What's your personal retirement number?

(MoneyWatch) You often hear mention of people's retirement "number," the amount of retirement savings that will magically insure a secure retirement. But do you believe in magic? I didn't think so.

The problem with any one retirement number is that it doesn't take into account your personal situation on a number of critical questions, such as:

- How much money will you spend on living expenses?

- How much retirement income will you get from Social Security or pensions?

- Will you work during your retirement years?

- Do you have children or parents who are dependent on you for financial support?

- Are you (and your spouse or partner, if applicable) in good health?

- Do you have a lot of debt, either for credit cards, student loans or a mortgage?

In short, relying on a general retirement number is dangerous and could easily leave you short of meeting your goals. Instead, you need a retirement number that's personalized to your circumstances.

- Retirement income scorecard: Interest and dividends

- Retirement income scorecard: Systematic withdrawals

- Retirement income scorecard: Immediate annuities

- 3 ways to turn your IRA and 401(k) into a lifetime retirement paycheck

A better way to determine the amount of retirement savings you need to have on hand in order to retire comfortably is to first determine how much retirement income you'll need to generate from your retirement savings given your answers to all of the above questions. But once you've estimated that amount, you're still not done.

That's because the amount of retirement savings you need to generate a given amount of income depends significantly on your choice of a retirement income generator (I call these RIGs in my book "Money for Life.") Once you select a RIG, or combination of RIGs, that best meets your goals and circumstances, you can use the payout rates from my retirement income scorecard series to estimate your personalized retirement number. Here are the steps to do this:

- Invert the payout rate for your specific RIG. If you forgot your high school algebra, this means divide the number "one" by the payout rate.

- Multiply the above result by the amount of retirement income you need.

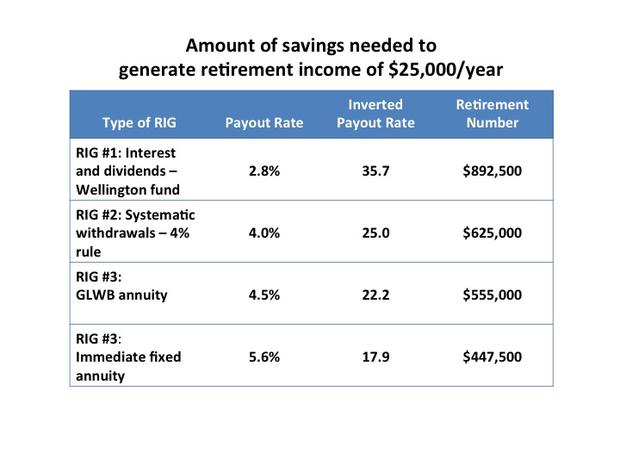

To make this easy to understand, let's look at an example. After you've done the math, suppose you need an annual income of $25,000 per year from your retirement savings, in addition to Social Security and any pension you may have, to cover your total spending needs. Also suppose that both you and your spouse are age 65. The table below from my recent retirement income scorecard series summarizes the amount of retirement savings needed to generate $25,000 per year from four different RIGs that are shown in my recent retirement income scorecard series.

Note that with RIG #1 -- interest and dividends using Vanguard's Wellington fund -- you need $892,500 in retirement savings to generate a retirement income of $25,000 per year. But if you use RIG #3 -- an immediate fixed annuity -- you'd only need $447,500 in retirement savings to generate the same amount. That's half as much savings to get the same retirement income. And if you select a different RIG, the amount of savings you need will be different still.

It's important to understand that the various RIGs each have their pros, cons and other characteristics, and that there's no single RIG that works best for everybody. You have a better chance of securing your retirement if you select the RIG, or combination of RIGs, that best meets your goals and circumstances. Then use the payout rate from your RIG to estimate your own personal retirement number. This will generate a number that's more accurate that what you'd get if you relied on a rule of thumb that may end up being a "rule of dumb."