Where to stash your cash today

(MoneyWatch) If your cash is sitting in the bank earning a whopping 0.01 percent annual percentage yield (APY), now is the time to get it working harder for you. Without having to put it in stocks or even bonds, you can earn a bundle no matter what happens to interest rates. The secret is finding CDs that have two key ingredients:

- High interest rates

- Low early withdrawal penalties

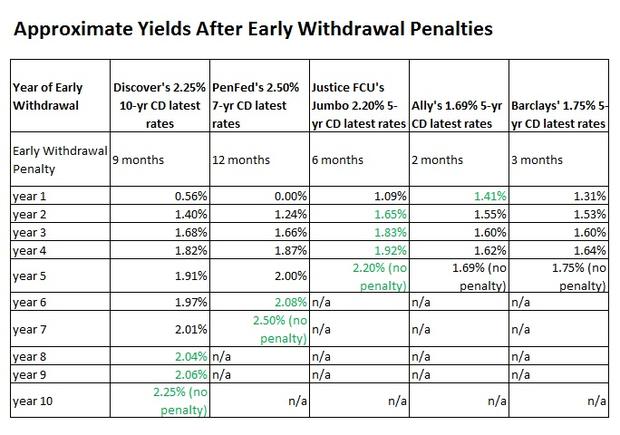

DepostAccounts.com just updated its search for such CDs, and founder Ken Tumin alerted me of the findings. Tumin noted that Ally Bank now has competition with Barclays' (BCS) new five-year CD. Barclays is paying 1.75 percent APY for a five-year CD with a three-month early withdrawal penalty. This is slightly higher than Ally Bank's 1.69 percent APY, though Ally has a two-month early withdrawal penalty.

If you think either that rates are going up soon or that you may need the money in the next year or two, Ally is probably your best bet. Beyond three years, the other four options above are likely to do better.

It's important to note that some financial institutions don't allow partial early withdrawals. The simple solution is to open multiple CDs. For example, if you were going to stash $50,000, you could open up 10 $5,000 CDs. That way, if you needed $4,000 cash, you could just close one CD.

Maximizing FDIC insurance

Stash your IRA cash

Credit union punishes members

In case you think these rates are hardly worth it, consider that the Ally CD will return the following, even if cancelled in one year:

- $10,000 CD - $141 interest

- $50,000 CD - $707 interest

- $100,000 CD - $1,410 interest

To lean more about these CDs, see this post at DepositAccounts.com. When investing in a CD, remember to read the fine print, and be sure your financial institution doesn't reserve the right to retroactively change terms on your existing CD.