Will Bernanke launch QE from Jackson Hole?

(MoneyWatch) Over 60 species of mammals, over 100 species of birds, and a half dozen game fish can be found in the Jackson Hole/Yellowstone area. This week, there will another animal in the area: the Federal Reserve official, who is in town for the annual Jackson Hole symposium.

The headliner of the event is Chairman Ben Bernanke, but making a special guest appearance will be Mario Draghi, the president of the European Central Bank. Investors will listen closely to speeches by both (Bernanke on Friday morning, Draghi on Saturday) to glean clues as to whether either central bank has immediate plans of action.

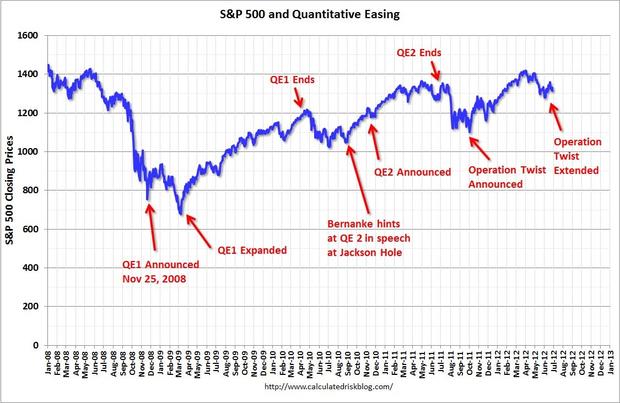

The form of action that investors have been craving is a third round of quantitative easing, or QE3, though the Fed prefers to call the operation "large-scale asset purchases." QE was announced in March 2009, began in the fall, and concluded at the end of Q1 2010. Bernanke hinted at QE2 from the Jackson Hole Symposium in August 2010, officially announced the program in November 2010, and concluded the purchases at the end of Q2 2011.

In a lecture given to George Washington University students last March, Federal Reserve Chairman Ben Bernanke explained how QE works. Here's the quick version:

The Fed buys U.S. Treasury bonds and mortgage-backed securities, which drives up prices, pushes down interest rates and reduces the availability of these bonds in the market. With fewer bonds available, investors turn to alternate assets, like corporate bonds. This part is important: When investors buy corporate bonds, they are essentially lending money to companies. The availability of corporate credit is an essential component in promoting the economic recovery, according to the Fed, and the byproduct of an improving economy is a rising stock market.

In fact, just the potential of QE3 has helped propel stocks during this summer's 10 percent rally. Here's a snapshot of how the S&P 500 has moved in conjunction with various Fed action since the financial crisis, courtesy of Calculated Risk blog.

In the GW lecture, Bernanke stressed that asset purchases are not government spending, because the assets the Fed acquires are ultimately sold back into the market. In fact, as of March, the Fed had made $200 billion, which benefited taxpayers by reducing the federal deficit.

To get you warmed up for Jackson, there will be plenty of data this week, including regional Fed surveys, the second estimate of second-quarter growth, the Fed Beige Book and Personal Income and Spending.

-- DJIA: 13,157, down 0.9% on week, up 7.7% on year (snaps 6-week winning streak)

-- S&P 500: 1,411, down 0.5% on week, up 12.2% on year

-- NASDAQ: 3069, down 0.2% on week, up 17.8% on year

-- October Crude Oil: $96.15, down 0.2% on week

-- December Gold: $1672.90, up 3.3% on week

-- AAA National Average Price for Gallon of Regular Gas: $3.74

THE WEEK AHEAD:

Mon 8/27:

10:30 Dallas Fed Survey

Tues 8/28:

9:00 S&P Case-Shiller HPI

10:00 Consumer Confidence

10:00 Richmond Fed Manufacturing Index

Weds 8/29:

7:00 MBA mortgage purchase applications index

8:30 Q2 GDP 2nd estimate (Q2 initial =1.5%, Q1=2%))

8:30 Q2 Corporate Profits

10:00 Pending Home Sales Index

2:00 Fed Beige Book

Thurs 8/30:

Chain Store Sales

8:30 Weekly jobless claims

8:30 Personal Income & Spending

Fri 8/31:

Ben Bernanke delivers speech from Jackson Hole, Wyo.

8:30 Chicago PMI

9:55 Consumer Sentiment

10:00 Factory Orders