Data shows retirees better off today than 1950

It may be natural to pine for the "good old days," but that feeling is misplaced when it comes to retirement. Despite the challenges that older people face today, retirement today is much better than it was in 1950.

According to a report from the Stanford Center on Longevity (SCL), in 1950 a 65-year-old man could expect to live to age 78, or an additional 13 years. By 2010, a man age 65 could expect to live to age 82, or 17 years longer. A woman age 65 in 1950 could expect to live another 15 years, to age 80, but by 2010 her life expectancy was 84.

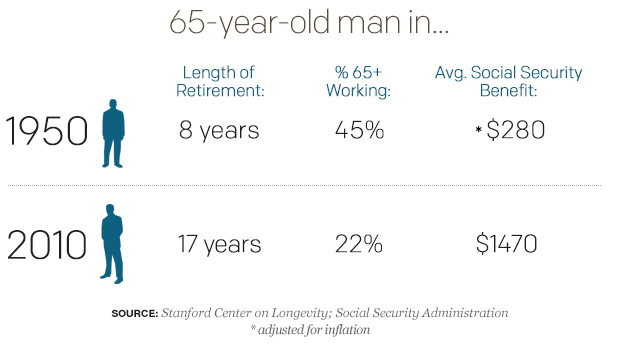

The same report shows that the average length of retirement in 1950 was eight years for men, increasing to 19 years by 2010. This is due to the combination of earlier retirement ages and longer life expectancies. (There are no comparable figures for women, since women entered the paid workforce in substantial numbers in the 1970s.)

Another SCL report shows that the percentage of older employees in the workforce has declined dramatically over the last six decades. In 1950, 45 percent of men age 65 and older were still working. This percentage declined to about 15 percent by 1990, but increased slowly to about 22 percent by 2010. (It's worth noting that this figures encompasses all men over age 65, including men in their 80s and 90s. The percentages of men working in their late 60s and early 70s are much higher.)

The introduction of early retirement and disability benefits allowed more people to retire early. In 1950, you had to wait until age 65 to collect Social Security retirement benefits. Early retirement, at age 62, was introduced in 1956 for women and in 1961 for men. Social Security's disability benefits were also introduced in 1956.

The average monthly Social Security benefit increased from $29 in 1950 to $1,262 in 2012. Adjusted for inflation, that $29 translates to $280 in 2012 dollars, which means that the average Social Security benefit two years ago was worth 4.5 times the average benefit in 1950.

According to the Social Security Administration, the median income for married couples age 65 and older increased from $20,750 in 1962 to an inflation-adjusted $44,718 by 2010. Similarly, over that same period of time the median income for a single person age 65 and older increased from $8,159 to $17,261. The median incomes for retirees in 1950 were even smaller than the incomes in 1962. Meanwhile, retirees today are three times as likely to receive a private pension as retirees in 1962.

These increases in income have all contributed to a significant decline in poverty among the aged, as shown in the first SCL report mentioned above. In 1959, for instance, roughly a third of people age 65 and older lived in poverty; by 2008, this percentage had declined to 10 percent.

Another important difference between then and now is that in 1950, retirement hadn't yet been glamorized by the media as the "golden years," an extended period of travel and recreation. Most retirees didn't retire to pursue their hobbies and interests -- rather they stopped working because they were unable to continue. After retirement, they lived simply and modestly in the communities where they had worked and lived all their lives.

In 1950, most people had one car at most. There were no computers, wide-screen TVs or cellphones. Long-distance phone calls were expensive, and most people kept in touch with far-away relatives via handwritten letters. Air travel was in its infancy, and it, too, was pricey. Hardly anybody ate at a restaurant, took a cruise or played golf. If you wanted to enjoy music, you listened to the radio, or if you were lucky you found a live performance. There were no music downloads, no CDs, no online radio.

You also had to pay for your medical bills out of your own pocket. Medicare was introduced in 1965, and employer-sponsored retiree medical plans were rare.

In the 1950s, we didn't know that heart disease or diabetes or a lot of other common diseases were largely caused by an unhealthy lifestyle, and it wasn't widely accepted that smoking was dangerous to your health. These days, there's a lot more research available that shows how to live long, healthy lives, and people have taken advantage of it to improve their health.

I could go on, but by now you should get the picture. There are vital lessons we can learn from looking back at retirement in the 1950s. But, in spite of all the well-publicized challenges with retirement, I'd much rather be aging today than back in the 50s.