Why I'm selling stocks

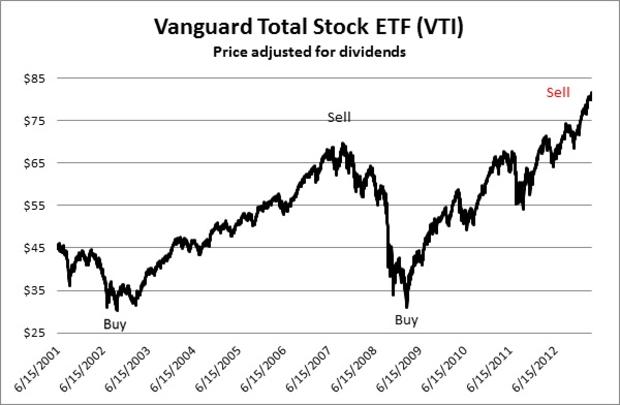

(MoneyWatch) I've recently reduced my stock exposure. It's not because I know what's going to happen in North Korea or what the Fed is going to be doing with quantitative easing. It's because, as of the time of this writing, the U.S. stock market is a staggering 17.1 percent higher than the previous pre-real estate bubble high. If you had bought the Vanguard Total Stock Market Index ETF (VTI) back on October 9, 2007, and done nothing other than let dividends reinvest, you'd be up 17.1 percent today.

Far from filling me with bullish euphoria, that the market is 17.1 percent higher than it was during the height of the real estate bubble baffles and concerns me. With the national debt at roughly twice the 2007 level, and our dysfunctional politicians refusing to work together to solve this crisis, it defies all logic and commonly held wisdom about the connection between investor confidence and the stock market. How is it possible that it is booming more now than when we believed real estate prices could never decline and companies like AIG and Lehman Brothers were too-big-to-fail financial icons?

Today, the market is 162.8 percent higher than the market bottom on March 9, 2009. Quite frankly, I don't understand this surge. So, in my own version of timing the market, I'm selling.

- A bear to remember

- Bear markets suck -- but don't give in to the pain

- Advisors show poor market timing

Emotions or logic?

Now before you jump to the conclusion that I'm acting emotionally, consider that there may be a method to my madness. See, while I don't understand the surge, I also didn't understand the plunge as I was pretty certain capitalism wasn't coming to an end in March 2009. I merely set an allocation target for stocks and rebalance. That means I have to be selling now just like I had to be buying during the financial crisis.

Though the reality is that I am timing the market, I'm doing so with focus and discipline. If you look at the chart, you'll note that I bought stocks after plunges and sold after surges. Since markets are now surging, I have to sell to get back to my stock allocation targets. And if you look at data on when investors bought and sold stock funds, you'll see that my movement in and out of stocks runs pretty much in the opposite direction of investor cash flows.

Perhaps the most obvious statement is that it's better to buy low and sell high than the reverse. Yet most investors and professional investment advisors do the opposite. Between March 2009 and December 2012, investors took $416 billion out of stock funds, according to the Investment Company Institute. Now that stocks are at an all-time high, investors poured $68 billion into stock funds in the first three months of this year. Some of those investors sold stocks to me in 2009, and I'm selling back to them now. I won't be right every year, but it certainly has worked in the long-run.

Selling now has nothing to do with what I believe the market will do going forward, and everything to do with an asset allocation policy and sticking to it. This requires that I put on my metaphorical noise-cancelling headphones to block out my emotions and pundit advice, but that's the not-so-secret formula for successful investing. Simple, but not easy.