What was Trump convicted of? Details on the 34 counts and his guilty verdict

Former President Donald Trump's conviction in New York stemmed from a $130,000 "hush money" payment his attorney Michael Cohen made to adult film star Stormy Daniels in the days before the 2016 election. Prosecutors said the deal was meant to keep voters in the dark about Daniels' allegation that she had sex with Trump years earlier, which he denies.

But the actual charges that Trump faced were far less salacious, and dealt with the comparatively mundane paperwork that was generated when he reimbursed Cohen for the payment.

Here's what to know about the charges Trump faced:

What was Trump convicted of?

Trump was charged with 34 counts of falsification of business records in the first degree, which is a felony in New York. He pleaded not guilty when he was arraigned last year.

In 2017, Cohen and Allen Weisselberg, an executive at the Trump Organization, reached an agreement about how Cohen would be repaid for the $130,000 that he sent to Daniels in exchange for her silence. Weisselberg detailed the calculations in handwritten notes that were shown to the jury at trial.

Cohen would receive $130,000 for the Daniels payment, plus $50,000 intended for a technology company that did unrelated work for Trump. That amount was doubled to account for taxes that Cohen would have to pay on the income. Weisselberg then tacked on an extra $60,000 as a bonus for Cohen, who was upset that his regular year-end award had been cut. The total worked out to $420,000.

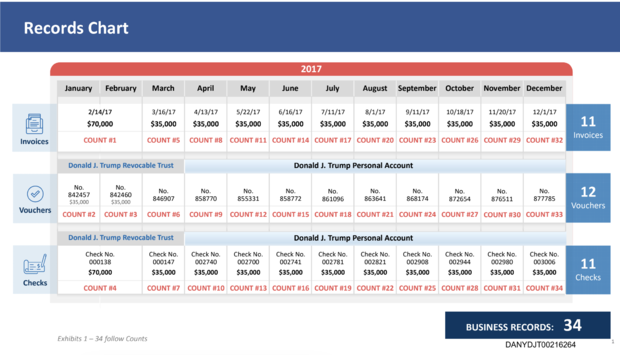

Cohen would be paid in a series of monthly payments of $35,000 over the course of 2017. The first check was for $70,000, covering two months. Cohen sent an invoice to the Trump Organization for each check, portraying the payment as his "retainer." Every time he was paid, a bookkeeper generated a record for the company's files, known as a voucher, with the description "legal expense." The first three payments were made from Trump's trust, while the remaining nine came from his personal account.

Each of the 34 charges against Trump corresponded to a check, invoice and voucher generated to reimburse Cohen. The prosecution laid out the charges in a chart that jurors saw several times during the trial:

Prosecutors said Trump knew the payments were to reimburse Cohen for the Daniels payment, not for his legal expenses.

The jury voted to convict on all 34 counts. As Trump looked on, the court's clerk asked the foreperson of the jury for the verdict.

"How say you to the first count of the indictment, charging Donald J. Trump with the crime of falsifying business records in the first degree, guilty or not guilty?" the clerk asked.

"Guilty," the foreperson responded, repeating the answer 33 more times.

Why were the charges a felony?

Under New York law, falsification of business records is a crime when the records are altered with an intent to defraud. To be charged as a felony, prosecutors must also show that the offender intended to "commit another crime" or "aid or conceal" another crime when falsifying records.

In Trump's case, prosecutors said that other crime was a violation of a New York election law that makes it illegal for "any two or more persons" to "conspire to promote or prevent the election of any person to a public office by unlawful means," as Justice Juan Merchan explained in his instructions to the jury.

What exactly those "unlawful means" were in this case was up to the jury to decide. Prosecutors put forth three areas that they could consider: a violation of federal campaign finance laws, falsification of other business records or a violation of tax laws.

Jurors did not need to agree on what the underlying "unlawful means" were. But they did have to unanimously conclude that Trump caused the business records to be falsified, and that he "did so with intent to defraud that included an intent to commit another crime or to aid or conceal the commission thereof."

What was Trump's defense?

Trump's lawyers argued that the payments to Cohen were for his work as Trump's attorney, not reimbursements for the Daniels payment.

The defense argued that the descriptions on the invoices and records were accurate — Cohen held the title "personal attorney to the president" once Trump took office, and was being paid for his legal services under an unwritten retainer agreement. Therefore, their argument went, no business records were falsified.

They also focused much of their firepower on portraying Cohen as a liar, with the goal of discrediting his testimony. Cohen was the only witness who testified that Trump knew about the true purpose of the reimbursements, a crucial pillar of prosecutors' effort to show Trump's intent.

Ultimately, the jurors rejected the defense's arguments and sided with prosecutors in finding Trump guilty.

When will Trump be sentenced?

Shortly after the verdict was handed down, Merchan, the judge, set Trump's sentencing date for July 11, just days before the start of the Republican National Convention.

Under New York law, each count of falsifying business records in the first degree carries a maximum sentence of four years in prison and a $5,000 fine. But Merchan has broad discretion when it comes to imposing a sentence. Most legal observers expect him to punish Trump with little or no time behind bars, based on factors like Trump's status as a first-time offender and his age. Merchan could instead rely on options like probation, home confinement or solely a fine.

Trump has vowed to appeal the verdict, and any sentence could be delayed until that process plays out.