Not what we need now: Rising oil and gas prices

Stocks suffered their worst week in two months as the breakout of sectarian violence in Iraq upends the relative calm investors enjoyed in recent weeks. The rise in energy prices were the center of attention, and for good reason: Low inflation has been the linchpin holding this stimulus-addled market and economy together.

Without ultra-low interest rates and ongoing bond buying from the Federal Reserve and other major central banks, the wheels would've come off by now. As it is, the real economy is fragile. First-quarter GDP growth in the U.S. is set to be revised down to a -2.1 percent contraction according to Macroeconomic Advisors. The consumer is showing signs of fatigue with retail sales soft, credit card use surging and the savings rate dropping hard.

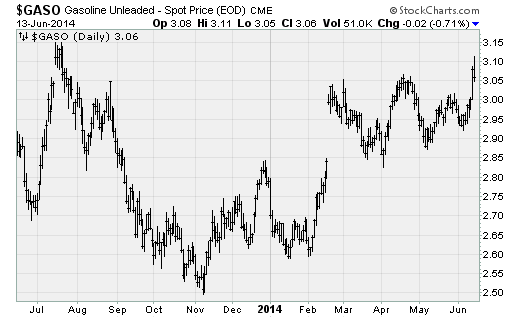

So, it's no help to see gasoline spot-market prices surging to levels not seen since 2013 (shown above), now just 10 percent from the all-time highs hit in 2011 and 2012.

Already, U.S. consumer price inflation has returned to the Federal Reserve's 2 percent annual target. And while policymakers have said they would tolerate a bit higher-than-normal rate for a time, a sustained rise in prices would not only damage household purchasing power but would call into question the continuation of the Fed's near-zero-percent interest rate policy.

That, in turn, would jeopardize the cheap debt-to-stocks conveyer belt that's bolstering equity prices, as I explained in a recent article.

Much depends on the situation on the ground in Iraq. So far, the extreme Sunni Muslim group known as Islamic State of Iraq and Syria (abbreviated ISIS or ISIL, depending on translation) hasn't yet jeopardized major Iraqi oil infrastructure. But that could change soon.

The large Baiji oil refinery, with a 310,000-barrel-per-day capacity, is reportedly still under government control. The Kurds have control of the Kirkuk oil fields. And that large Iraq-Turkey oil pipeline (ITP) that runs north has been shut for maintenance since March.

But should ISIS take Baiji (protected by Iraqi special forces at the moment) or destroy or damage the ITP, oil and gasoline prices could shoot much higher. The disputed region is home to another large oil refinery, the Daura facility, with capacity of 300,000 barrels per day. In April, Iraq produced 3.34 million barrels per day vs. a sustainable production capacity of 3.65 million barrels according to Deutsche Bank.

It's worth remembering that a similar geopolitically driven rise in energy prices in 2011, caused by the Arab Spring uprising in Libya and elsewhere, resulted in a spike in inflation that forced the Fed to end its "QE2" bond-buying program on schedule. The pullback in stimulus ushered in a tumultuous summer of trading that year, ending in the most violent correction of the bull market thus far during that August.

Much will depend on the Iraqi government's success (with the help of Iranian Shiite forces and perhaps U.S. air power) in putting down ISIS. Also watch for hints that Fed is becoming worried about inflation at its upcoming policy announcement and press conference next week.

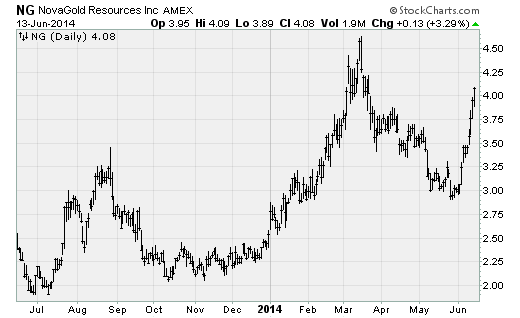

For now, I continue to recommend investors remain cautious with a focus on the safe haven and inflation-protection qualities of precious metals and the related mining stocks. NovaGold (NG) is up more than 18 percent since I added it to my Edge Letter Sample Portfolio back on June 5.

Disclosure: Anthony has recommended NG to his clients.