Trade war with China: “A very dangerous domino”

Tough talk from President-elect Donald Trump is making economists and some business leaders nervous about a potential trade war with China.

They say investors and consumers should be leery, too.

Investors cheering potential tax cuts and infrastructure spending that could boost the U.S. economy seem to be ignoring the enormous executive power Mr. Trump will wield on trade. And consumer confidence readings suggest consumers aren’t particularly worried that his tough talk could lead to higher prices on a range of products from consumer electronics to clothing.

A series of Trump tweets threatening to impose tariffs and label China a currency manipulator, along with his unexpected call with Taiwan’s leader (a provocative move from China’s perspective), have done nothing to ease fears of trade tensions ahead.

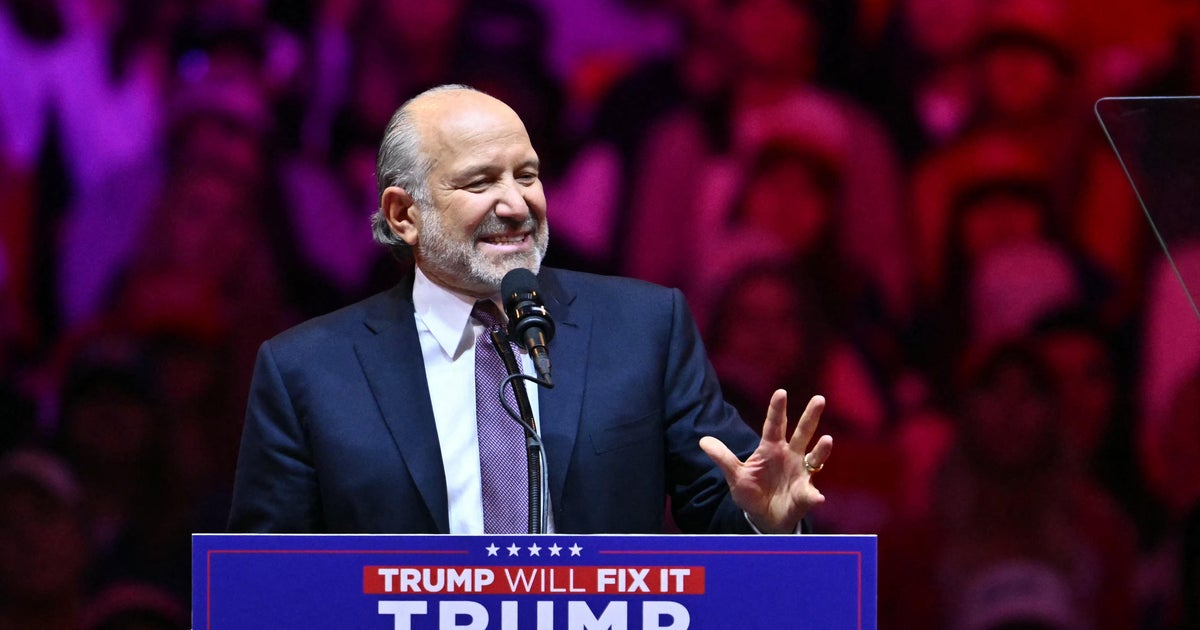

“Financial markets are rallying in excitement over pro-growth policies and discounting the potentially damaging trade policies,” Diane Swonk, chief economist at DS Economics, told CBS MoneyWatch. “You don’t need a full-out trade war to have repercussions for U.S. consumers and businesses operating abroad.”

Swonk said she and her economist peers hope “cooler heads prevail” and the U.S. and China can avoid turning a war of words into escalating tariffs, which would hurt consumers by pushing prices higher, particularly on products sold at discount retailers. Farmers who export corn and grain to China could also feel the pain if China buys from other nations instead.

“It’s just a very dangerous domino and spillover effects with a lot of unintended consequences,” Swonk said. “You can have well-meaning intent, but very rapidly get to a situation that’s not as productive and hurts the economy and consumers.”

If hostilities flare, China would have plenty of ways to inflict pain on the U.S. economy, though it likely also would wind up in an economically worse position than the U.S., wrote Mark Williams, Chief Asia Economist for Capital Economics, in a research note.

“China relies far more on U.S demand than vice versa,” noted Williams, who does not think a trade war is imminent.

A move by the U.S. to impose tariffs on Chinese-manufactured products such as mobile phones and laptops would effectively become a tax on U.S. buyers, since China supplies about 70 percent of those products globally, Williams wrote. If trade tensions escalate to the point of tit-for-tat tariffs, the countries would likely select certain products to hurt each other, a move that could put American-made cars and aircraft “in the firing line.”

China could also use nontariff measures (such as additional regulations) to slow down imports and make life harder for U.S. companies doing business in China, for instance, by making it more difficult to get profits out of the country. China also could further escalate military and territorial tensions in the South China Sea and make deals with exclusive trading partners scorned by Mr. Trump’s promise to withdraw from the Trans Pacific Partnership, or TPP.

To address the potential pain of fewer exports, China also could more easily enact a stimulus plan – and in China, such a plan wouldn’t require action from a slow-moving Congress.

Another wrinkle: Trump’s hardline stance is likely contributing to a weakening in the Chinese yuan, which the government is trying to prop up to stem outflows of capital. If those efforts fail, China could take more draconian measures to slow capital flows, including from U.S. companies doing business in China.

Meantime, in the U.S., despite the joyous reaction on Wall Street to Republican “unity” in Washington, the reality is there’s no Kumbaya on a stimulus package, tax cuts and corporate tax reform. Some Republicans already are pushing back on Trump’s proposal for $1 trillion in infrastructure spending.

“Reminder, this was a split party before the election and remains one,” Swonk said. “That’s been lost in translation.”

Harsh rhetoric aside, both China and the U.S. benefit from good trade relations.

While plenty of Trump voters embraced the notion China is stealing American jobs, in reality China is “making U.S. consumers better off by stretching their incomes further, manufacturing things that U.S. workers do not want jobs making,” wrote Carl B. Weinberg, chief economist for High Frequency Economics.

Mr. Trump’s campaign promise of tariffs as high as 45 percent on Chinese-made goods would be a disaster scenario for consumers.

“Tens of millions of Walmart, Costco and Dollar General customers -- heck, all U.S. consumers -- are going to see the prices of almost all the stuff they buy go up,” Weinberg wrote. “That will not make them happy, and almost all of them will not get a new or better job because of it.”

Swonk said it’s too early to tell whether China will take retaliatory action and how much of Mr. Trump’s threats amount to posturing.

Still, she worries.

“We have promises but not policies,” Swonk said. “That combined with where the president can act, and so far where the president-elect has already acted, has been more hostile than hopeful.”