What if you could time recessions -- perfectly?

(MoneyWatch) One of investors' worst traits is a lack of discipline when times get tough. They tend to abandon their plans at terrible times, which got me thinking about what their performance would be like if they knew when recessions were coming. Based on my many years of conversations with investors, I'm confident that most would be willing to pay a princely sum to have that kind of foresight. How much would you be willing to pay? And would it be worth the cost?

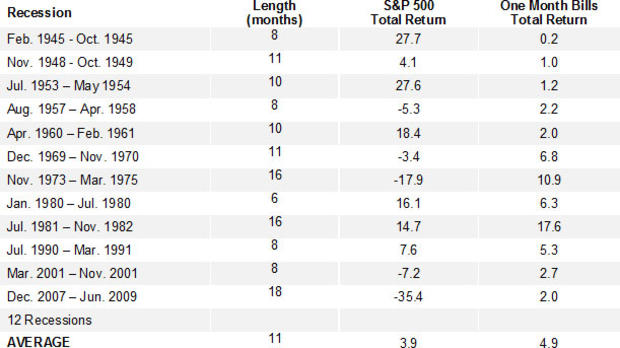

Prior to the most recent crisis, the National Bureau of Economic Research listed 11 recessions for the period 1945-2007. Over this period, the average return for the S&P 500 Index (total return based on equally weighting the 11 episodes) was 7.4 percent. That was actually 2.3 percent greater than the return on one-month Treasury bills. In other words, prior to the most recent recession, there was a noticeable equity risk premium even during recessions.

- Why the Dow's new high is just a number

- Is the gold rally over?

- Are concerns about "bond ladders" valid?

How did the most recent recession affect these results? The table below has the data for each of the recessions since 1945, including the most recent one.

Including the last recession, we now find that there was a negative stock risk premium during recessions -- a perfect timing strategy would have produced a benefit of 1 percent. What lessons can we take from this?

The first lesson is to not treat the unlikely as impossible. The fact that the largest loss in the prior 11 recessions was about 18 percent didn't mean that a future loss couldn't be much larger. A related mistake would be thinking that because something has not happened, it can't.

The second lesson is that even with a perfect timing strategy, the benefit would have been only 1 percent (and that's without considering transaction and tax costs). For us mortals who live in the real world, there are no clear crystal balls, and the beginnings and endings of recessions are typically only known well after the fact. There's also some real world evidence on the inability for active managers to add value during bear markets and recessions.

A study by Vanguard reached the conclusion that "whether an active manager is operating in a bear market, a bull market that precedes or follows it, or across longer-term market cycles, the combination of cost, security selection, and market-timing proves a difficult hurdle to overcome. They also confirmed that past success in overcoming this hurdle does not ensure future success." This study covered both domestic and international markets, and Vanguard reached this conclusion despite the data being biased in favor of active managers because it contained survivorship bias.

The second study "Modern Fool's Gold: Alpha in Recessions," looked at the ability of active management to add value in expansions and contractions. The study covered the period July 1990 through March 2010. The following is a summary of its findings:

- Active management cost investors roughly 1 percent a year during expansions, while only covering costs during recessions. Thus, active management failed to generate alpha in any environment.

- Fewer than 20 percent of prior business cycle "winners" repeated their prior performance.

- Recessions have the greatest variability of performance. This is especially damaging given that investors are risk averse -- the pain of a loss is much greater than the joy felt from an equivalent gain.

Keep these facts in mind the next time you're tempted to take action that just might lead to committing portfolio suicide.

Image courtesy of Flickr user 401(K) 2013.