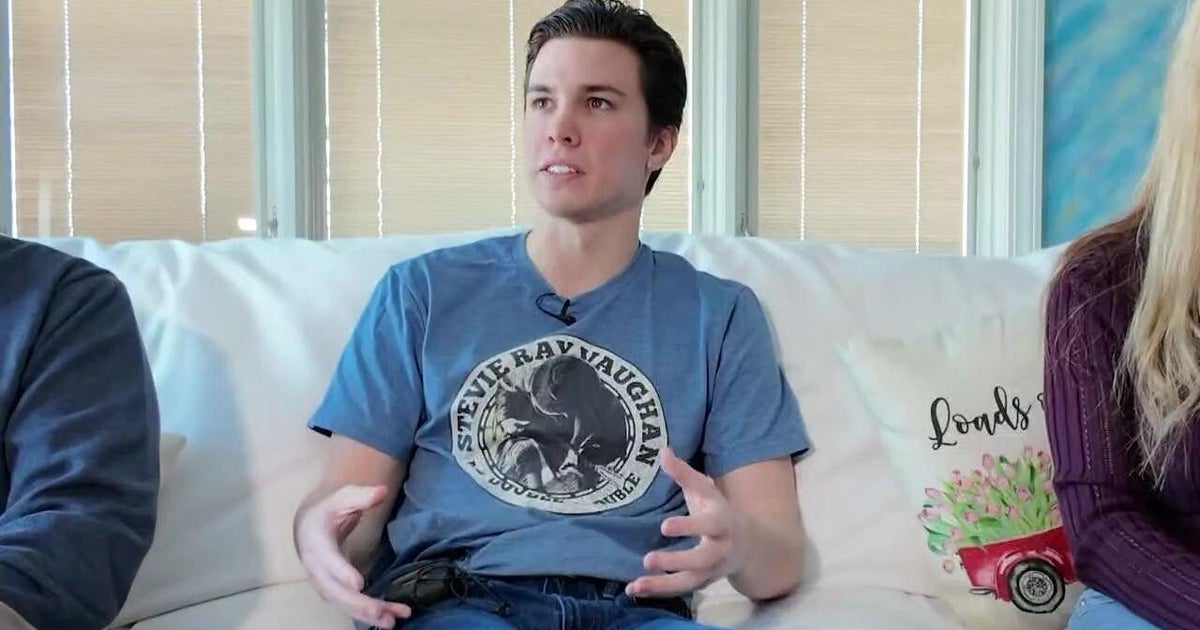

"It's really becoming a heavy burden on families," student lending manager Donald Kerr, of Triple A's College Planning Office, said.

Some students are even questioning the value of a higher education. As many as seven out of 10 college grads are nearly $30,000 in debt today, but there are ways to cut those costs.

"I'm a big fan of going to a state school and then transferring to a more expensive school," Kerr said.

Kerr suggests going to a community or state school for the first two years.

"Then transfer to a private school with that brand name degree," he said.

Kerr said although college costs have outpaced financial assistance today, there's still a lot of financial aid available and that you can sometimes negotiate.

That's right -- you can ask your school of choice for more money and you don't have to accept their initial financial package offer. Experts said to never rule out a school based on the list price as, oftentimes, more expensive schools will hand out more money. It's also wise to look and apply for scholarships, every year, and the more obscure the better.

"I got out of school with under $10,000 in debt," said Wombi Rose, a Webb Institute alum.

Rose only had to pay for room and board when he attended Webb Institute on Long Island. The engineering school is one of a handful of tuition free colleges that also include Berea College in Kentucky, Barclay College in Kansas, and Williamson College of the Trades in Pennsylvania.

When applying for a student loan, Kerr said follow this rule of thumb: make sure your student loan debt doesn't exceed the starting salary for your future, chosen profession.

"Say you have a student loan debt of $200,000 and you are making $50,000, those are the people that I see all the time that are in trouble," she explained.

Tuition-free schools can have special requirements, like working on campus. Another way to save is by attending an in-state school, which can cut tuition by as much as $10,000 a year.