14 million Americans paid for tax-prep services they could've gotten for free

Tax-preparation firms impeded millions of Americans in using an Internal Revenue Service program that lets people file their taxes for free, a recent U.S. government report concludes.

Most taxpayers qualify to file their returns for free under an IRS-sponsored program known as Free File. But at least five of the 12 commercial tax-prep companies that agreed to provide free software under the program used code to hide their free service from online searches, the Treasury Inspector General for Tax Administration (TIGTA) found in an audit.

The federal watchdog looked into the Free File program last spring after the nonprofit newsroom ProPublica revealed that TurboTax parent Intuit, H&R Block and other tax-prep companies were steering low-income customers to paid services that could've been done for free.

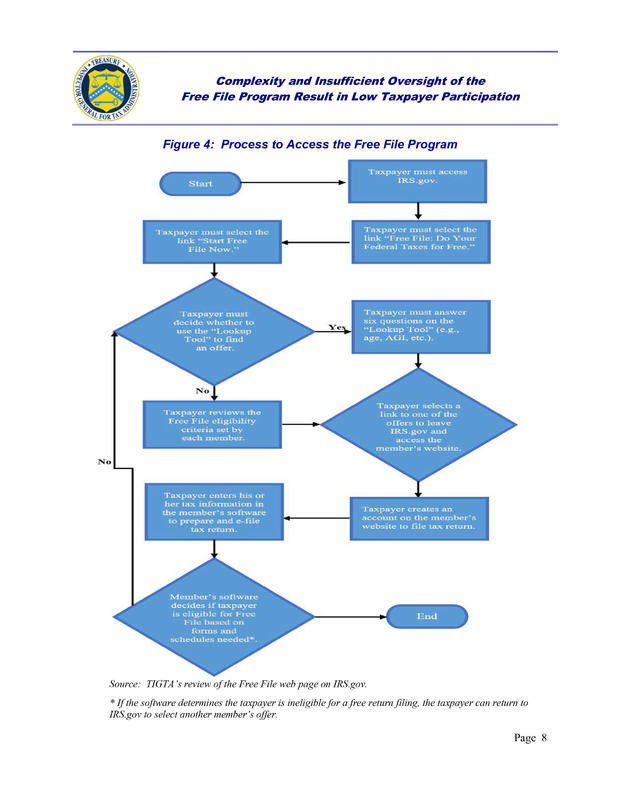

The Free File program, which the IRS created in 2003, is supposed to let 70% of Americans file their taxes for free. (This year, anyone earning less than $69,000 is eligible.) But the process to use Free File "is obscure and complex," the Inspector General's office found.

The only sure way for a taxpayer to file for free is through the IRS' website, irs.gov/freefile. Yet that requirement isn't mentioned in the IRS' agreement with commercial tax preparers, and most taxpayers don't know about it.

Last year, 104 million taxpayers met the criteria to use Free File, but only 2.5 million used it, the audit found. About a third, or 35 million, filed their tax returns through a commercial site. Via follow-up surveys with a sample of those taxpayers, the watchdog estimated that 14 million people paid a fee to file their taxes when they were eligible to file for free.

A detailed flowchart shows just how many clicks a person needs to make to successfully fill out a return via Free File.

With Free File mostly absent in online searches, most taxpayers may be unaware the program exists. The IRS hasn't advertised the program since 2014. Nearly 30% of low-income taxpayers contacted in a follow-up survey told TIGTA they didn't know about the offering or its availability.

"[T]he IRS does not provide adequate oversight to ensure that the Free File Program is operating as intended," the audit concludes. "Moreover, taxpayers are not made aware of protections .... and do not have a process to report concerns."

The report recommends a number of changes, including that the IRS promote Free File and regularly test whether tax-prep firms are complying with the program.