Subpoenas in Trump criminal probe suggest fresh scrutiny of his Seven Springs estate

Manhattan prosecutors conducting a criminal investigation into possible bank, tax and insurance fraud by former President Donald Trump and his company recently subpoenaed documents from an engineer who worked on an expansive property owned by the Trump family in Westchester County, north of New York City.

The engineer, Ralph Mastromonaco, told CBS News he recently received the subpoena and quickly complied, turning over maps of the 200-acre Seven Springs Estate and other documents he produced for the Trump Organization nearly a decade ago. The subpoena has not been previously reported and there is no indication that Mastromonaco is being investigated for wrongdoing.

Mastromonaco said his work included surveying Seven Springs as part of an effort by the Trump Organization to get approval for a subdivision in 2013, and that he doubts his work will prove relevant to the tax fraud investigation.

"I think they are just touching every base. I really had nothing to do with the project after (that). My role ended after they got an approval and whatever they did after that, I had nothing to do with," Mastromonaco said.

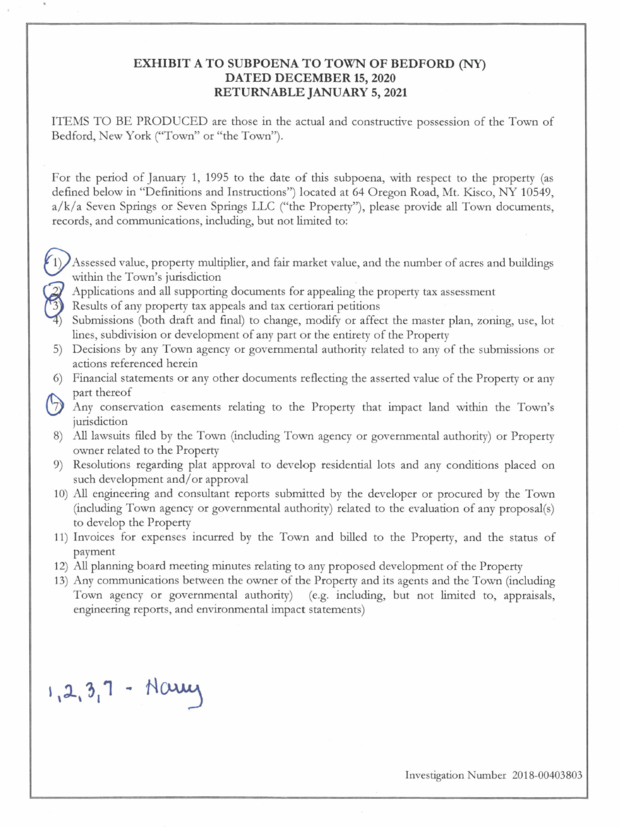

Mastromonaco's subpoena came weeks after Manhattan investigators sent another subpoena to the town clerk of Bedford, New York. Seven Springs straddles Bedford and two other affluent suburban towns, North Castle and New Castle. The grand jury subpoena, which was obtained by CBS News, requests documents related to Seven Springs valuations and tax assessments, tax appeals, and conservation easements.

Manhattan District Attorney Cyrus Vance first began investigating Mr. Trump in 2018, and initially targeted hush-money payments made during the 2016 campaign to adult film star Stormy Daniels by former Trump attorney Michael Cohen. However, Vance's office has indicated in court filings that the investigation has since widened to look at possible crimes as wide-ranging as fraud and tax evasion.

Seven Springs has also drawn scrutiny from New York Attorney General Letitia James, who is conducting a civil probe into the Trump Organization.

James' office has indicated in court documents it is interested in a 2015 valuation of Seven Springs that factored into a $21.1 million tax deduction taken by Mr. Trump.

Vance's office said in a September court filing that in the past decade, Mr. Trump's valuation of the property ranged from between $25 million and $50 million, to between $261 and $291 million.

As part of his investigation, Vance is seeking Mr. Trump's tax records. The Supreme Court ruled in July that a subpoena of the records was constitutional, but their release was held up by a follow-up appeal on different grounds. The Supreme Court has not yet said if it will hear that appeal.

Vance's office has not said why it is interested in documents Mastromonaco produced for the Trump Organization, and declined to confirm the subpoena or comment for this article. His investigation is one of two known criminal probes focused on Mr. Trump. On February 10, the District Attorney in Fulton County, Georgia, launched an election fraud and racketeering investigation into Mr. Trump's attempts to influence the outcome of the 2020 presidential election in Georgia.

Alan Futerfas, an attorney who is counsel for Mr. Trump in the Supreme Court proceedings, declined to comment on the subpoena. Attorneys for the Trump Organization did not reply when asked for comment.

Mr. Trump has previously called Vance's investigation a "witch hunt," and one of his attorneys, William Consovoy, referred to it in court in October 2019 as a "fishing expedition."

For the New York State civil case, James' office has said in court filings that it is "seeking information concerning whether the Trump Organization and its agents improperly inflated, or caused to be improperly inflated, the value of the Seven Springs Estate."

"Valuations of Seven Springs were used in connection with an appraisal….to claim an apparent $21.1 million tax deduction for donating a conservation easement on the property in tax year 2015, and in submissions to financial institutions as a component of Mr. Trump's net worth," attorneys for James's office wrote in an August 2020 court filing.

Mastromonaco said James' office subpoenaed similar documents more than a year ago.

James' office has interviewed Eric Trump and squared off in court with a lawyer for the Trump Organization who initially refused to hand over emails relating to Mastromonaco's work, citing attorney-client privilege. A New York court rejected that argument in December.

Mr. Trump purchased Seven Springs in 1995 for $7.5 million, and originally planned to build a golf course on it. After that plan faced local opposition, Mr. Trump considered building and selling 15 mansions on the property, which includes what once was H.J. Heinz Jr.'s 10-acre family estate, called "Nonesuch."

Donald Trump Jr. and Eric Trump told Forbes in a 2014 interview that they have used the property as a vacation and weekend residence. Eric Trump called the estate "home base for us," and said the brothers enjoyed riding ATVs and fishing on the property.

The New York Times reported last September that in 2014 Mr. Trump deducted $2.2 million in property taxes by claiming Seven Springs was an investment property. The deduction was not applicable to personal residences.

Trump and Seven Springs gained nationwide attention in 2009 when then-Libyan dictator Muammar Qaddafi rented the property where he planned to pitch a Bedouin-style tent that he often brought with him while traveling. Qaddafi was visiting New York for a United Nations' General Assembly and had been turned away by other officials in New York City and Englewood, New Jersey. Tents were installed on Trump's property, but the plan was scrapped when Bedford town officials objected. In 2016, Mr. Trump told CBS News' "Face the Nation" that he made "a fortune" on the brief deal.

By 2015, Mr. Trump had dropped all public plans for development of the property, and placed much of it in a conservation easement, which came with a $21.1 million tax deduction.

In an August 2020 court filing, the New York Attorney General's office accused the Trump Organization of refusing "to produce records sufficient to show how a $21.1 million apparent tax deduction in connection with the Seven Springs conservation easement was reflected on applicable tax returns." The two sides continue to litigate that dispute.

Mastromonaco said his work for the Trumps had long since ended by then.

"I'll save you a lot of time, because I don't really think I had any relevance to any of this, because my role in the project ended well before there was any controversy," Mastromonaco said.