Why Trump's payroll tax cut wouldn't do much for the economy

- President Trump said he's considering cutting payroll taxes, but they wouldn't do much to boost economic growth.

- Tax cuts have one main effect — getting people to spend money. But today's economy needs more business investment, not consumer spending.

- Floating further tax cuts could also be seen as an admission the Tax Cuts and Jobs Act didn't have the economic impact it was intended to.

As the Trump administration dithers over whether it is considering a cut in payroll taxes, liberal and conservative economists alike offered their take on the notion: Don't bother.

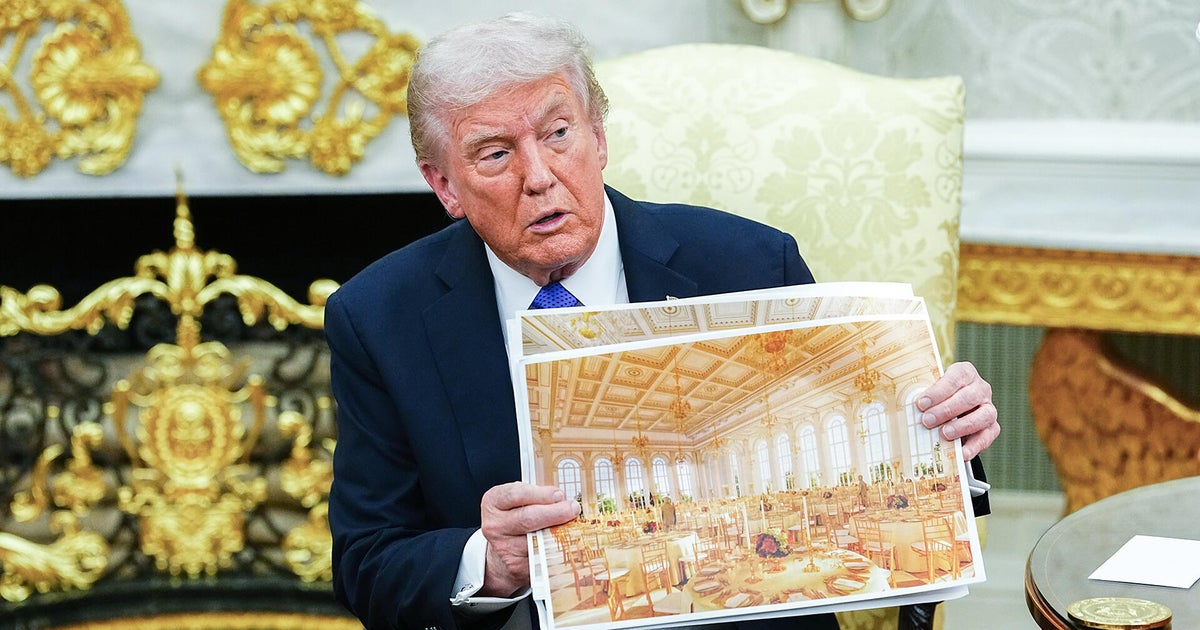

President Donald Trump told reporters on Tuesday that he is "thinking about" trimming payroll taxes, adding that "a lot of people would like to see that." His comments came only hours after White House officials denied the administration was considering such a cut.

Although lowering payroll taxes — currently 12.4%, split between worker and employer — could modestly boost economic growth, such a cut wouldn't address the main reasons the economy is slowing, including mounting concerns about the U.S. trade war with China.

Worse, a tax cut could have unintended effects by signaling to workers that the economy is weakening. In turn, that could cause a pullback in spending — exactly the type of behavior that is likely to hasten a recession.

"It doesn't seem as if it's the right time to be doing such a policy — consumer spending seems to be doing pretty well in the U.S.," said Kyle Pomerleau, chief economist at the right-leaning Tax Foundation.

"Looking at the current economy, the weakness really isn't consumer demand — it's more on the investment side. Some economists suspect that that issue is stemming from the trade war and the pending tariffs the president has been announcing."

Consumer spending has been robust this year. By contrast, business investment has flagged. Some companies, like U.S. Steel, are laying off workers. Because business investment usually lays the groundwork for future economic activity, including hiring workers and producing goods, slow investment today means sluggish growth down the road.

The reasons for slow investment? In a word: tariffs.

"A payroll cut, all else equal, would stimulate the economy — but more easily, a reduction in tariffs would have the same effect," said Gregory Daco, chief U.S. economist at Oxford Economics.

He added: "More clarity on the administration's intentions on the trade confrontation would alleviate uncertainty, and would make businesses and consumers more comfortable spending. If you just put together a stimulus package, the risk is that people have more money, but they put it aside."

The administration is clearly aware of the risks, and is trying to walk a fine line on its messaging. So in the same tweet, Mr. Trump touts the "very strong" economy while also accusing his Federal Reserve chair of hampering growth.

There's also a political risk in saying the economy needs a spark only 18 months after the Republican party passed one of the largest tax cuts in U.S. history.

"The Trump administration said their 2017 law was a middle-class tax cut. So when they're saying, 'Now we need a cut to help consumers,' it's an admission that the 2017 law did not do that," said Steve Wamhoff, director of federal tax policy at the left-leaning Institute on Taxation and Economic Policy.

According to ITEP, 70% of the 2017 tax cuts went to the richest 20% of households. Because the payroll tax is a flat tax, it would hit more middle-class people, but not perfectly — nearly half of it would go to the top 20%.

Directing additional cash to lower-earning people is a sure way to spur spending, according to a range of economic research. Tax cuts, though, aren't a great way to do so. Estimates from the Congressional Budget Office show that tax cuts geared to lower- and middle-income earners usually return about 30% of their cost in the form of added spending. The program that offer the highest return? Direct purchases by the government.