Child Tax Credit Payments Start Hitting Parents' Bank Accounts

NEW YORK (CBSNewYork) -- The new Child Tax Credit starts hitting bank accounts Thursday, and millions of families will receive financial relief.

It's part of the American Rescue Plan that Congress passed in March, boosting the Child Tax Credit, CBS2's John Dias reported.

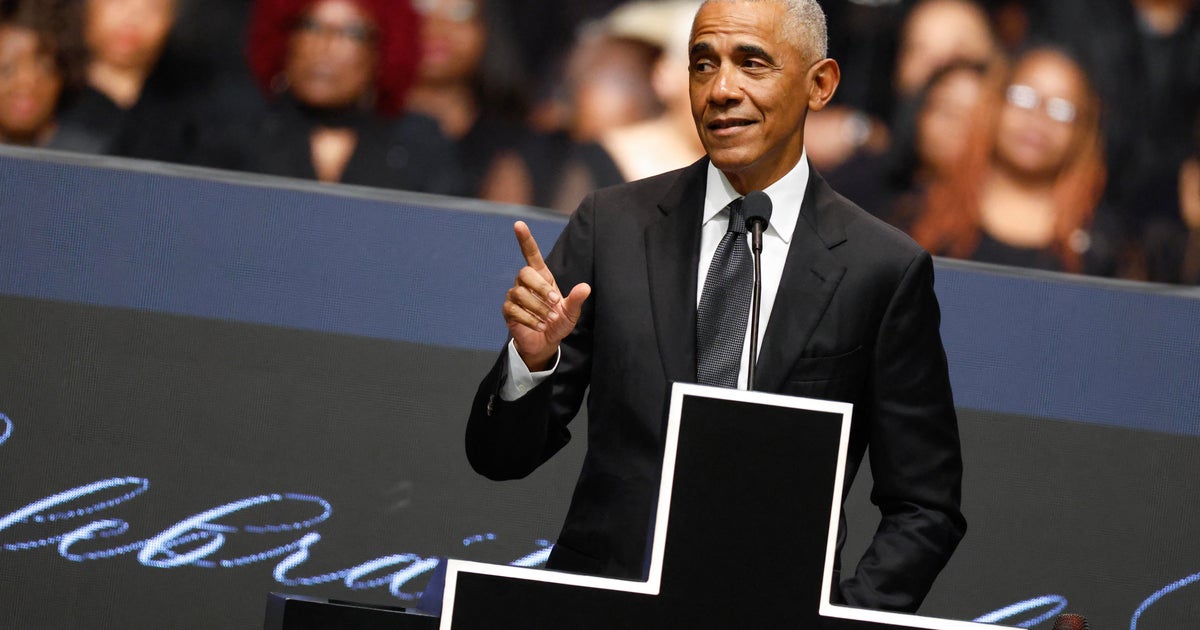

"The people in this country who need a tax cut aren't the folks at the top. They've gotten plenty of tax cuts. They're doing just fine. But it's the people in the middle, the folks who are struggling," President Joe Biden said.

Senate Majority Leader Chuck Schumer expanded on what the credit will mean for New Yorkers.

"It does great things for our economy, pumping money into it. It does great things for families who had to struggle with COVID -- so many families have had to struggle," Schumer said. "Most of all, what we're proud of, it takes half the kids in New York out of poverty."

In order for families to qualify, single taxpayers must make $75,000 or less, and married couples filing taxes jointly must make $150,000 or less.

They will receive monthly payments through December of up to $300 per month for each child under 6, and up to $250 per month for each child ages 6 to 17. They'll get the rest of the money next year when they file their taxes, for a grand total of $3,600 per child.

East Harlem dad-of-two Edgar Gonzaga is among those who qualify.

"Would definitely put it toward school, because with COVID, the bills are definitely getting expensive," he told CBS2.

Clinton Hill resident Cynthia McKnight, who also has two children, just got a financial boost, but now she is also thinking about the low-income Brooklyn families she helps during her volunteer work. The pandemic hit them hard.

"This is a huge game changer," McKnight said. "I'm getting emotional because it was so traumatic to so many people. I would deliver food to kids who didn't even have beds to sleep on. The cash will help people buy beds, school supplies, be able to live."

Congressman Hakeem Jeffries said the credit will help low-income, middle and working class families.

"Because during pre-pandemic normal, far too many New York City families and children were struggling, but we want to build back better," Jeffries said.

The IRS will send out money based on last year's tax return. So people who started making more money this year and no longer qualify for the credit need to go to IRS.gov and opt out.

"If you get it and you don't qualify, you have to pay that money back to Uncle Sam next tax season," CBS News business analyst Jill Schlesinger explained.

If you filed taxes for 2019 or 2020, which included the child tax credit, you don't have to do anything. The checks will automatically be mailed or direct deposited into your account.

"The people we really need to contact are those who don't normally file a return but are now eligible for, as you said, a refundable credit," said Sue Simon, of the IRS.

Families that make no income can also receive the credit, and parents who are undocumented can qualify as long as they have an individual taxpayer identification number and their children have Social Security numbers.