Why Wall Street looks like it's losing its footing

U.S. equities moved lower on Tuesday, as the Dow Jones industrials index got pushed a further 140 points away from the 18,000 threshold it first crossed in December 2014. The catalyst this time was a batch of disappointing economic data, currency market volatility and weakness in high-yield bonds.

And several indicators are pointing to more trouble ahead.

Commodity-based stocks took it on the chin Tuesday, as energy companies dropped 2.2 percent and materials were down 1.7 percent . Global growth concerns were in focus after Australia's surprise interest rate cut, weaker Chinese manufacturing data and weak bank earnings in the U.K. and Europe. In the U.S., the Citigroup Economic Surprise Index fell to its lowest level in more than 10 months.

Adding to the pressure are Beijing's efforts to crack down on commodity speculation.

A number of moves were notable on a technical basis.

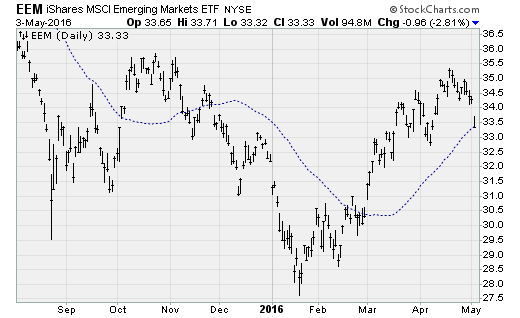

The iShares Emerging Markets (EEM) exchange-traded fund fell to test its 50-day moving average (chart above) for the first time since late February as strength in the dollar and global growth worries hit foreign equities.

Treasury bonds are attacking their 20-day moving average in what looks like the first new short-term uptrend since March -- a sign investors are scrambling for safety and a refuge from the recent rise in market volatility. High-yield, or junk, bonds as represented by the Barclays High Yield Bond ETF (JNK) suffered their worst one-day loss since early March as a flurry of energy sector defaults raises concerns about risk-vs.-reward for investors.

And small-cap stocks in the Russell 2000 have dropped below their 200-day moving average, reversing a breakout from early April.

The situation is vulnerable as Wall Street heads into Friday's all-important nonfarm payrolls report. Analysts are looking for 200,000 new jobs and a 0.1 percent drop in the unemployment rate, to 4.9 percent. A solid report will increase the odds of a June rate hike from the Federal Reserve. And that would further unnerve freshly rattled markets.