Trump Media asks lawmakers to investigate possible "unlawful trading activity" in its DJT stock

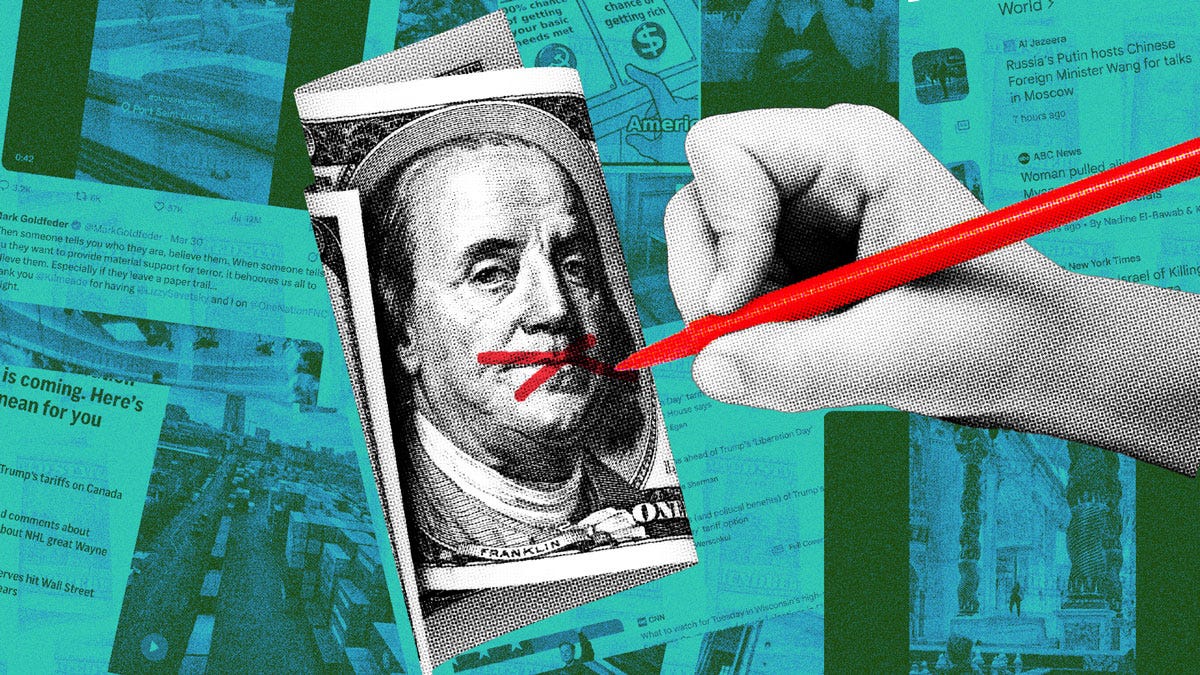

Trump Media & Technology Group is asking lawmakers to investigate what it claims is "potential manipulation" of its stock, which trades under the ticker DJT – the same as the initials of former President Donald Trump.

In an April 23 letter, Trump Media CEO Devin Nunes, a former Republican congressman from California, asked several House committees to "open an investigation of anomalous trading of DJT."

The committees Nunes asked to look into the issue are the House Committee on the Judiciary; its Committee on Financial Services; its Committee on Ways and Means; and the Committee on Oversight and Reform.

Nunes has previously alleged that the media company's stock has been targeted by unscrupulous investors since it went public in late March. Earlier this month, he asked the Nasdaq stock exchange, where DJT trades, for help in looking into possible incidents of "naked" short selling. That practice is banned in the U.S. because it involves shorting a stock without first borrowing the shares, which can destabilize prices.

"'[N]aked' short selling often entails sophisticated market participants profiting at the expense of retail investors," Nunes wrote in his letter to House Republican committee leaders.

Trump Media shares have swung wildly since going public last month. After surging to a high of $79.38 per share on March 26, its first day of trading, the stock plunged to as low as $22.55 per share on April 16. The shares have since regained ground, rising $1.38, or 4.2% to $33.95 in Wednesday afternoon trading.

What is naked short selling?

Short selling occurs when investors borrow shares of a stock they believe will decline in price, and then sell those holdings on the market for cash proceeds. If the stock price tumbles, the trader then purchases the shares at the lower price and returns the stock to the trading firm from which they originally borrowed the shares.

That enables the traders to pocket the difference between the borrowed stock price and the sale price. Such trading is legal. But "naked" short selling skips the step where the trader borrows shares of the stock, meaning that the investor sells shares they don't own. Later, they buy the stock to cover their position.

Naked shorting can lead to large declines in a target company's stock price, and can also undermine market confidence, according to law firm Kohn, Kohn & Colapinto.

Wall Street trading firms

Nunes also cited "data made available to us" that he said shows four companies have been responsible for 60% of the "extraordinary volume of DJT shares traded."

The companies include well-known Wall Street firms, such as Citadel Securities, a market-making firm founded by billionaire Ken Griffin, and Jane Street Capital.

Neither Citadel nor Jane Street returned requests for comment, nor did the other two firms cited by Nunes, VIRTU Americas and G1 Execution Services.

Trump Media, whose main asset is the social media platform Truth Social, has prompted comparisons with "meme" stocks like GameStop. These stocks typically attract individual investors based on social media buzz, rather than on business fundamentals relied on by institutional investors, such as profitability and revenue growth.

Nunes wrote to the lawmakers that he believes an investigation into naked short selling of DJT's shares is "needed to protect shareholders, including TMTG's retail investors."

He added, "It may also shed light on the need for policy changes" such as :requiring brokers to better document their efforts to locate and borrow stock, and stiffening penalties for illegal naked short sellers."