Victoria's Secret parent company's stock down as Jeffrey Epstein ties emerge

Victoria's Secret has long lived by the business mantra sex sells. But its corporate parent's connections to Jeffrey Epstein, the financier arrested and charged Monday with the sex trafficking of underage girls, could further sink the fortunes of the ailing lingerie retailer, damaging a brand that already had seemed out of touch in the #MeToo era.

L Brands shares are down 10% this week, to around $25, near the lowest they've been since 2010, after news accounts detailed the decades-old dealings between Epstein and L Brands CEO Les Wexner, the 81-year-old corporate legend who built his family's single clothing store outside Columbus, Ohio, into a global retail empire.

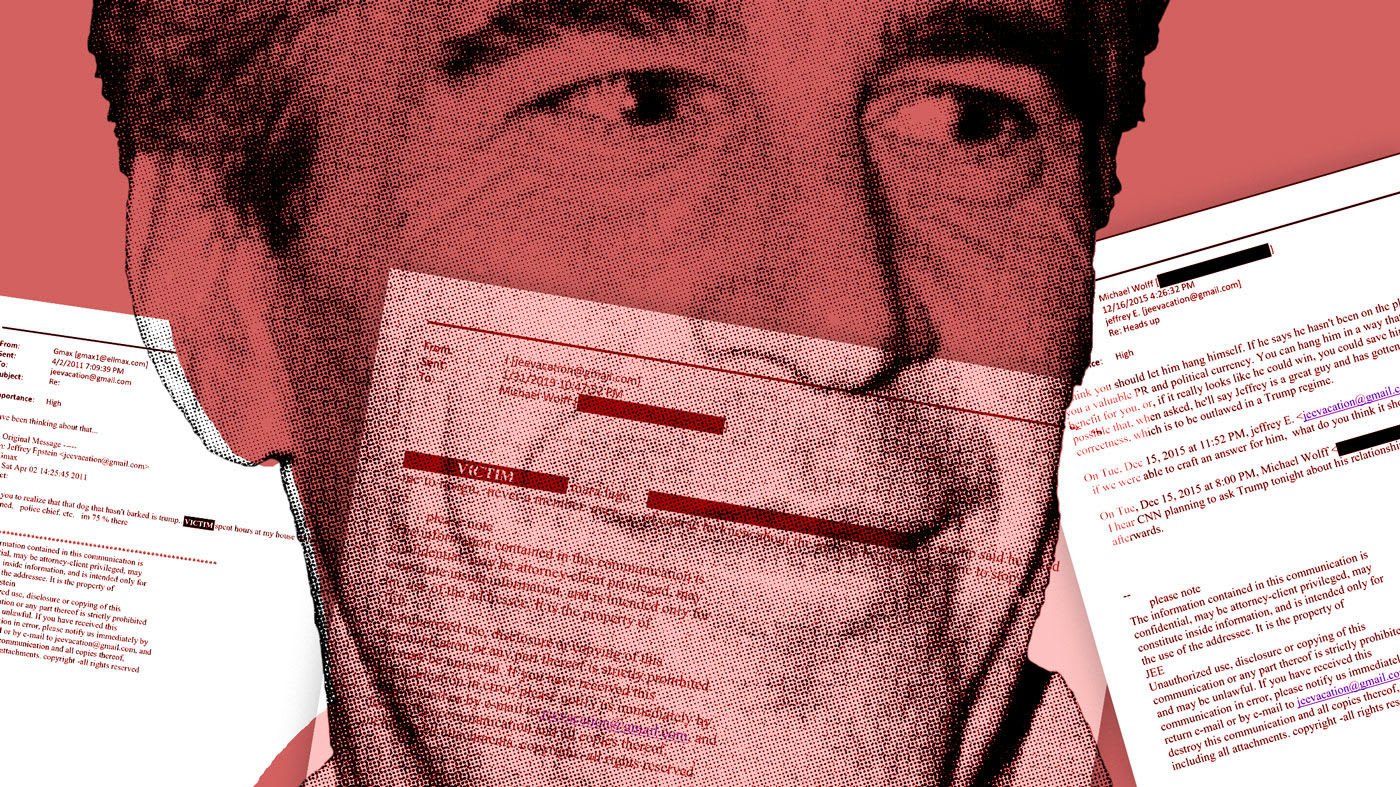

Epstein's New York City mansion, where prosecutors say they found a trove of naked pictures of underage girls last weekend, was once owned by Wexner. He reportedly transferred the home in 2011 to Epstein, his onetime financial adviser, in a complex transaction valued at $20 million, according to the New York Times.

Perhaps all investors need to know about how Victoria's Secret has adapted to the marketing realities of today's Me Too movement is this: The investor relations page for corporate parent L Brands is headed by a picture of eight young, lingerie-clad women. At the center of the image is model Taylor Hill, who began posing for Victoria's Secret at 18. She is now 23. The picture was taken in early 2015.

L Brands owns Victoria's Secret, yes, but it's not the company's only brand. It also owns the beauty products retailer Bath & Body Works, which these days is its fastest growing chain of stores. Yet there are no pictures of soap or fragrances on L Brand's main investor relations page, just the image of women in their underwear.

Epstein, who pleaded not guilty to this week's charges, was never an employee of L Brands. Wexner said in a statement to L Brands employees released July 15 that he "severed all ties" to Epstein nearly 12 years ago, which was around the time his financial adviser pleaded guilty to prostitution charges in Florida.

"As you can imagine, this past week I have searched my soul … reflected … and regretted that my path ever crossed his," Wexner said in the statement to employees. "When Mr. Epstein was my personal money manager, he was involved in many aspects of my financial life. But let me assure you that I was NEVER aware of the illegal activity charged in the indictment."

Wexner continued: "We all know that what is being reported about Mr. Epstein will receive significant news coverage. I fully expect that this will remain in the news for some time to come. And we don't know what twists and turns these events will take … but I can assure you that I will continue to act in the company's best interest as this unfolds, and I ask you to do the same. I am proud that our company has long-held core values – those values have never been more important than today, and I ask that we all wave them higher now than ever before."

While Epstein has been described as a billionaire during his many years in the limelight, it's not clear how he made his fortune, or if it actually reaches into the 10 figures. His long-time association with Wexner, though, appears to be a major source of any wealth he has.

Wexner himself is worth $6.6 billion, according to Bloomberg, and much of it comes from his 17% stake in L Brands. The company's shares traded for as low as $6 on a split-adjusted basis in the mid-1980s, which is when Epstein began working with Wexner. The shares hit a high of nearly $100 in 2016.

Wexner at times has described Epstein as both a close friend and a trusted adviser. The link between Epstein and Wexner and his corporations is detailed in financial filings going back to the mid-1990s. A 1994 filing from The Limited Inc., the previous corporate name of L Brands, lists Epstein as a financial adviser and a trustee of the Wexner Foundation. The business address listed for Epstein is the same listed for the Columbus headquarters of Wexner's Limited.

Epstein has said he started working for Wexner in 1986, a few years after he left a trader job at Wall Street's legendary Bear Stearns. A 2003 Vanity Fair profile of Epstein described him as a "familiar face to many of the Victoria's Secret girls" who had enjoyed had a front row seat at the 2002 Victoria's Secret fashion show.

L Brands, which once also owned Abercrombie & Fitch as well as The Limited, made many investors on Wall Street wealthy, not just Wexner and, presumably, Epstein. But L Brands has struggled the past few years. Victoria's Secret announced in February it would close 53 stores after holiday sales fell 7%. Same-store sales were down 5% in the most recently completed quarter.

Part of the reason is the decline of traditional retailing in general. But L Brands has also failed to appeal to a young and more socially conscious demographic. Randal Konik, an analyst who follows L Brands for investment bank Jefferies, recently called Pink, a Victoria's Secret brand marketed to young women, "without fans and ruderless."

L Brands overall revenue, though, continues to rise, largely driven by Bath & Body Works. The problem: Whiles sales are up, the company's costs in recent years have risen even faster. As a result, L Brands' profits, which is what investors should really care about, are about half of what they were just four year ago. The stock is down 75% since then, but even there it might not be worth buying. The shares trade at 10.5 times this year's expected earnings. That would be very cheap for the shares of a fast growing business, like Amazon, but it's high for a struggling retailer. Shares of The Gap, for instance, trade at a price that's 8.6 times this year's expected earnings.

It's perhaps ironic that the one thing to turn around L Brands shares now would be if the Epstein headlines wake up L Brands' insiders to the fact that a change of strategy is needed. The company has made some high-profile hires recently. Unfortunately, that investor relations page, and CEO Wexner's awkward silence on his relationship with Epstein, suggest the company's much-needed makeover isn't coming any time soon.

This story was updated with additional information on the reported financial terms of the transfer from Les Wexner to Jeffery Epstein of the New York City mansion where prosecutors say they found a trove of naked pictures of underage girls this week.