A truce in U.S.-China trade war, but no peace treaty

President Donald Trump is touting a thaw in U.S.-China trade relations as a breakthrough, saying in a tweet that it represents a "BIG leap forward" and that "very good things will happen." But experts -- and even White House advisers -- were more cautious in describing the cease-fire.

"I can't call it an agreement yet," Larry Kudlow, Director of Mr. Trump's National Economic Council, told reporters in a call on Monday.

Noting that a similar pause in hostilities in May later fell apart, economists also warned that the sides remain far apart in ironing out key disputes. Those include intellectual property protection for American companies, Chinese commitments to buy more U.S. goods, and Beijing's broader focus on turning China into a technological, industrial and military powerhouse.

"With the truce probably mostly due to a (possibly temporary) change of mind in the U.S., and room for agreement on much of the substance rather narrow, it is fragile," Andrew Hunter of Capital Economics said in a note to clients.

Here are the biggest takeaways from the truce between the U.S. and China, which was announced at last weekend's G-20 summit in Buenos Aires, Argentina.

Details lacking -- and clock is ticking

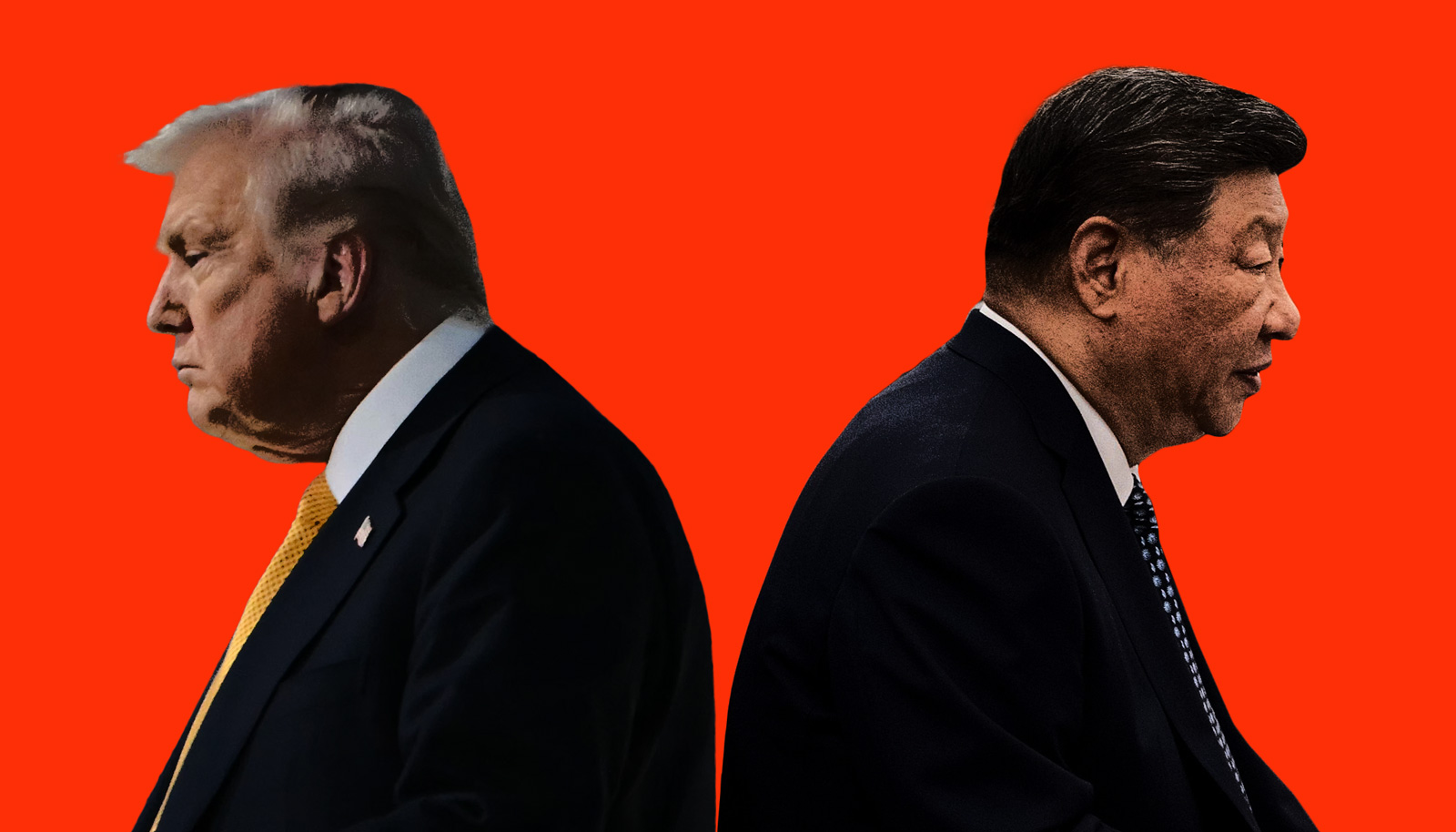

Mr. Trump and Chinese President Xi Jinping didn't clinch an actual trade deal; rather, they called a 90-day truce, until March 1, in the ongoing trade war between the world's two biggest economies.

The U.S. postponed a tariff hike on $200 billion in Chinese imports that would've dramatically escalated the conflict by raising the rate to 25 percent, from 10 percent, on Jan. 1. For American consumers, that at least postpones the prospect of sharply higher prices on a range of Chinese-made goods.

"Trump's 'deal' with President Xi at the G-20 met our expectations for the best possible outcome," Height Capital analyst Clayton Allen wrote in a note. "This best possible outcome, however, is notably light in actual commitments or details."

Official statements sow confusion

The official U.S. and Chinese statements on the deal differ in important ways, including potential Chinese purchases of American products. According to the White House, China agreed to buy a "very substantial amount of agricultural, industrial and energy products" from the U.S., though details are scanty.

Kudlow on Monday said China has made "early commitments" on de-escalating the trade standoff, but the specifics and timeline remain unsettled. "Much of the credibility of this discussion will hinge on rapid movement and implementation of Chinese commitments and they know that," he said.

Adding to the confusion, Mr. Trump late Sunday also said on Twitter that China will lower its 40 percent tariff on U.S. cars, reportedly surprising auto industry executives. China's statement did not cite its intention to cut levies on American vehicles.

China initially had a 25 percent tariff on U.S. auto imports, but lowered it over the summer to 15 percent before the U.S. tariffs took effects following discussions in May. It then raised that tariff to 40 percent in retaliation to stiffer U.S. levies.

Tariffs remain in place

None of the tariffs the U.S. has already imposed on China under Mr. Trump, including the $200 billion on Chinese imports in September, have been removed, Chad Bown of the Peterson International Institute of Economics, pointed out in a tweet.

"Despite all of his announced 'deals,' NONE of those tariffs have been removed," Bown wrote. "And on the U.S. export side, U.S. trading partners have responded with retaliatory tariffs covering over $125 billion, or 8 percent, of U.S. exports. At the moment, NONE of those tariffs have been officially removed either."

5 major issues

U.S. and Chinese officials will return to the table to address intellectual property rules, forced technology transfer, non-tariff barriers, cyber intrusions and cyber theft, according to the White House. If agreement can't be reached, U.S. tariffs on Chinese imports would rise to 25 percent as planned.

The Information Technology Industry Council, a Washington-based group that represents technology companies, in a statement called the truce a "critical first step," urging "both leaders to stay focused on the benefits of an open and rules-based trade relationship."

Yet the list of disagreements is daunting, observers said, especially given the hard line the U.S. administration took last week before the Trump-Xi meeting in Argentina.

"You've got five major areas that the U.S. wants concessions on. I don't know how that's achieved within 90 days," said Michelle Casario, an assistant professor of economics at Villanova University, in an interview with CBS MoneyWatch. "I see this as a reprieve, but then in March you could see the full implementation" -- and even an expansion to all Chinese goods, as previously threatened by Mr. Trump.

"They've been fighting over these things for decades, so how in 90 days do you make progress when China won't even acknowledge technology transfer?" Casario said, referring to requirements that Western companies share proprietary information with Chinese businesses as a condition for doing business there.

Farmers still hurting

Mr. Trump said U.S. farmers will see immediate benefits, saying in a tweet that China will start buying their products "immediately."

If China does increase its purchases of U.S. agriculture products, they are most likely to include pork and soybeans, according to Goldman Sachs. Still, farmers remain cautious.

"Any signal, even if temporary, that this trade war may de-escalate is welcome news for farmers," a group called Farmers for Free Trade said in a statement. "While farmers are cautiously optimistic about this development, they are also keenly aware that they are still subject to the existing painful retaliatory tariffs and lost markets that have hurt their recently harvested crops and income."

Truce mirrors one with the EU -- and not in a good way

Height Capital's Allen said the pause in the U.S.-China trade fight is "almost identical" to a July agreement between Mr. Trump and European Commission President Jean-Claude Juncker, including the announcement of more EU purchases of agricultural products.

But "that pause appears to be unraveling as Trump is again pushing auto tariffs in an attempt to force the Europeans to make concessions," Allen said. That could happen with China, too.

"Without any firm commitments from the Chinese on larger intellectual property or other issues, Trump will likely return to threatening tariffs when he fails to get what he wants in the next three months," he said.