Why cash is trash for long-term investors

Nearly three years after stocks hit their bear market bottom, investors are still leery of equities and hiding out in cash, much to the detriment of their long-term financial goals.

Fund-industry statistics show that investors currently hold fewer stocks relative to other asset classes than at any time in history, according to DWS Investments, part of Deutsche Bank Group (DB).

That means a lot of folks missed the rebound in stock prices since those dark days of March 2009. True, this year has been no fun at all, but the S&P 500 is still up nearly 80 percent from its bear market nadir.

Why it's good news that investors hate stocks

The best investment of 2012?

Jeremy Grantham's 4 tips for investors

Cash, meanwhile, is yielding less than nothing, once you subtract inflation from near-zero percent interest rates. Unfortunately, many investors are still looking for a tell-tale sign indicating it's time to reposition their cash holdings back into the capital markets, writes Jeff Piliero, regional investment manager at Wells Fargo Wealth Management, in a new note to clients.

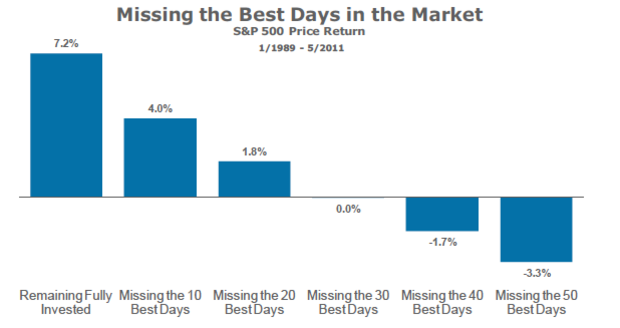

That's a huge mistake. Market-timing (that is, guessing where stocks are headed in the short term) is a near impossible feat, Piliero says, because the lion's share of returns tend to come in short, unpredictable stretches.

Indeed, from January 1989 to May 2011, the S&P 500 rose 7.2 percent on a price basis. But if you subtract just the 50 best performance days out of those 12-plus years, the S&P 500 actually lost 3.3 percent. See the chart, courtesy of Wells Fargo Wealth Management and Bloomberg, below:

That's a strong case for remaining committed to your long-term financial plan, regardless of how stomach-churning the stock market may be. As Piliero notes, even during the most difficult times, over the long term a diversified allocation across stocks, bonds and other asset classes is far more prudent than piling into cash.