What factors are buffeting stocks?

Stocks came under pressure again on Monday with important areas like biotech, big tech and junk bonds dropping hard as Wall Street grows increasingly nervous about the prospect of a Federal Reserve interest rate hike before year-end as well as ongoing economic troubles in China.

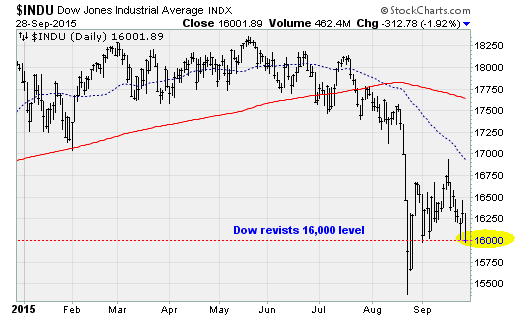

The Dow Jones industrials lost 1.9 percent, or 313 points, to close at 16,001 -- its third retest of the psychologically important 16,000 level this month. The small-cap stocks in the Russell 2000 weren't as lucky: They lost a whopping 2.9 percent to return to levels not seen since last October.

The catalyst is the ongoing fallout from last week's speech by Fed Chair Janet Yellen, in which she reinforced the case for a rate hike in 2015. Rates haven't been jacked up since 2006, but Wall Street still simply isn't ready: The futures market odds of a December rate hike are only around 40 percent, and October odds are even lower. And that's why the selling is intensifying.

Reinforcing the selling were comments by New York Fed President William Dudley, who told The Wall Street Journal that rates will go up this year. After the close, San Francisco Fed President John Williams told a crowd at UCLA in Los Angeles that he also still expects a rate hike this year. He said he sees preliminary signs of excess risk-taking in financial markets and that the U.S. economy needs to generate just 100,000 new jobs per month (half the current six-month average) for stable economic growth.

Also contributing was another disappointing data point out of China: Industrial profits fell 8.8 percent year-over-year for the biggest monthly decline since 2011.

That's hitting commodities again. Crude oil dipped back below the $45-a-barrel level. High-yield, or junk, corporate bonds were hit really hard as well. The iShares High Yield Corporate Bond Fund (HYG) dropped all the way back to levels not seen since late 2013. Concerns are growing about the potential for energy sector bond defaults if energy prices stay low.

Treasury bonds moved higher on safe-haven buying, pushing the iShares 20+ Year Treasury Bond (TLT) up 1.7 percent, which punched it out of a two-month downtrend. It's ironic that fears over higher short-term interest rates from the Fed are pulling down long-term interest rates. But such are the ways of the financial markets.

Looking ahead, all eyes are on Friday's nonfarm payroll report for additional clues as to whether the Fed will really hike interest rates this year. Based on Williams' comments, it would take a dramatic and sustained decline in job creation to postpone a rate hike at this point.

That's especially true in the context of supporting evidence of health, such as Monday's personal income and spending data, which was good enough for Ian Shepherdson at Pantheon Macroeconomics to increase his third-quarter estimate of consumption to a 3.4 percent annualized rate.

If the Fed sticks to its guns about normalizing monetary policy, technical indicators are warning the stock sell-off could get ugly if the NYSE Composite Index violates its 200-week moving average for the first time since the August 2011 sell-off. Stocks went on to lose another 13 percent once that threshold -- which is a key level of long-term uptrend support -- was crossed.

Already, the NYSE Composite has dropped 12 percent from the high set in May.

Fundamentals are also demanding, with stocks fully valued but with S&P 500 earning set to decline 4.5 percent for the third quarter, according to Factset data.

One caveat is that negative sentiment is reaching extremes, suggesting that maybe a 0.25 percent interest rate rise by the Fed wouldn't be so terrible after all. Ed Yardeni at Yardeni Research noted that the plunge in the Investors Intelligence Bull/Bear Ratio has exceeded the extremes seen during 2010 and 2011, and is similar to the fall of 1987. Sentiment that bearish means the time to buy stocks may be near.

With so many cross-currents in play, one thing is for sure: After a long, quiet period that ended in August, recent market volatility looks set to continue.