Both Sides Present Closing Arguments In Hedge Fund Insider Trading Trial

NEW YORK (CBSNewYork/AP)-- Extensive wiretap evidence in the biggest hedge fund insider trading case in history proves a Wall Street heavyweight routinely used a cadre of "corporate spies'' to get secrets and earn tens of millions of dollars in illicit revenue, a prosecutor said in his closing argument Wednesday.

When the jury listened to FBI recordings of Raj Rajaratnam, "You heard the defendant commit his crimes time and time again in his own words,'' Assistant U.S. Attorney Reed Brodsky told the panel. "The tapes were devastating evidence of the defendant's crimes, in real time.''

WCBS 880's Irene Cornell: The Federal Prosecutor Replayed Wiretap Tapes

Podcast

The jury head more than 45 audio recordings during seven weeks of testimony; authorities have called it the broadest use of wiretaps ever in a white collar case.

The government also relied on the testimony of a parade of cooperators who were allegedly corrupted by Rajaratnam, including a disgraced technology industry executive and analysts. Prosecutors also implicated a former Goldman Sachs board member as one of the tipsters, in part by calling Goldman chairman Lloyd Blankfein to testify the tapes showed that the board member violated confidentiality policies.

Authorities have said Rajaratnam earned at least $68 million from illegal tips. His Galleon Group of hedge funds, prosecutors say, became a multi-billion dollar success at the expense of ordinary stock investors who did not have the access to secrets about the earnings surprises of public companies and early word of mergers and acquisitions.

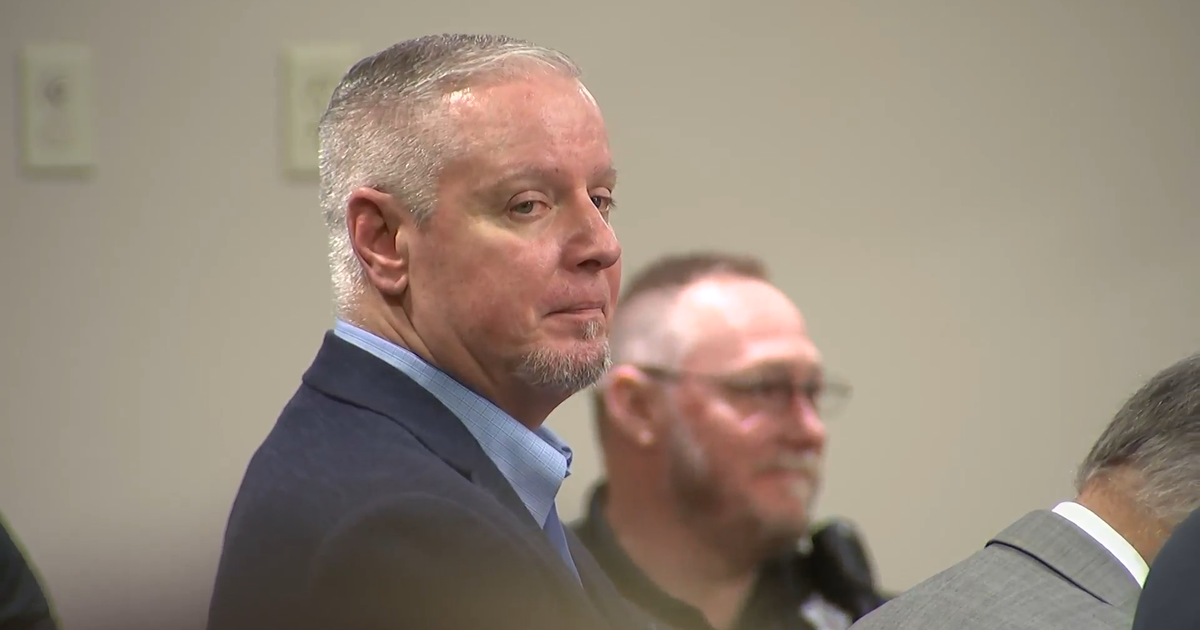

Rajaratnam's attorney, who was to give his closing argument later Wednesday, has argued that the tapes only reveal harmless chatter about market rumors, and that his client relied on legitimate research for his trades. On Wednesday, the 53-year-old defendant sat quietly on a bench behind a team of attorneys crowded around the defense tape.

In his closing, Brodsky repeatedly referred to the audio evidence, telling the jury, "Let's go to the tapes'' and playing incriminating segments. He argued that they showed that insider trading -- and orchestrating cover-ups -- was business as usual for Rajaratnam.

The prosecutor played one tape in 2008 on which another hedge fund manager who has pleaded guilty, Danielle Chiesi, frets, "I'm a little nervous because you know people are going to investigate me. I really a believe that.''

Rajaratnam advises her to buy 1 million shares of tech stock on an inside tip, then sell 500,000 of those shares -- a tactic prosecutors say was used to throw regulators off the trail. In another instance, about 30 minutes of calls with an Intel tipster scored Rajaratnam a $2 million windfall on the computer chip-maker's stock, Brodsky said.

"That may be an easy way to make money ... but it's not legal and it's cheating,'' the prosecutor said.

The closing argument came in the only trial so far in a three-year investigation targeting inside trading in the hedge fund industry.

The probe has resulted in more than two dozen arrests and 19 guilty pleas from former hedge fund traders and employees of public companies who Brodsky said were corrupted by Rajaratnam's lust for illegal profits. It also has led to a second investigation aimed at consultants in the securities industry who pass off inside information as the product of legitimate research.

Rajaratnam, born in Sri Lanka and educated at the University of Pennsylvania's prestigious Wharton School, has pleaded not guilty to conspiracy and securities fraud and remains free on $100 million bail. The Galleon funds shut down after his October 2009 arrest.

At trial, Blankfein testified about an Oct. 23, 2008, Goldman board meeting in which board members were told that the investment bank was facing a quarterly loss for the first time since it had gone public in 1999. He also said a trusted board member with a solid reputation, Rajat Gupta, was on the call.

Prosecutors say phone records show Gupta called Rajaratnam 23 seconds after the meeting ended, causing Rajaratnam to sell his entire position in Goldman the next morning.

"A great reputation doesn't give you a free pass to break the law,'' Brodsky said of Gupta.

Gupta has not been charged criminally in the Galleon probe. He has denied related civil charges brought by the Securities and Exchange Commission.

(TM and Copyright 2011 CBS Radio Inc. and its relevant subsidiaries. CBS RADIO and EYE Logo TM and Copyright 2011 CBS Broadcasting Inc. Used under license. All Rights Reserved. This material may not be published, broadcast, rewritten, or redistributed. The Associated Press contributed to this report.)