Trade war with China could hurt these U.S. businesses most

It is how trade wars catch flame. President Donald Trump has proposed tariffs on aerospace, machinery, and information and communications technology products imported from China. Beijing swiftly replied with its own tariffs on U.S. fruits, wine, steel pipe and pork, among other goods.

Here at home, some industries are particularly at risk. That's because companies in these sectors not only import parts and materials from China, but also often export finished products there as well.

There are three primary mechanisms by which U.S. tariffs on China could hurt American companies. Tariffs on Chinese imports would increase the cost of raw materials for U.S. businesses, forcing them to pay more to make the same goods, whether cars, appliances or electronics. China's reciprocal tariffs make U.S. goods more expensive for Chinese consumers, hurting the many businesses trying their luck in the world's largest market.

Finally, China could make it hard for American companies to do business using other methods, such as increasing regulations on U.S. companies in China or slowing down deals.

"The retaliation could turn into dissuading Chinese consumers and Chinese businesses from buying U.S. products and brands," Keith Parker, a strategist at UBS, told CBS MoneyWatch. "There's lots of things that can be done, if trade tensions were to escalate, whether it's influencing purchasing decisions or making exports to the U.S. more difficult."

Technology and electronics

U.S. technology companies rank particularly high on the list of potential losers because many of them are exposed in multiple ways: They rely on Chinese suppliers, and they sell to Chinese companies. UBS, which compiled a list of public companies with significant sales in China, noted that cell phones, computer equipment, semiconductors and clothing were potentially the most vulnerable products if Beijing chooses to hit back.

"All iPhones come out of China," said Jeff Fieldhack, an analyst at Counterpoint Research. "And other U.S. companies, even if their R&D and development is here in the U.S., they're still making their parts and assembly in China."

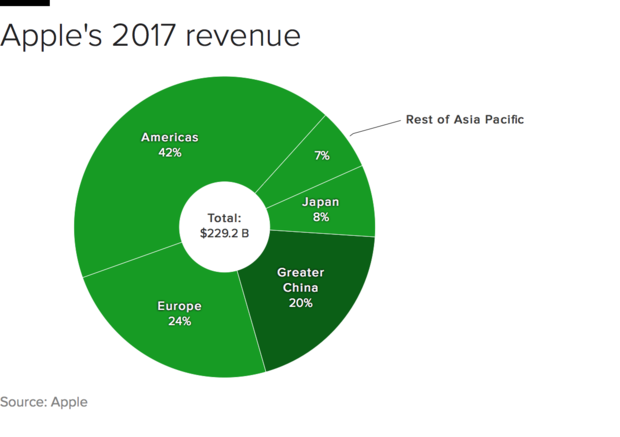

Apple (AAPL) is exposed to China in several ways: It relies on Chinese factories for assembly; China has an effective lock on the rare-earth minerals essential for Apple products; and China's fast-growing middle class is increasingly important for Apple's consumer strategy. Some 20 percent of Apple's sales last year were in China.

"China is the biggest market to over 100 countries. It's hard to find another country with that kind of demand," said Ann Lee, a former professor at Peking University and author of "Why China's Economy Collapsed." "If the U.S. goes forward, you could see blowback that could hurt companies and workers."

Apple competitor Samsung could potentially win big in a tariff scenario. While it assembles some of its parts in China, most of its manufacturing takes place in South Korea, said Patrick Moorhead, president of Moor Insights & Strategy. If Chinese or U.S. tariffs made Apple products more expensive, consumers would likely shift to Samsung products. "People just won't be willing to lay out 20 percent more on their iPhone," he said.

Boeing

Boeing (BA) stock, which plunged when the U.S. announced steel and aluminum tariffs in February, continued to drop Wednesday, reflecting the company's vulnerability to international tensions.

China has unique leverage because it buys so many of Boeing's planes. It signed a deal to buy 300 Boeing planes during Mr. Trump's fall visit to the country. Over the next two decades, China is projected to order around $1 trillion worth of aircraft, according to Bloomberg.

After the U.S., "China is the largest market for Boeing aircraft in the world; it's about 20-25 percent of aircraft deliveries every year," said Chris Higgins, senior equity analyst at Morningstar. "They don't really need to enact tariffs to retaliate on Boeing; all they need to do is shift purchases to Airbus."

"If they announce a large order for Airbus aircraft tomorrow, that would send a message," he added.

A lesser risk is the rising cost of metal itself. Because aircraft are made primarily of steel and aluminum, an increase in those costs would ding its profit margins. Aluminum, which makes up nearly 80 percent of an airplane's body weight, is set to get 10 percent pricier after the tariffs.

But the industry is relatively used to volatile commodity prices, said Higgins -- aluminum prices rose nearly 25 percent last year with "hardly a peep" from the aerospace industry. (Steel, while it's subject to heavier 25 percent tariffs, makes up only about 10 percent of an airplane's weight.)

Soybeans

Some of the fiercest opposition to tariffs is coming from a sector that has, so far, been spared retaliation: soybeans. Soybean farmers sent $14 billion of crops to China last year and see themselves as a prime target for countermeasures.

"We're very concerned about the type of retaliation we might get," said Wayne Fredericks, who grows soybeans and corn on 750 acres in northern Iowa. "The soybean industry is sitting in the bull's eye of Chinese retaliatory efforts."

China is the biggest customer for U.S. soybeans, buying one-third of our soybean crop last year. That number, which has increased exponentially over the last 15 years, is driven by the Chinese middle class' growing appetite for meat. The soybeans are pressed and used for animal feed and, to a lesser degree, for cooking oil.

"As income levels have risen in China, diets have shifted more and more to meat consumption," said Joseph Glauber, senior research fellow at the International Food Policy Research Institute. "They've modernized their pork and poultry production, so it looks a lot like the U.S., and they feed them much like we do in the U.S." -- that is to say, with soybeans and corn. Sorghum and barley have also benefited from this growth to a lesser degree.

For its part, China has accused the U.S. government of unfairly subsidizing the soybean industry to flood the markets (the very same tactic of which Mr. Trump accuses the Chinese.)

"Certainly these issues are not new," said Kirk Leeds, director of business development for the Iowa Soybean Association (ISA). "What appears to be different is the Trump administration is taking what appears to be a much more aggressive position. That makes many of us nervous."

Leeds, who is leading an ISA delegation on a two-week trip to China, spoke to CBS News from a high-speed train between Beijing and Wuhan. His group had just met with the U.S. ambassador to China, Terry Branstad, who is also Iowa's former governor.

"I think the next couple weeks could be critical," he said. "Everyone is aware over here, everyone's paying attention to us and most [people] are hoping that there will be a firm resolution."

Financial firms

In October, China loosened regulations on foreign ownership of Chinese banks, a step the U.S. finance industry lauded as historic. With the U.S. contemplating tariffs—not to mention knocking down Chinese ownership of U.S. companies—observers worry China could reverse its steps.

"That was a huge offer from the Chinese, and that could completely go down the drain with these kinds of tariffs," said Lee. "The Chinese will say, 'Why should we be bending over backwards when you don't want to establish a stronger relationship?'"

In nearly all other sectors, Chinese rules on foreign companies remain famously strict (a fact that Mr. Trump highlighted on Thursday).

"U.S. companies, tech companies and high-value-add companies are in essence forced to partner with a domestic producer in China. That's one area where policymakers could tighten the screws," said Peter Donisanu, investment strategy analyst at Wells Fargo.

With higher barriers to ownership, U.S. companies could conclude it's easier to sell their share of an enterprise and essentially exit the Chinese market.

Hard bargain

Given the potential of tariffs to hurt hundreds of U.S. businesses, many analysts are choosing to see Thursday's announcement not as the last word, but rather as an opening gambit aimed at bringing China to the bargaining table.

"For now this seems to be about renegotiating trade deals," said Donisanu, citing the examples of steel and aluminum tariffs, which were watered down significantly before they even came into effect.

But even if the final tariffs are small numerically, a prolonged negotiation between the U.S. and China could have other consequences. Decisions about supply chains, factories, hiring and firing can take years to fully play out. In the meantime, American industry has two weeks to press the case for particular tariffs—and to fret about the results.

"Maybe in a few years we can look back and say, as convoluted as this strategy is, it was beneficial for the U.S.," said Fredericks, the soybean farmer. "But the process is pretty painful."

Jillian Harding and Rachel Layne contributed reporting.