Who is your financial adviser really working for?

Under laws and regulations currently in effect, financial advisers aren't obligated to act in your best interests when recommending investments for your retirement accounts and offering guidance on your retirement plans. Are you surprised to hear that?

If so, you're not alone: According to a survey conducted by Financial Engines, the country's largest independent registered investment adviser, 46 percent of all Americans mistakenly believe that all financial advisers are fiduciaries and are legally required to put the best interests of their clients first when it comes to making recommendations on their retirement savings.

The U.S. Department of Labor (DOL) issued regulations in April 2016 that would require advisers to act as fiduciaries when making retirement savings recommendations. The so-called "fiduciary rule" had been scheduled to go into effect in April 2017, but its future is in doubt.

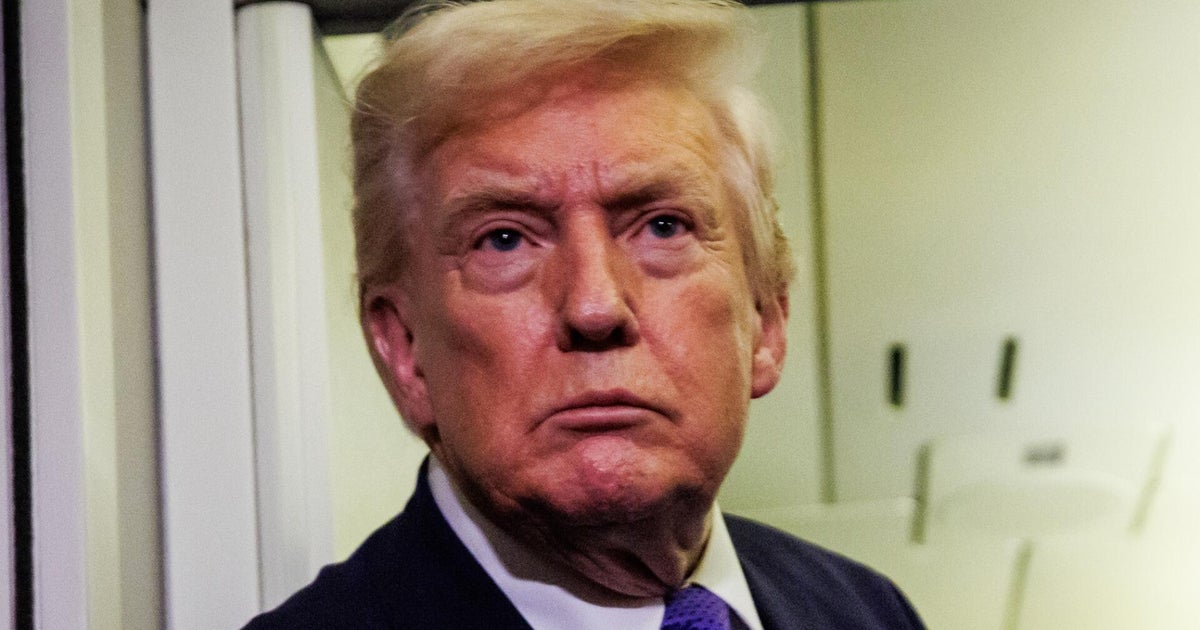

Responding to intense lobbying from some corners of the financial industry the Trump administration is moving to block the rule's implementation. Mr. Trump will sign a presidential memorandum Friday instructing the Labor Department to delay implementing the new rule for 90 days while DOL reviews it.

In addition, several lawsuits have been filed by financial industry groups to kill the fiduciary rule, and the GOP-controlled Congress has separately introduced a bill to delay the regulations' implementation.

The Financial Engines survey shows that many Americans have misconceptions about the rules regarding financial advisers:

- Almost two-thirds of those surveyed say they don't know what a "fiduciary" is as it relates to financial advisers.

- 41 percent of those who already work with a financial adviser aren't sure if their adviser is a fiduciary or not.

An overwhelming majority of survey respondents support the intent of the DOL regulations:

- 93 percent said it's important that all financial advisers be legally required to put their clients' best interest first when providing advice on retirement savings.

- 77 percent said they would support requiring all financial advisers who provide advice on retirement assets to be legally required to put their clients' best interest first.

One of the biggest issues the fiduciary rule tries to tackle is the manner in which advisers are compensated for making their recommendations. That's because many investment and insurance products pay commissions to brokers and agents, creating the potential for financial conflicts of interest.

The DOL is concerned that some brokers and agents might direct their clients to investments that pay more compensation compared to other investments, even when the other investments might be reasonably expected to perform better for the client. The new regulations would prevent that conflict of interest.

The Financial Engines survey asked respondents about payment structures that create such conflicts in investment advice. Fifty-five percent of respondents said those structures "are a bad thing for me," 35 percent said "I'm not sure" and only 10 percent said these structures "are a good thing for me."

Supporting the DOL fiduciary rule are a number of academics, professional adviser organizations and consumer groups, including:

- AARP

- Professional advisory organizations such as Certified Financial Planners, the Financial Planning Association (FPA) and the National Association of Personal Financial Advisors (NAPFA)

- Consumer Federation of America

- Alicia Munnell, the director of the Center for Retirement Research at Boston College

Financial Engines and the Garrett Planning Network are two prominent financial advisory firms that have said they already act as fiduciaries on behalf of their clients. Financial giant Bank of America Merrill Lynch is taking steps to eliminate potential conflicts of interest before the regulations take effect, and other financial institutions are scrambling to redesign the products to comply with the regulations.

Opponents of the regulations accuse the DOL of regulatory overreach, claiming that the regulations are too complex and burdensome. They say the rules will result in fewer Americans receiving financial advice. Opponents include the American Council of Life Insurance, the Insured Retirement Institute, Grover Norquist of Americans for Tax Reform and the GOP Congress led by Representative Paul Ryan.

The bottom line for retirement investors: You're the best watchdog of your investments and financial security. Don't rely on the government to watch out for you because the chances are good it won't.

Be an informed, savvy investor. Ask your adviser if he or she has conflicts of interest due to compensation. Ask about plans to comply with the new rules. The wrong answer might mean it's time to switch advisers -- after all, you can find prominent financial institutions that will place your interests first, and you can give them your business.

It's just good old American values at work to ask how much you're paying and to make sure you receive good value and fair treatment.

Note: This story has been updated to reflect President Trump's decision to order the DOL to delay the fiduciary rule's planned April implementation.