CBS2 Gets Clarification From SBA On What Lies Ahead For Local Businesses And Paycheck Protection Program

NEW YORK (CBSNewYork) -- Here's an update on a story CBS2 did recently on a local business owner who was struggling to get a much-needed loan from the Small Business Administration.

As CBS2's Jenna DeAngelis reported Monday, Julia Testa, owner of Julia Testa Flowers, finally go her loan. However, she says she has been left with a lot of questions as the government keeps changing the rules.

DeAngelis went directly to the SBA for answers.

"The Mother's Day orders are starting to roll in. We're really excited about it because we really need the business," Testa said.

DID YOU LOSE YOUR JOB AMID THE OUTBREAK?

- New York: Filing An Unemployment Claim

- New York City: Help With Energy Bills

- New Jersey: Filing An Unemployment Claim

- New Jersey: Jobs Portal To Find New Work

- Connecticut: Filing An Unemployment Claim

Testa is gearing up for one of her busiest weeks as a florist. Thankfully, she has employee Christine Wilkinson back at the SoHo shop to help.

"When we were able to come back to work, of course I wanted to come back," Wilkinson said.

Wilkinson, the company's wedding director, was furloughed in March. She collected unemployment, including bonus money when Congress passed the "Cares Act."

"When I was able to get the extra $600 a week that was like a godsend," Wilkinson said. "I was making more on unemployment."

But she was banking on job security, being able to work when asked.

And now that Testa got her SBA Paycheck Protection Program loan, she can bring back more employees as the program was designed to do.

But she has concerns.

"We are finding that we're having a little bit of difficulty having some of the staff come back to work," Testa said. "Everyone's making between $18 and $30 an hour depending on their role here."

WHAT IF YOU OWN A SMALL BUSINESS AND NEED HELP?

- U.S. Small Business Administration Guidance & Loan Resources

- Economic Injury Disaster Loan Program

- NYC Employee Retention Grant Program

- New York City Small Business Continuity Fund Survey

- Facebook Small Business Grants Program

In order to have the PPP loan forgiven, Testa has eight weeks to meet hiring targets.

"Are we allowed to bring on new employees when the employees you had before don't want to come back?" Testa said.

Like many business owners, Testa has many questions, which DeAngelis took directly to the SBA.

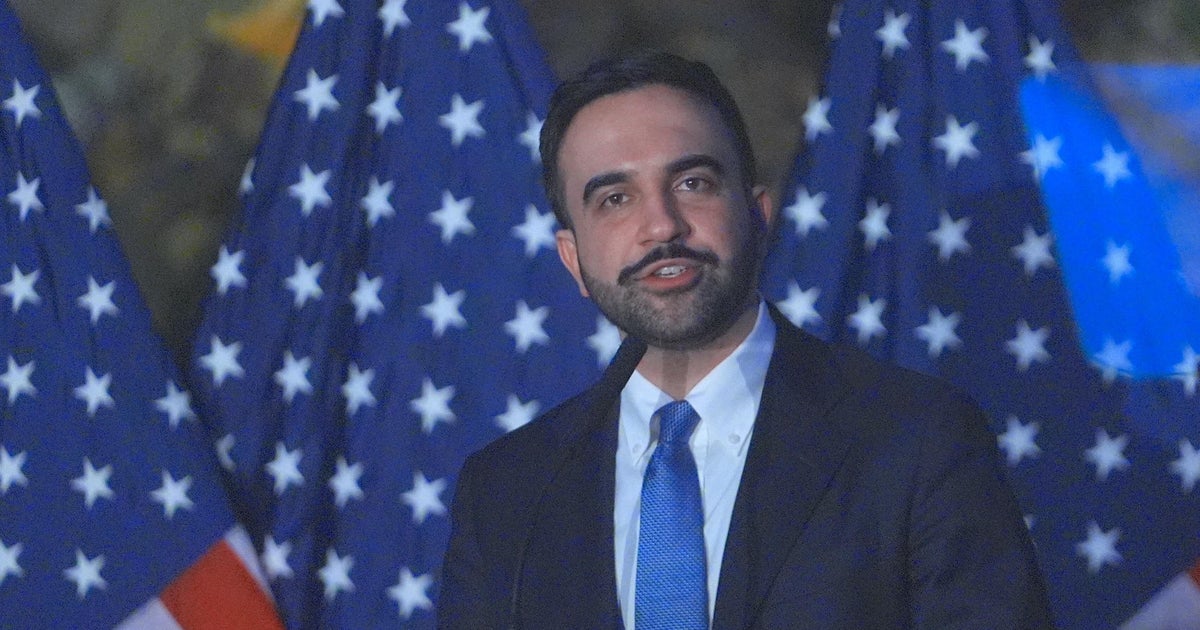

"Yes, the PPP, the way it works is as long as you use 75% of the loan proceeds for employee payroll and benefits, your entire loan will be forgiven," SBA regional administrator Steve Bulger told CBS2. "We are hearing about some furloughed employees who are getting their jobs offered back to them but they don't want to take it because they're making more money or whatever on unemployment and that's something that they have to be very careful of. State laws require that if you do, if you are receiving unemployment benefits and your former employer or any employer offers you a job for the same pay you were making, then you have to take that job, you can't choose to remain on unemployment."

Bulger said over the two rounds of SBA loans, an estimated 250,000 small businesses in the Tri-State Area have been given loans worth about $35 billion.

When asked if he thinks the second round will cover all the businesses or if he thinks there is the potential for a third round, Bulger said, "Don't know yet. Right now we've gone through about $175 billion in Round 2, so we still have about $140 billion left and we'll see how long that takes us."

As for where the most confusion lies, Bulger said, "Some businesses were under the impression they can use this money to pay any of their bills. Then they learned it's really designed to pay employees first, there was some confusion on that.

"That's really the intent of Congress, which is why they called it the Paycheck Protection Program, not the Small Business Survival Program, just to make sure the focus was on paying employees," he added.

Bulger is encouraging small businesses to apply. As for those like Testa, he said stay tuned. In the coming weeks the SBA will issue more guidance on how to assure loan forgiveness.

For now, Testa's focus is getting her Mother's Day deliveries out.