Year-end tax deadline looms for retirees

(MoneyWatch) If you're age 70-1/2 or older and have savings in deductible IRAs, deductible 401(k), Roth 401(k), or 403(b) or 457(b) accounts, then by December 31 you'll need to withdraw what is known under the law as a required minimum distribution (RMD). Any amount you fail to withdraw to meet the RMD is subject to a 50 percent tax, so you don't want to miss this deadline.

According to Fidelity Investments, as of November 9 nearly two-thirds of the investment firm's IRA customers who are required to take RMDs for tax year 2012 have yet to withdraw the full amount. Additionally, 54 percent haven't taken any of their RMD to date for the year. With 2012 drawing to a close, it's a good time to review some of the basic rules regarding RMDs.

To start, let's look at the first time you're subject to these rules. If your 70th birthday was between January 1 and June 30 of 2012 (including the starting and ending days in this period), then you'll be age 70-1/2 by year-end and subject to the rules. If your 70th birthday is on or after July 1, 2012, then you can wait until next year to worry about the rules.

The basic requirement is that you need to withdraw the RMD by December 31 of each year and then include your withdrawals in your taxable income for the year -- with one important exception. For the first year you're subject to the RMD rules, you have until April 1 of the following year to withdraw the minimum amount. So if 2012 is the first time you're required to make minimum withdrawals, you can wait until April 1, 2013, to make your withdrawals and include the amount in 2013 taxable income. If you take advantage of this exception, however, you'll need to remember that you'll have to take two taxable withdrawals during 2013: the delayed 2012 minimum withdrawal and the regular 2013 minimum withdrawal.

How much do you need to withdraw?

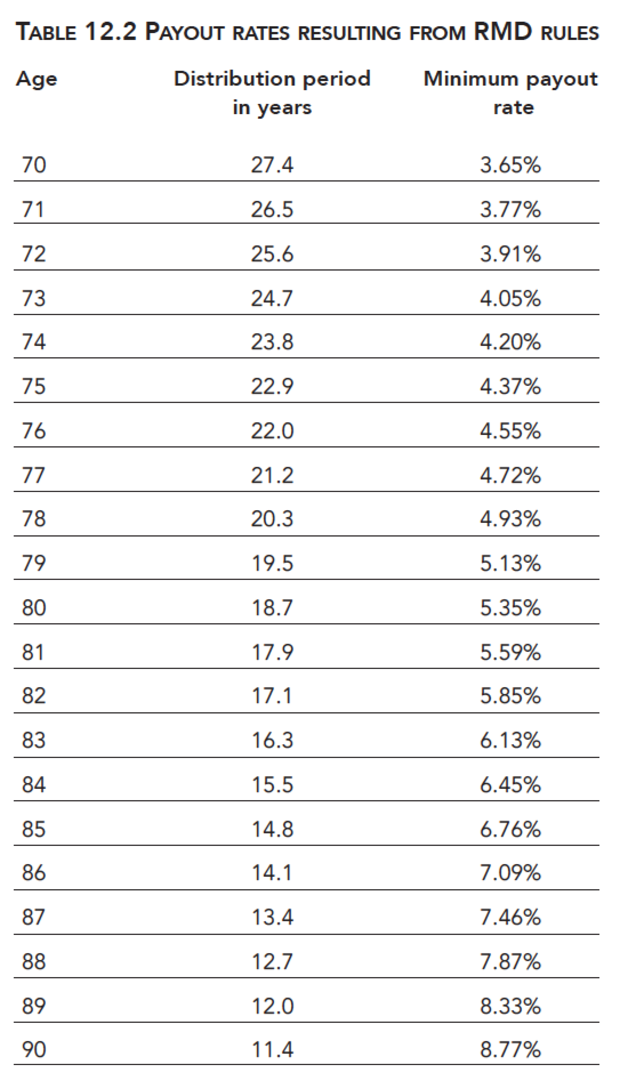

The RMD you have to withdraw is based on the value of your accounts as of December 31 of the previous year. The IRS requires that you divide this value by the "distribution period" for each applicable age to determine the RMD you owe. To help you out, I've done the math for you: The table below shows the distribution period and the minimum payout rate for each age (these figures apply to the majority of situations).

A few essentials to note:

- Although I stopped the table at age 90 for brevity's sake, the IRS table continues beyond age 90.

- For the above table, if you're the account holder, use your age on your birthday during the appropriate calendar year.

- If you're married and your spouse is more than 10 years younger than you, a different table with payout rates that are lower than the above rates applies in your situation. A separate table also applies to beneficiaries after the account holder has died.

If you have more than one IRA, you must calculate the amount of the RMD separately for each IRA, although you're allowed to withdraw the total amount you owe from just one of your IRAs. Similarly, if you have more than one 403(b) account, you must calculate the RMD separately for each 403(b) account, but you can take the total amount you owe from just one of your 403(b) accounts. If you have more than one 401(k) or 457(b) accounts, you must calculate the RMD separately for each account and you must also withdraw the RMD you owe on each account from each specific account.

The RMD rules don't apply to the following investments:

- Roth IRAs while the owner is alive

- Employer-based retirement plans, such as 401(k) accounts, if you're still working for the company that sponsors the plan (that is, if you haven't yet retired from that employer). If you own 5 percent or more of that business, however, the RMD rules apply at age 70-1/2 even if you're still working at that business

- Investments held outside of any tax-advantaged account

In addition, the RMD rules don't apply to an annuity that's paid over your lifetime or the joint lives of you and your beneficiary.

Because a complete description of the RMD rules is beyond the scope of this post, I encourage you to consult either a tax accountant; your IRA, 401(k), 403(b), or 457(b) plan administrator; or an online source to learn more. Your IRA or 401(k) institution may be able to calculate the RMD for you, but the ultimate responsibility for complying with these rules lies with you (In other words, you're still on the hook if your IRA or 401(k) institution makes a mistake with the math.)

The RMD rules can be a trap for the unwary. Be sure to double-check the calculations yourself so you know you're paying exactly what you owe and don't get hit with a penalty later.

This post is an excerpt from my latest book, "Money for Life: Turn Your IRA and 401(k) Into a Lifetime Retirement Paycheck." The book contains more information on how the various tax rules affect your retirement income, and also includes strategies for minimizing your taxes in retirement.