Trump vs. China on trade: 3 flashpoints to watch

Wall Street is reaching for the dramamine this week, as trade-related headlines rattle stock prices and result in stomach-churning volatility. Here's just one sign of how investor sentiment is shifting: The Dow Jones industrials index has closed below a key measure of long-term trend known as its 200-day moving average -- for the first time since the summer of 2016.

Worries are mainly focused on the risk of a deepening trade tit-for-tat between President Donald Trump and China. That's because the jousting threatens to a stumble into an outright trade war, with all the various consequences that could flow from that.

The latest round kicked off less than two weeks ago when Mr. Trump confirmed he was approving a 25 percent tariff on $50 billion worth of Chinese imports. Beijing responded swiftly, announcing equivalent tariffs on U.S. goods. Trump then fired back, asking his administration to identify another $200 billion worth of Chinese goods to be hit with a 10 percent tariff if China goes through with its counterthreat in early July.

Moreover, Mr. Trump threatened yet another $200 billion worth of tariffs if Beijing responds to the U.S. levy on the first $200 billion.

Given all this, here are three trade catalysts investors should pay attention to:

Will Beijing weaponize the yuan?

Beijing didn't respond to Mr. Trump's latest tariff threats but instead seems to be focusing on nontariff options such as a currency devaluation (which, ostensibly, will lower the cost of Chinese exports for U.S. consumers and thus counteract the president's tariffs).

China cannot keep retaliating in terms of its U.S. import volume since it took in only $187 billion worth of American-made goods last year.

The People's Bank of China on Sunday cut a policy rate -- known as the reserve requirement ratio -- unlocking some 700 billion yuan worth of liquidity as the domestic economy contends with Mr. Trump's trade pushback as well as rising margins calls, wider credit spreads and rising corporate defaults. The yuan continued to weaken on Tuesday -- with the losses especially notable vs. the U.S. dollar -- at a pace of decline not seen since late 2016.

Mr. Trump made China's history of currency manipulation and outright mercantilism a cornerstone of his populist GOP primary contest throughout 2015 and 2016. Any sustained slide in the yuan will no doubt bring forth additional tariff threats.

Will Trump crack down on Chinese investment?

U.S. equities were slammed on Monday following over-the-weekend reports the Trump administration was looking to bar Chinese companies from investing in U.S. technology firms. Treasury Secretary Steven Mnuchin refuted the report in a tweet on Monday morning, saying the administration is targeting all countries attempting to "steal our technology," not just China.

Stocks kept sliding. So the narrative was changed again: Peter Navarro, President Trump's top trade adviser, made a late-day appearance on CNBC, saying the stock market sell-off was a "very large overreaction" and insisted the White House has no plans to impose investment restrictions.

On Tuesday, Mr. Trump himself chimed in and seemed to jibe with Mnuchin by saying the U.S. would use the 1988 law that set up the Committee on Foreign Investment in the U.S. (or CFIUS) to protect U.S. interests when foreign companies seek to buy or invest in U.S. companies. Speaking to reporters at the White House, the president said "we have the greatest technology in the world, people come and steal it. We have to protect that, and that can be done through CFIUS."

He added that media reports saying he was planning two further initiatives, in addition to CFIUS, to prevent Beijing from taking U.S. technology were merely "a bad leak...probably just made up."

Will the stock market cause Trump to blink?

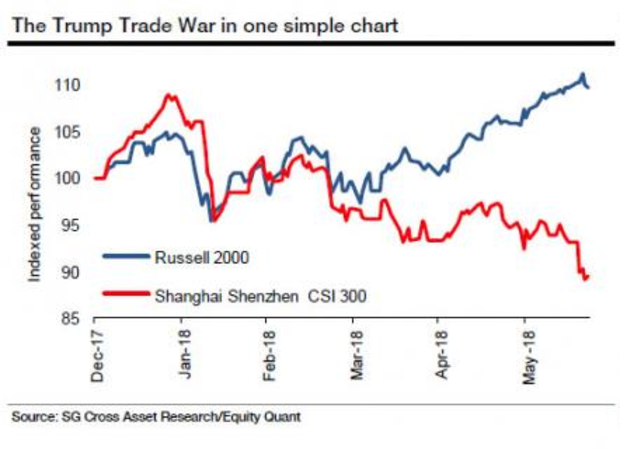

Trump's affinity for a strong stock market is well known. And by that metric, the U.S. has thus far been winning in the trade spat with China, as shown in the chart below, which tracks the action in domestically focused stock indexes for each country.

But Monday's sell-off seems to have rattled him, according to a report by The Wall Street Journal, which noted that the easing of possible action on investment flows could represent an "olive branch to Beijing" ahead of the July 6 imposition of previously announced tariffs.

The change of tack was assigned to "recent declines in the stock market and to U.S. companies getting battered by tariffs in U.S. trade battles with the European Union, Canada, Mexico, and China," according to industry lobbyists and China experts cited in the Journal's story.

And that's good because according to Bank of America Merrill Lynch analysts, if President Trump pushes ahead with the tariff on the first $200 billion tranche of Chinese goods, the cumulative tariff "tax" on American consumers rises to around $45 billion -- canceling out the benefit to households of the tax cut package passed last year.